If you're looking for a crypto loan in the USA, there's no need to put up collateral. You can get a loan without collateral using one of these three methods.

There is no easy answer when it comes to getting a crypto loan without collateral in the USA. The process can be complicated and time-consuming, and there may not be any available options available.

Some possible methods for getting a crypto loan without collateral in the USA include:

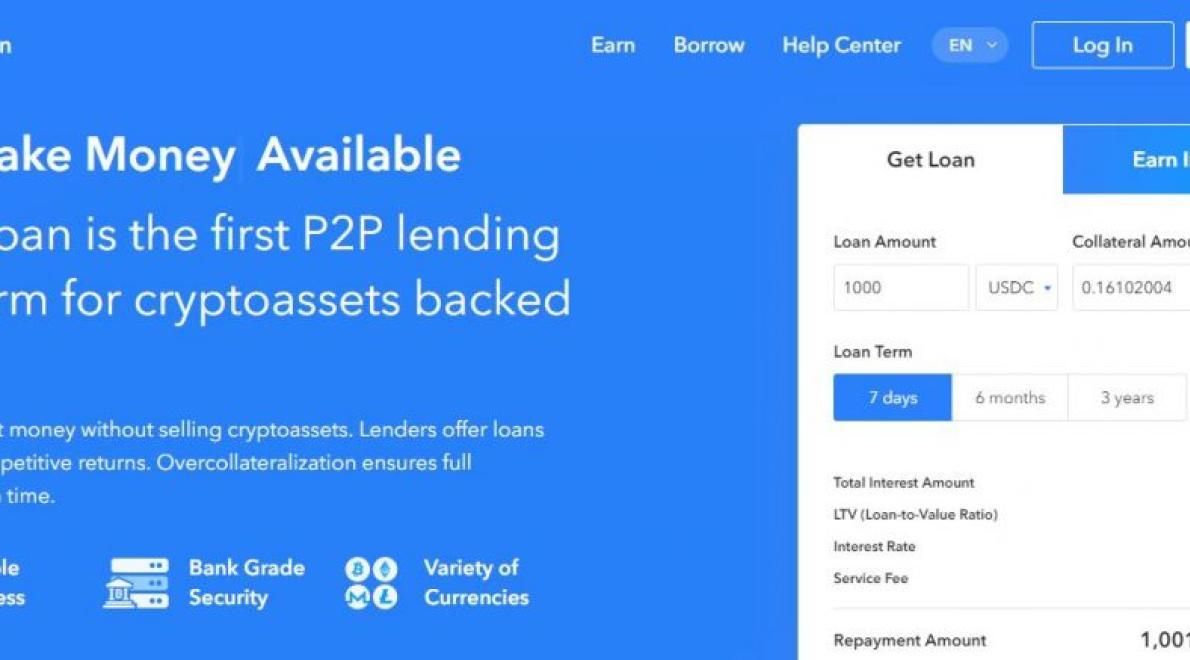

1. Search for a crypto lending platform. These platforms offer short-term loans to digital currency holders, and they may be able to help you find a loan that meets your specific needs.

2. Contact a crypto broker. These brokers are typically experienced individuals who can help you find a loan that meets your specific needs. They may be able to connect you with lenders who are willing to provide loans without collateral.

3. Go through an online peer-to-peer lending platform. These platforms allow borrowers and lenders to connect directly, and they may be able to provide you with a loan that meets your specific needs.

4. Contact a traditional financial institution. These institutions may be willing to provide you with a loan that meets your specific needs, but they may require you to provide collateral.

There are a few lenders that offer crypto loans without collateral in the USA. These lenders typically operate as online banks, and they offer loans in a variety of currencies.

Some of the most popular lenders for crypto loans without collateral in the USA are BitLendingClub and Kabbage. Both lenders offer loans in Bitcoin, Ethereum, and other cryptocurrencies.

Crypto loans without collateral are a relatively new type of loan, and there are still a few restrictions on them. For example, most lenders only offer loans in amounts of $10,000 or less. And borrowers usually need to have good credit ratings to be approved for a crypto loan.

If you're looking for a lender that offers crypto loans without collateral, the best option is probably one of the online banks listed above. They offer a wide range of loans in a variety of currencies, and they have good credit ratings.

There is no easy answer when it comes to finding the best crypto loan without collateral in the USA. However, the following steps can help you get started:

1. Consider your financial situation

Before you start looking for a crypto loan without collateral, you first need to take into account your current financial situation. This includes your current income and assets, as well as your debt and credit score.

