If you're one of the many people who invested in cryptocurrencies last year, you may be wondering how they'll affect your taxes. The good news is that loans for crypto taxes are now available from a number of different companies. This means that you can get the money you need to pay your taxes without having to sell your assets. There are a few things to keep in mind when taking out a loan for crypto taxes. First, make sure that you understand the terms of the loan and that you will be able to repay it. Second, remember that the interest on these loans can be high, so be sure to shop around for the best rates. Finally, be sure to consult with a tax professional before taking out any loan, as they can help you maximize your deductions and minimize your tax liability.

1. Consult with an accountant or tax specialist to get started on your tax planning for crypto-related transactions.

2. If you are selling crypto, consider tracking your gains and losses on a regular basis to ensure you are complying with all tax laws.

3. If you are using crypto to purchase goods or services, make sure to keep accurate records of your transactions and pay applicable taxes.

4. If you are receiving crypto as a loan, be sure to keep track of the terms and conditions of the loan, as well as the interest rate and repayment schedule.

5. Always consult with a lawyer if you have any questions or concerns about your tax obligations related to crypto transactions.

When trading cryptocurrency, it is important to understand the tax implications of your transactions. When you make a purchase with Bitcoin, for example, the transaction is considered a purchase of goods and services. The IRS classifies this as a transaction that must be reported on your tax return.

If you sell cryptocurrency, you may also have to pay taxes on the proceeds. Depending on the cryptocurrency you are selling and the country you are selling in, you may have to pay VAT, income tax, or both.

It is also important to be aware of any loans you may be taking out when trading cryptocurrency. A loan is considered a financial transaction that must be reported on your tax return. This includes any loans you take out to buy cryptocurrency or to sell cryptocurrency.

To ensure that you arepaying taxes and loans on your transactions correctly, it is important to keep track of all of your transactions. You can use a cryptocurrency tracking tool, such as CoinTracking, to help you keep track of your transactions.

Cryptocurrencies are becoming more and more popular, but they also come with their own set of tax implications. If you're considering taking out a loan in cryptocurrency, be sure to know the tax implications of doing so.

Cryptocurrency loans are typically treated as taxable income, just like any other form of income. This means that you'll have to pay taxes on the interest and principal that you receive from the loan. Make sure to keep track of your income and tax liabilities so that you can pay the appropriate amount of taxes.

