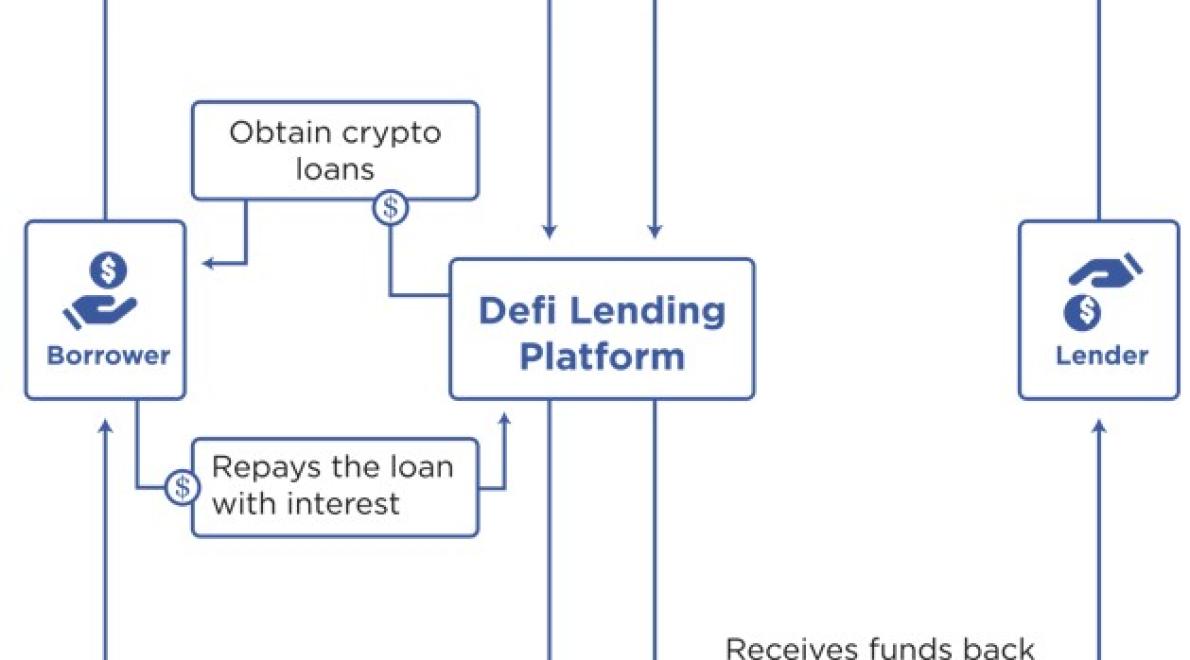

Crypto loans are a type of financial product that allows borrowers to take out a loan using cryptocurrency as collateral. These loans are typically provided by lending platforms that use decentralized finance (DeFi) protocols to connect borrowers and lenders. Crypto loans can offer a number of benefits, including the ability to access liquidity without selling your crypto assets, and the potential to earn interest on your collateral. However, they also come with risks, such as the risk of losing your collateral if the value of your crypto assets falls.

Crypto Loans are a new financial product that allows people to borrow money in cryptocurrencies. The Crypto Loans movement is a group of companies and individuals who are working to make the Crypto Loans ecosystem a success.

Crypto Loans are a new financial product that allows people to borrow money in cryptocurrencies. The Crypto Loans movement is a group of companies and individuals who are working to make the Crypto Loans ecosystem a success.

Crypto Loans are a new financial product that allows people to borrow money in cryptocurrencies. The Crypto Loans movement is a group of companies and individuals who are working to make the Crypto Loans ecosystem a success.

Crypto Loans are a new financial product that allows people to borrow money in cryptocurrencies. The Crypto Loans movement is a group of companies and individuals who are working to make the Crypto Loans ecosystem a success.

Crypto Loans are a new financial product that allows people to borrow money in cryptocurrencies. The Crypto Loans movement is a group of companies and individuals who are working to make the Crypto Loans ecosystem a success.

Crypto loans are disrupting traditional banking by providing an alternative financial system that is more accessible and affordable. Crypto loans allow borrowers to borrow money against their cryptocurrency holdings, which provides them with a secure and instant way to access funds.