2. Do your research

Once you have a good understanding of your financial situation, you need to do some research to find the best crypto loan without collateral. This includes checking out different lending platforms, reading reviews, and talking to other people who have experience with crypto loans.

3. Find a reputable lender

After you have researched the different lending platforms and found one that looks promising, you need to find a reputable lender. This means finding a lender that has a good reputation and has been in business for a long time.

4. Agree on terms and conditions

Once you have found a reputable lender, you need to agree on terms and conditions. This includes things like the interest rate, the amount of money you can borrow, and the repayment schedule.

Crypto lending platforms are a great way to get a crypto loan fast and without collateral. There are a few different platforms that offer this service, and each one has its own set of requirements.

Some of the most popular platforms for crypto loans are BitLendingClub and BTCjam. Both platforms require that borrowers have a verified account and good credit score. They also require that borrowers have a valid bank account and be able to provide identification documents.

Once you have registered with one of these platforms, you can begin applying for loans. You will need to provide information about your identity, your bank account, and your credit score. The platforms will then review your application and determine whether or not you are eligible for a loan.

Once you are approved for a loan, you will need to provide a deposit collateral. This can be in the form of cryptocurrency, real estate, or other assets. The platform will then transfer the loan funds to your bank account.

There are a few ways to get a collateral-free crypto loan in the USA. One way is to use a peer-to-peer lending platform such as LendingClub or Prosper. Another way is to use a cryptocurrency loan service such as BitLendingClub.

There are a few pros and cons to getting a crypto loan without collateral in the USA. On the pro side, you could potentially get a much higher interest rate than you would if you were to borrow money with collateral. This could be beneficial if you need money quickly and don’t have time to wait for a traditional loan to process. Additionally, crypto loans without collateral are not subject to federal or state borrowing regulations, so you could potentially get a loan from a more reputable lender.

However, there are also a few potential cons to consider. First, it’s possible that you won’t be able to get your money back if you need to. Second, if the value of your crypto decreases significantly, you may not be able to get your loan repaid in full. Finally, if you don’t pay back your loan on time, you could have penalties and interest added onto the balance.

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, first released in 2009, is the most well-known cryptocurrency.

Cryptocurrencies are not legal tender, and their value is volatile. There is no central authority that regulates them.

Cryptocurrencies are not subject to government or financial institution control.

Cryptocurrencies are not insured by the government.

Cryptocurrencies are not subject to income or capital gains taxes.

Cryptocurrencies are not subject to payroll taxes.

Cryptocurrencies are not subject to property taxes.

Cryptocurrencies are not subject to debt or credit ratings.

Before getting a crypto loan without collateral, be sure to understand the risks involved. Cryptocurrencies are highly volatile and can experience large swings in value. There is no guarantee that you will be able to repay your loan, even if you are successful in selling your cryptocurrency later. If you cannot repay your loan, you may be forced to sell your cryptocurrency at a much lower price than you would have if you had used it as collateral.

There are a few risks associated with getting a crypto loan without collateral in the USA. The first is that you may not be able to get the money you need if you need it quickly. The second is that you may not be able to get the money back if you need to. Finally, you may have to pay interest on the loan, which can be high.

There are a few ways to make sure you get the best deal on a crypto loan without collateral in the USA. One way is to compare different lenders and find one that offers the best terms. Another way is to find a lender that accepts cryptos as collateral. Finally, make sure you fully understand the terms of the loan before signing up.

There are a few things you can do to get a crypto loan without collateral in the USA.

The first thing to do is to find a reputable crypto lending platform. There are a few good options out there, such as BitLendingClub and BTCJam.

Once you have found a platform, you will need to create an account and fill in some basic information. This will include your name, email address, and bank details.

After you have registered, you will need to submit a loan application. This will require you to provide information about your project, such as the amount of cryptocurrency you want to borrow, the interest rate you are willing to pay, and the duration of the loan.

Once you have submitted your application, the lending platform will review it and decide whether or not to offer you a loan. If you are approved, the platform will send you a loan request form.

You will then need to submit the form to the cryptocurrency you want to borrow. You will need to provide information about the coin, such as the amount, the interest rate, and the terms of the loan.

Once you have submitted the form, the cryptocurrency will be transferred to your wallet, and the loan will be processed.

What is the process for getting a crypto loan without collateral in the USA?

There is no one-size-fits-all answer to this question, as the process for getting a crypto loan without collateral will vary depending on the specific lender you are working with. However, some tips on how to get a crypto loan without collateral in the USA may include submitting an application online, providing personal information such as your credit score and income, and verifying your identity using a government-issued ID or passport.