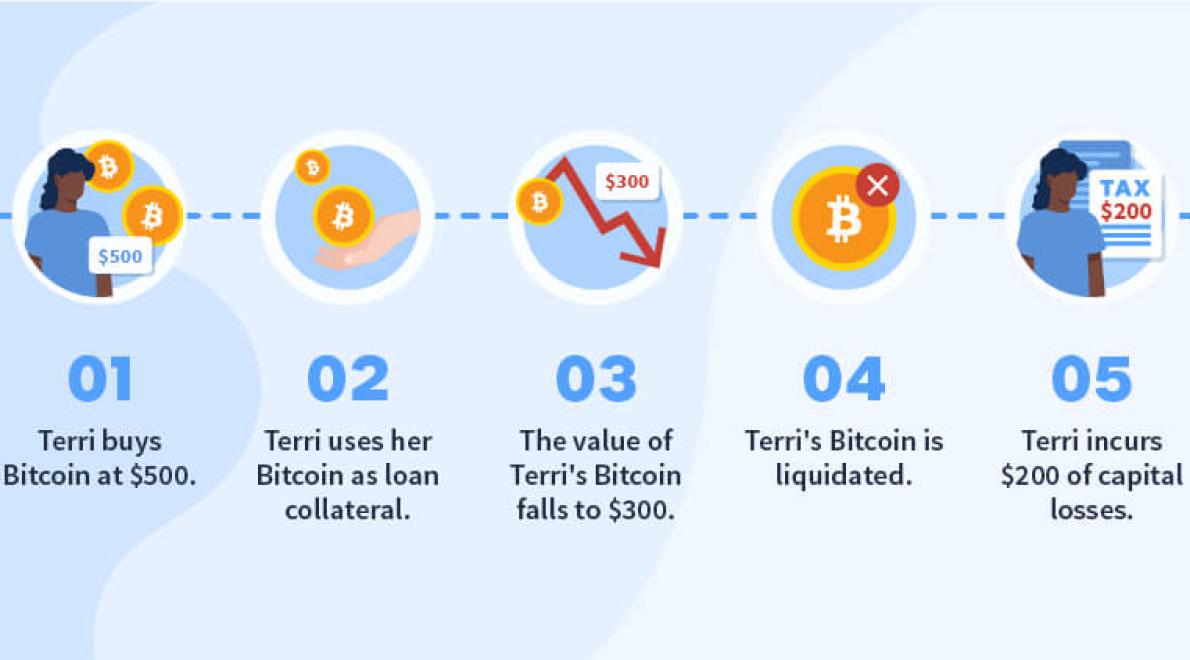

If you're using a cryptocurrency loan to invest in cryptocurrencies, you may be able to take advantage of tax breaks that are available to investors. For example, you could claim capital gains or loss on the sale of your cryptocurrencies, which could reduce your tax liability. Keep in mind, however, that these tax breaks are only available if you sell your cryptocurrencies within a certain timeframe. If you don't sell your cryptocurrencies within that timeframe, you may have to pay taxes on them at their market value.

Overall, be sure to know the tax implications of taking out a cryptocurrency loan before you decide to do so. By doing so, you'll be able to make informed decisions about whether or not it's the right option for you.

Cryptocurrencies and blockchain technology have caused a lot of buzz in the financial world over the past few years. While there is still much to learn about this new frontier, here are a few things you need to know about crypto taxes and loans before getting involved.

Cryptocurrency Taxes

As with any new investment, it’s important to understand the tax implications of cryptocurrency ownership and transactions. Currently, cryptocurrency is treated as property for tax purposes. This means that you’ll need to pay capital gains and/or income taxes on any profits you make from selling or using cryptocurrencies.

If you’re using cryptocurrencies to purchase goods or services, then you may also be subject to income taxes on those transactions. You should consult with a tax professional to get an accurate understanding of your specific situation.

Cryptocurrency Loans

Cryptocurrencies and blockchain technology offer a unique opportunity for lending. With the right setup, borrowers and lenders can use cryptocurrency loans to finance a variety of projects.

Lenders can use cryptocurrency loans to finance businesses, properties, or other ventures. Borrowers can use cryptocurrency loans to purchase assets or to start their own businesses.

Cryptocurrency loans are a great way to get access to financing without having to put up traditional collateral. They’re also a good way to reduce risks associated with traditional lending products.

Before getting involved with cryptocurrency loans, it’s important to understand the risks involved. Cryptocurrency loans are not regulated by the same laws that govern traditional loans. This means that lenders could face serious financial consequences if the borrower fails to repay the loan.

If you’re interested in getting involved in the cryptocurrency lending industry, it’s important to understand the risks involved. You should also consult with a qualified financial advisor to get an accurate understanding of your specific situation.

There are many things to consider when it comes to handling loans and cryptocurrency. Here are a few tips to help you steer clear of tax trouble:

1. Understand The Tax Implications Of Your Transactions

Before making any financial decisions, it is important to understand the tax implications of your transactions. This includes loans and cryptocurrency investments.

If you make a cryptocurrency investment, you may be able to deduct the cost of the investment in your taxable income. However, you may also be subject to capital gains taxes if you sell the cryptocurrency later on.

Similarly, if you take out a loan, you may be required to pay interest and/or penalties if you don’t repay the loan in a timely manner. In some cases, you may also be subject to income taxes on the interest that you earn.

2. Keep Records Of Your Transactions

It is important to keep records of your transactions in order to comply with tax law. This includes tracking the date, amount, and purpose of your transactions.

3. Consult With A Tax Advisor

If you have questions about how your transactions may affect your tax liability, it is important to consult with a tax advisor. A tax advisor can help you understand the tax implications of your transactions and recommend the best course of action for you.

If you are a cryptocurrency holder, then you probably know that you need to keep track of your taxes and loans. Here are some tips on how to do both:

1. Keep track of your profits and losses.

If you have made profits from your cryptocurrency holdings, then you will likely need to report those profits to the IRS. Similarly, if you have lost money on your crypto investments, then you will need to report that loss to your tax accountant.

2. Pay your taxes.

If you have made taxable gains or losses from your crypto investments, then you will need to pay taxes on those gains or losses. Similarly, if you have taken out loans to invest in cryptocurrencies, then you will need to pay back those loans with interest.

3. Stay up to date on tax laws.

As cryptocurrency technology evolves, so too do the tax laws that apply to cryptocurrency holders. If you are not familiar with the latest tax laws affecting cryptocurrency holders, then you should consult with a tax advisor.