Crypto loans are also a cheaper alternative to traditional loans. Robo-lending platforms like Lending Club and Bitbond charge interest rates of between 10 and 20 percent, while crypto loans typically charge much lower rates of around 1 percent. This makes crypto loans a more affordable option for borrowers who are unable to obtain traditional loans due to high interest rates or poor credit history.

Crypto loans are also a more secure option than traditional loans. Crypto loans are collateralized by the borrower’s cryptocurrency holdings, which ensures that the loan will be repaid in full and that the cryptocurrency will not be seized by the lender. This is in contrast to traditional loans, which are not collateralized and can be seized by the lender if the borrower defaults on the loan.

Overall, crypto loans are a more affordable, secure, and accessible alternative to traditional banking systems. They are changing the way people borrow money and are likely to continue to disrupt the banking sector in the future.

Crypto loans are a great way to get the money you need without having to worry about interest rates. Traditional loans can be quite expensive, and if you need money quickly, a crypto loan may be a better option.

Another benefit of crypto loans is that they are often easier to get than traditional loans. You don’t need to go through a bank or another institution, and you can often get a loan in minutes. This means that you can get the money you need much more quickly than you would with a traditional loan.

Finally, crypto loans are often more secure than traditional loans. Many banks are hesitant to lend money to cryptocurrency companies, but this isn’t always the case with crypto loans. There is a much smaller risk that your crypto loan will not be repaid, which can be a great advantage.

Cryptocurrencies are a new and untested asset class, and there is a risk that they will not be backed by anything tangible. This means that there is a risk that borrowers will not be able to repay their loans, and this could lead to financial ruin for borrowers and investors.

To mitigate the risks of crypto loans, it is important to have a clear understanding of the risks involved and how to reduce them.Some of the key risks of crypto loans include:

1. The risk of not being able to repay the loan: Crypto loans are unsecured, meaning that borrowers do not have any collateral to protect them in the event that they are not able to repay the loan. If the borrower is not able to repay the loan, this could lead to financial ruin for them and their investors.

2. The risk of price volatility: Cryptocurrencies are highly volatile, and this could lead to a loss of value for the borrower if the price of the cryptocurrency falls.

3. The risk of fraud: There is a risk that borrowers will be defrauded, and this could lead to them losing all of their investment.

4. The risk of theft: There is a risk that someone will steal the cryptocurrency belonging to the borrower, leading to them losing all of their investment.

5. The risk of cybercrime: There is a risk that the borrower's cryptocurrency will be stolen or attacked by cybercriminals, leading to them losing all of their investment.

6. The risk of insolvency: There is a risk that the borrower will go bankrupt, and this could lead to them losing all of their investment.

7. The risk of regulatory uncertainty: There is a risk that the authorities may change their stance on cryptocurrencies, which could lead to them losing all of their investment.

8. The risk of market volatility: The market for cryptocurrencies is highly volatile, which could lead to a loss of value for the borrower if the price of the cryptocurrency rises or falls.

9. The risk of loss of access to funds: If the borrower's cryptocurrency falls in value, this could mean that they do not have enough money to repay their loan.

10. The risk of being left with nothing: If the borrower's cryptocurrency falls in value, this could mean that they lose all of their investment, leaving them with nothing.

Crypto loans and deFi are two of the most important innovations in the crypto space. They have the potential to change the way we think about and use cryptocurrencies.

Crypto loans are a new way of borrowing money using cryptocurrencies. borrowers can borrow money against their cryptocurrency holdings, and the lenders can earn interest on the loans.

DeFi is short for “decentralized finance”. It is a new way of using blockchain technology to create trustless financial products. This allows people to borrow money, trade assets, and invest in projects without needing to go through a traditional financial institution.

Both crypto loans and deFi have the potential to revolutionize the way we use cryptocurrencies. They could enable us to borrow money cheaply and easily, and they could help people to invest in projects they believe in without having to worry about the risk of losing their money.

There are still some kinks to be worked out in both crypto loans and deFi, but they are already changing the way we think about cryptocurrencies and the blockchain.

