Crypto to USD loans are a great way to get the money you need without having to sell your crypto assets. With a loan, you can borrow against your crypto holdings and repay the loan in USD. This allows you to keep your crypto while still getting the cash you need.

Crypto loans are becoming increasingly popular as a means of obtaining financing for cryptocurrencies and blockchain projects. There are a few different ways to get a crypto loan in USD, depending on your needs and preferences.

One option is to find a crypto lending platform that specializes in helping borrowers get loans in USD. These platforms typically have extensive networks of lenders and provide detailed information about the loan process and the various loan options available.

Another option is to seek out individual lenders who are willing to provide crypto loans. This can be a more challenging process, as lenders typically require a higher degree of trust and confidence in the cryptocurrency market.

Regardless of the method you choose, make sure to carefully research the available options and select a platform or lender that meets your specific needs.

and investments

Crypto can provide a number of benefits for loans and investments, including:

- Lower interest rates: Crypto lending platforms often offer lower interest rates than traditional lenders, which can make loans more affordable.

- Greater security: Cryptocurrencies are often more secure than traditional investments, meaning that your money is less likely to be lost or stolen.

- Increased transparency: Because cryptos are decentralized, there is increased transparency around them, meaning you can trust the information you receive about them.

- Reduced risk: Cryptocurrencies are often less risky and volatile than traditional investments, meaning you can potentially gain more money from them.

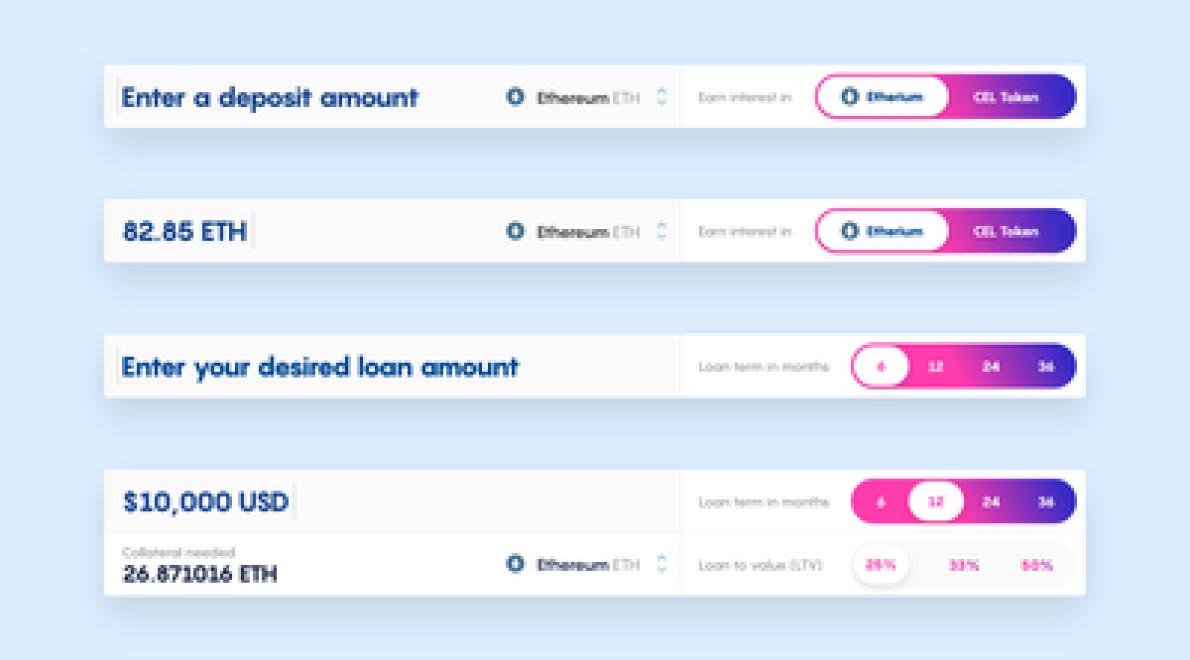

Crypto can be used as a way to get a loan in USD. For example, if someone wants to borrow $10,000 in USD, they could use bitcoin or other cryptocurrencies to pay the lender.

There is no definitive answer to this question as there are a variety of ways that people can get loans using cryptocurrency. Some people may use a peer-to-peer lending platform, while others may use a traditional lender that accepts cryptocurrencies as a form of payment. It is important to keep in mind that not all lenders are willing to work with crypto, so it is important to research potential lenders before engaging in any transactions.

There is no one-size-fits-all answer to this question, as the best way to get a loan with crypto and USD will vary depending on your specific situation. However, some possible methods include contacting a cryptocurrency lending platform or using a peer-to-peer lending platform.

Some benefits of using crypto to get a loan in USD are that it is secure, fast, and cheaper than traditional methods. Additionally, crypto loans are not subject to traditional lending criteria, such as credit scores or collateral requirements, which makes them an appealing option for those who may not qualify for traditional loans.

There is no one-size-fits-all answer to this question, as the best way to use crypto as collateral for a loan will vary depending on the specific situation and preferences of the lender. However, some tips on how to use crypto as collateral for a loan include:

1. carefully consider the risks associated with using crypto as collateral for a loan

2. always ensure that the value of the crypto being used as collateral is above the required minimum threshold

3. make sure that the terms of the loan are favourable to the borrower, including terms related to interest rates and collateral requirements

4. keep an up-to-date record of all transactions related to the collateral being used for the loan, in order to provide complete documentation to the lender should any issues arise

There are a number of ways to get a loan with USD and crypto. Some lenders will only work with certain types of borrowers, so it's important to do your research before applying.

Cryptocurrencies can be used to secure a loan, but there are some risks associated with doing so. First, cryptocurrency loans are not regulated by the government, and there is no guarantee that the loan will be repaid. Second, cryptocurrency loans are often not FDIC insured, so you could lose your money if the loan goes into default. Finally, cryptocurrency loans are often not subject to the same credit requirements as traditional loans, so you may not be able to get a loan from a traditional lender.

There are a few ways to use crypto to get a loan in USD. One way is to use a cryptocurrency lending platform. These platforms allow you to borrow cryptocurrencies from other users. You then have to repay the loan with a fixed amount of cryptocurrency. Another way to use crypto to get a loan is to use a crypto-based credit card. These cards allow you to spend cryptocurrencies as if they were traditional currency. You then have to repay the loan with traditional currency.

Crypto can provide a secure and fast way to transfer money between lenders and borrowers. Crypto also allows borrowers to access loans from a wider range of lenders, without the need for a traditional credit score. Additionally, crypto loans are immune to traditional financial fraud, making them a more secure option for borrowers.

Crypto is a better option for a loan because it is more secure than USD.