Crypto loans can be a great way to get access to funds you need without having to sell your cryptocurrency. However, it's important to understand the tax implications of taking out a crypto loan so you don't end up paying too much in taxes.

Here are five tips for making the most of crypto loans and avoiding tax headaches:

1. Know The Tax Implications Of Taking Out A Crypto Loan

When you take out a crypto loan, there are a few things to keep in mind. For starters, the interest on the loan is likely considered taxable income. Additionally, any profits you make from the loan (if you're able to repay it) are also likely taxable.

2. Track Your Progress Repaying The Loan

It's important to track your progress repaying the loan so you know exactly how much money you're bringing in each month and how much you're spending on interest and repayment costs. This will help you determine if you're on track to repay the loan in full and avoid any penalties or interest charges.

3. Make Sure You Have The Financial Resources To Repay The Loan

Before taking out a crypto loan, it's important to make sure you have the financial resources to repay it. If you can't repay the loan in full, you may be subject to penalties and interest charges.

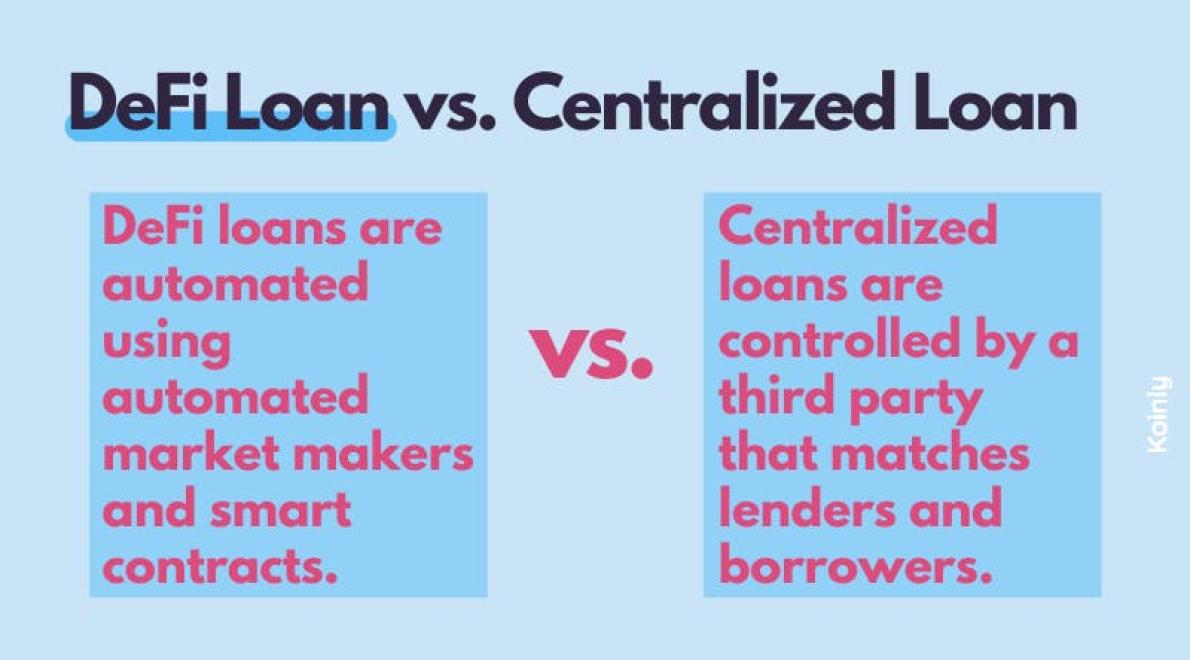

4. Compare Crypto Loans To Traditional Loans

Before taking out a crypto loan, it's important to compare it to other traditional loans options. This will help you determine if crypto loans are the best option for you.

5. Consult With A Tax Professional

If you have any questions about the tax implications of taking out a crypto loan, consult with a tax professional. They can help you understand all of the options and make sure you're taking advantage of the most favorable tax laws for you.

Cryptocurrencies are digital or virtual tokens that use encryption to secure their transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrencies are not legal tender, and their value is highly volatile.

When you buy or sell cryptocurrencies, you may be subject to capital gains or losses. Tax rules vary depending on your country of residence, so it’s important to consult an accountant or tax specialist about your specific situation.

You can also borrow money in cryptocurrencies, but this is risky and may not be feasible for all investors. Before you borrow money in cryptocurrencies, be sure to do your research and understand the risks involved.

Cryptocurrencies and blockchain technology are still relatively new, so there is still much to learn about them and their taxation. However, there are some important things to keep in mind.