If you want to get a crypto loan, there are a few different ways to go about it.

One way is to find a crypto lending platform. These platforms will help you find a crypto loan from a variety of lenders.

Another way is to ask your friends and family if they are willing to lend you money in crypto. They may be more than happy to help out, especially if you offer to repay them in cryptocurrency.

Finally, you can also try to find a crypto loan directly from a lender. These loans are usually much more expensive, but they can be a more reliable option.

Crypto loans are a new way to get money that uses blockchain technology. Crypto loans are a way for people to borrow money using cryptocurrencies as collateral.

There are three types of crypto loans:

1. Crypto lending platform: These platforms allow people to borrow and lend cryptocurrencies.

2. Cryptocurrency-based credit card: These cards allow people to spend cryptocurrencies like regular credit cards.

3. Crypto derivatives: These are contracts that give investors the right to receive a certain amount of cryptocurrency at a set time in the future.

Crypto loans typically require collateral that is in the form of bitcoin, ether, or other cryptocurrencies. This collateral can be used to secure a loan and protect the lender from any potential default.

Crypto loans are repaid by exchanging the loaned crypto for fiat currency. The borrower then sends the fiat currency to the lender, and the lender sends back the crypto.

Crypto loans are an interesting way to get a loan without having to go through a traditional lender. There are a few advantages to using a crypto loan:

1) You don’t need to provide a lot of personal information.

2) You can borrow money from a global network of lenders.

3) The interest rates are usually lower than those offered by traditional lenders.

4) There is no need to pay back the loan until you want to.

There are also a few disadvantages to using a crypto loan:

1) Crypto loans are not regulated or backed by a government institution, so there is no guarantee that you will be repaid.

2) Crypto loans are not as popular as traditional loans, so you may have to wait a long time to find a lender willing to lend you money.

Overall, crypto loans are an interesting way to get a loan without having to go through a traditional lender. They offer some advantages (lower interest rates, global reach, no need to repay until you want to), but they also have some disadvantages (unregulated, not as popular, possibility of not being repaid).

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are not subject to traditional financial lending standards. This means that there is a higher risk of losing your money if you take out a cryptocurrency loan. Before you take out a cryptocurrency loan, be sure to do your research and understand the risks.

Here are some tips to help you get started:

1. Know What You're Getting Into

Before you take out a cryptocurrency loan, be sure to understand the risks. Cryptocurrencies are volatile and can be difficult to trade. If you don't have the experience or knowledge to trade cryptocurrencies, it's best to avoid taking out a loan in this area.

2. Understand the Terms of the Loan

Before you take out a cryptocurrency loan, be sure to understand the terms. Many cryptocurrency loans involve high interest rates and require strict repayment terms. Make sure you understand the terms of the loan before you sign anything.

3. Do Your Research

Before you take out a cryptocurrency loan, be sure to do your research. There are a lot of scams out there, and you don't want to fall victim to one. Be sure to do your research to make sure the lender you choose is reputable and has a good reputation.

4. Compare Rates and Terms

Before you take out a cryptocurrency loan, be sure to compare rates and terms. Compare different lenders and find one that offers the best deal for you. Be sure to read the terms and conditions of the loan carefully before signing anything.

1. What is a crypto loan?

A crypto loan is a type of borrowing where you borrow cryptocurrency rather than traditional currency. The borrowed cryptocurrency is then used to purchase items or services. Crypto loans are typically offered by crypto exchanges and other lending platforms.

2. Is a crypto loan safe?

Yes, crypto loans are generally safe and secure. However, like with any financial transaction, there is always the potential for risk. Before taking out a crypto loan, make sure you are fully aware of the risks involved and take appropriate precautions.

3. How do I get a crypto loan?

You can get a crypto loan by contacting a lending platform or exchange. Alternatively, you can try to find a lender through online forums or social media. Be sure to research the available options before making a decision.

4. What are the benefits of taking out a crypto loan?

The benefits of taking out a crypto loan include the ability to borrow cryptocurrency at a low interest rate. Additionally, crypto loans are usually fast and easy to process. Finally, crypto loans can be used to purchase items or services of your choice.