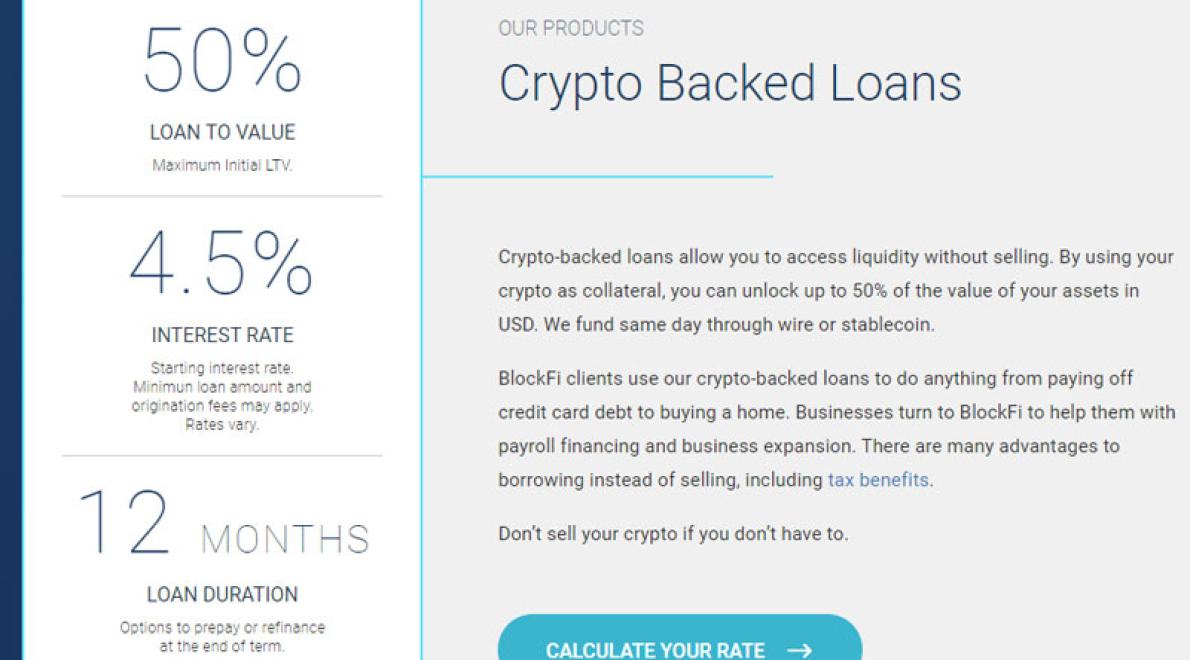

Blockfi is a crypto lending platform that offers loans in both USD and crypto. They are one of the few companies that offer this service and have been growing in popularity since their launch in 2017. Blockfi has a simple application process and offers competitive rates, making it a great option for those looking to borrow against their crypto holdings.

Low interest rates are one of the main benefits of using loan products offered by blockchain company, Loanblock. Loanblock’s crypto loans offer borrowers up to 78% interest rates, which is significantly lower than traditional lending rates.

Loanblock also offers a fast and easy application process, with borrowers receiving approval within minutes. And if borrowers need to pause or stop their loan payments, they can do so without penalty.

Overall, Loanblock’s crypto loans are an excellent option for those looking for a low-interest loan that is still accessible and easy to use.

If you want to use your crypto as collateral for a loan from a lending platform, then you need to find a platform that offers this service. Some of the most popular platforms that offer this service are BitLendingClub and Bitbond.

Once you have found a lending platform that offers this service, you will need to create an account with them. Once you have created your account, you will need to deposit your crypto into your account. After you have deposited your crypto, you will need to submit a loan request.

After you have submitted your loan request, the lending platform will review your application. If they approve your loan request, they will transfer your crypto to the address that you have provided in your loan request.

If the lending platform denies your loan request, then they will return your crypto to your account.

To get a crypto loan from Blockfi, you first need to create an account. After you create your account, you will need to complete a loan application. Once you have completed the loan application, you will be able to submit documents to prove your income and creditworthiness. After you have submitted all of the required documents, Blockfi will review your application and decide if you are eligible for a loan. If you are approved for a loan, Blockfi will process the loan and provide you with a loan terms sheet.

There are many benefits to taking out a crypto loan from Blockfi. First and foremost, we offer competitive interest rates, which is essential for anyone looking to finance their crypto holdings. Additionally, our platform is fully compliant with all relevant regulations, so you can be sure that your loan will be safe and secure. Finally, our team of experienced loan officers are available 24/7 to help you get the financing you need to grow your crypto portfolio.

If you want to get a loan in cryptocurrency, Blockfi is a good option. Blockfi is a cryptocurrency lending platform that allows you to borrow cryptocurrencies against your own assets. You can use this platform to get a loan in bitcoin, ethereum, and other cryptocurrencies.

To use Blockfi, first sign up for an account. Then, deposit your cryptocurrency into your account. You can use this cryptocurrency to collateralize the loan. Once you have deposited your cryptocurrency, you will need to create a loan request. In your loan request, you will need to provide information about your loan, such as the amount you are requesting, the terms of the loan, and the collateral you are using.

Once you have created your loan request, Blockfi will review it. If the loan is approved, Blockfi will transfer the cryptocurrency you are using as collateral to your account. If the loan is not approved, Blockfi will return the cryptocurrency to your account.

There are no specific requirements for getting a loan from Blockfi, other than having a valid bank account and being able to provide documentation of your income and assets.

The process for taking out a loan from Blockfi is easy and straightforward. First, you will need to create an account on Blockfi. After creating your account, you will be able to apply for a loan. Once you have applied for a loan, Blockfi will review your application and determine if you are eligible for a loan. If you are eligible for a loan, Blockfi will process your loan and provide you with a loan proposal. After you have reviewed the loan proposal, you will be able to decide whether or not you want to accept the loan proposal. If you decide to accept the loan proposal, Blockfi will process the loan and provide you with the funds.

The interest rates for Blockfi loans are variable and depend on the loan amount, term, and credit score of the applicant.

It typically takes about two business days to process a loan request.

Blockfi loans can be repaid in a number of ways, including through a direct debit to your bank account, through a purchase of Blockfi tokens, or through a service that allows you to earn interest on your loan.

If you can't repay a loan from Blockfi, Blockfi will work with you to find a solution. If you don't repay a loan within the agreed timeline, Blockfi may take various actions, including:

Selling your assets to repay the loan

Reporting the loan to credit bureaus

Seizing your assets

Contacting law enforcement

Blockfi will work to minimize any negative consequences of not being able to repay a loan.

First and foremost, be sure to read the terms and conditions of any loan you take out from Blockfi. These will outline the interest rates, borrowing limits, and other important details.

Once you have read the terms, it's time to fill out the loan application form. This will require information such as your name, address, and banking information. Once you have submitted the form, Blockfi will review it and determine if you are eligible for a loan. If you are approved, Blockfi will process the loan and provide you with a Loan Agreement and Terms & Conditions document.

Finally, be sure to keep copies of these documents for your records. You will need them if you have questions or problems with your loan.