Cryptocurrency and blockchain technology are still relatively new, so there is still much to learn about them and their taxation. However, there are some important things to keep in mind.

Cryptocurrencies and blockchain technology are still relatively new, so there is still much to learn about them and their taxation. However, there are some important things to keep in mind.

Cryptocurrencies and blockchain technology are still relatively new, so there is still much to learn about them and their taxation. However, there are some important things to keep in mind.

Cryptocurrencies and blockchain technology are still relatively new, so there is still much to learn about them and their taxation. However, there are some important things to keep in mind.

When it comes to cryptocurrency and blockchain transactions, it's important to keep in mind that these are considered property transactions. This means that the IRS considers cryptocurrencies and blockchain technology as assets, not currency. This means that you will likely have to pay taxes on any profits you make from crypto trading or mining.

Another thing to keep in mind is that you may need to get a loan in order to invest in cryptocurrencies or blockchain technology. Loans can be expensive, so it's important to do your research before taking one out. Make sure you understand the terms of the loan you're considering, as well as the interest rates.

Cryptocurrencies and blockchain technology are still relatively new, so there’s a lot of confusion about how they should be treated for tax purposes. That’s why it’s important to get ahead of the curve and understand the basics of crypto taxes and loans before entering the market.

Crypto Taxes

Cryptocurrencies and blockchain technology are considered property, so they’re taxed like any other property. For example, if you earn income from cryptocurrencies, you’ll have to report that income on your taxes.

The good news is that many crypto investors can take advantage of tax breaks, such as the ability to deduct losses from cryptocurrency investments. If you’re a crypto investor, it’s important to consult with a tax professional to determine your specific tax situation.

Crypto Loans

Crypto loans are a relatively new phenomenon, and there’s still much uncertainty about their legality. In general, crypto loans are similar to traditional loans, except that the loan is secured by a cryptocurrency rather than traditional assets.

While crypto loans may seem like a great way to get access to cryptocurrencies, there are a few risks involved. For example, crypto loans may not be legal in all jurisdictions, and they may be difficult to repay. If you decide to take out a crypto loan, it’s important to consult with a lawyer to ensure that the loan is legal and safe.

Cryptocurrencies are a new and exciting financial technology. While they may have the potential to revolutionize the way we think about money, they also come with unique tax considerations. Here are some tips on how to make smart moves with your cryptoassets and minimize tax risks:

1. Understand Your Tax Situation

Before making any major decisions with your cryptoassets, it is important to understand your tax situation. This includes understanding your capital gains and losses, as well as any applicable taxes you may owe. If you are unsure about your tax situation, consult with a tax advisor.

2. Avoid Capital Gains & Losses

One of the most important things you can do to minimize tax risks is to avoid capital gains and losses. Capital gains are associated with the increase in the value of your cryptoassets over time, while losses are associated with the decrease in the value of your cryptoassets over time. If you have made any significant investments in cryptocurrencies, be sure to track your progress over time to ensure you don’t incur any unwanted capital gains or losses.

3. Consider Trading Cryptocurrencies

If you are looking to make some quick and easy profits with your cryptocurrencies, trading might be a good option for you. While trading can be risky, it can also be a very profitable activity. Make sure to do your research before trading, especially if you are not familiar with the technical details of cryptocurrencies.

4. Consider Using a Bitcoin IRA

If you are interested in using cryptocurrencies for retirement savings, a Bitcoin IRA may be a good option for you. A Bitcoin IRA allows you to invest in cryptocurrencies and use them to fund your retirement account. While this is a complex and risky process, it can offer some great opportunities for long-term success.

5. Consider Using a Crypto Loan

Crypto loans can provide a quick and easy way to turn your cryptocurrency into fiat currency. While there are risks associated with crypto loans, they can also be a very profitable venture. Be sure to do your research before signing up for a crypto loan, and make sure you understand the terms and conditions of the loan.

One of the most important things you can do to protect yourself financially is to understand how cryptocurrency taxes work. Cryptocurrency is treated as property for tax purposes, so you’ll likely have to pay taxes on any profits you make from trading or holding cryptocurrencies.

If you need a loan to cover some expenses, it’s also important to know the pros and cons of borrowing money in cryptocurrency. There are a few things to keep in mind when considering a loan in cryptocurrency: first, the interest rates on loans in cryptocurrency can be high, and second, there is a risk that you won’t be able to repay the loan if the value of the cryptocurrency crashes.