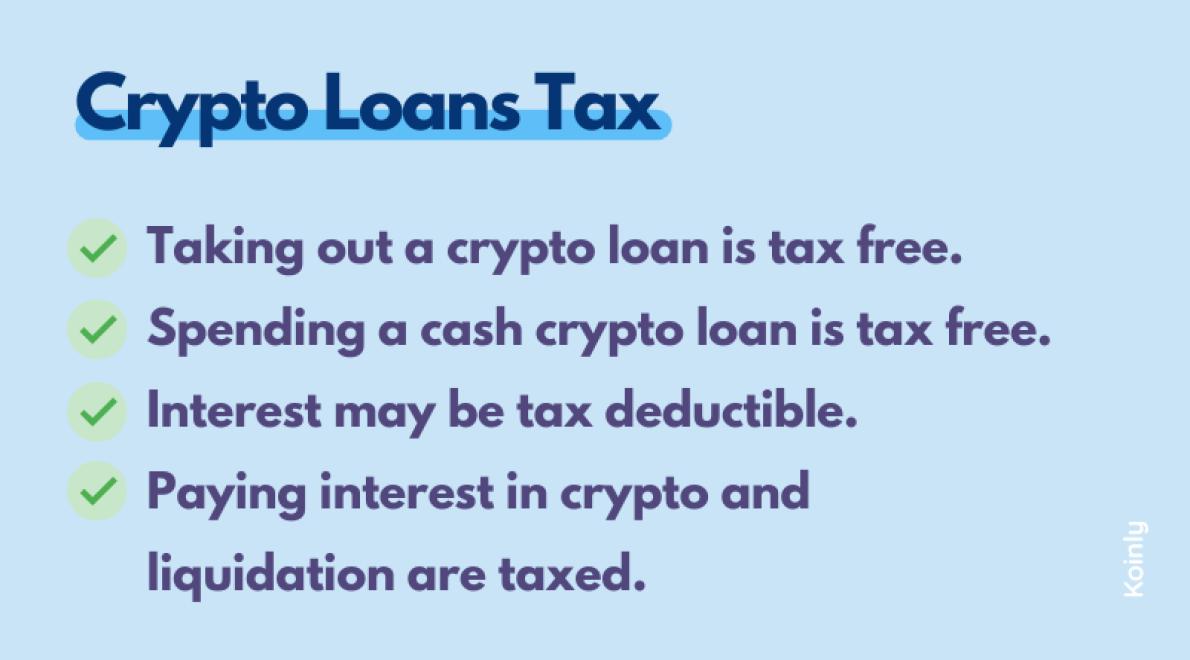

According to the Internal Revenue Service (IRS), cryptocurrency loans are taxable. The IRS treats cryptocurrency loans as property transactions, which means that they are subject to capital gains tax.

Crypto loans are not currently taxable in the same way as traditional loans. This is because crypto loans are not considered to be “financial instruments” under current tax law.

This means that crypto loans are not subject to capital gains taxes, or any other taxes related to the ownership of assets. This could change in the future as crypto loans may be classified as financial instruments, but for now they are not.

This is an important distinction to make, as it may affect the taxability of crypto loans in particular and cryptocurrency in general. If crypto loans were to be taxable in the same way as traditional loans, this could lead to significant tax liabilities for borrowers.

However, until this changes, crypto loans are not subject to the same taxes as traditional loans.

Crypto loans are taxed in the same way as any other loan. The borrower pays taxes on the interest and any other income they earn from the loan.

Crypto loans are a new type of loan that allow you to borrow money using cryptocurrency. Crypto loans are similar to traditional loans in that you need to pay back the loan with interest. However, the main difference between a crypto loan and a traditional loan is that you borrow cryptocurrency instead of fiat currency.

Cryptocurrency is a type of digital asset that is used to purchase goods and services. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. This makes them an interesting option for loans because they are not subject to traditional banking regulations.

The advantage of using a crypto loan over a traditional loan is that you don’t have to worry about creditworthiness or collateral. This makes crypto loans a good option for people who don’t have a good credit history or who don’t have any valuable assets to use as collateral.

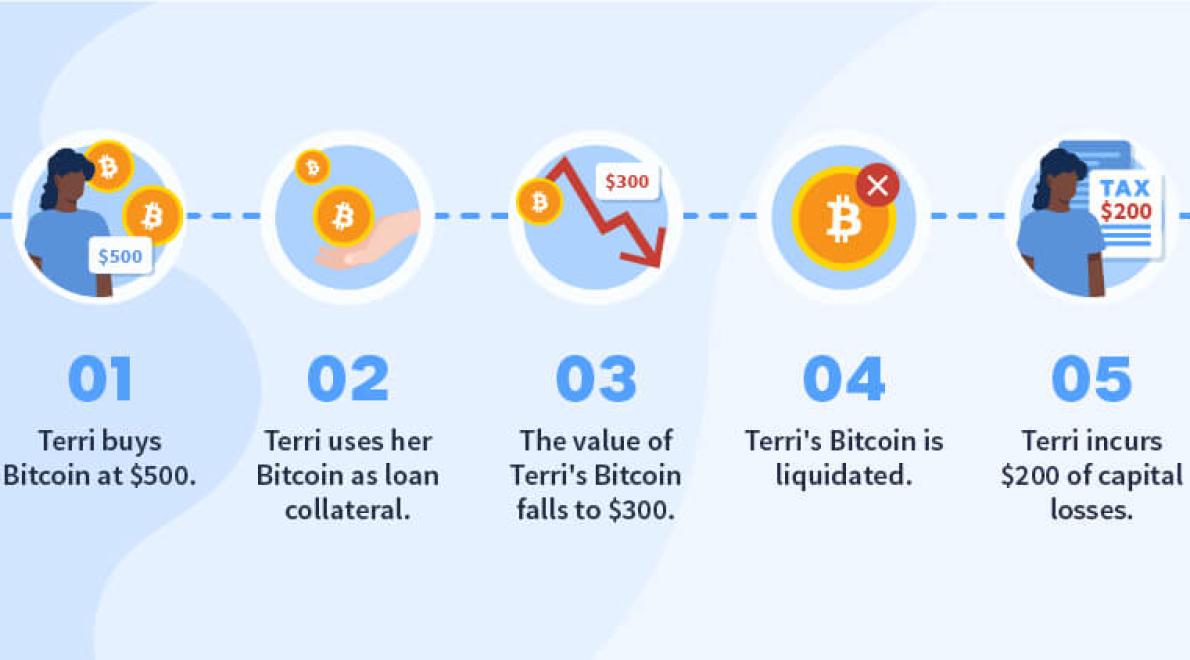

The disadvantage of using a crypto loan is that cryptocurrency is volatile and can be difficult to trade. This makes it risky for lenders and borrowers. If the value of the cryptocurrency falls, it may be difficult for the borrower to repay the loan. If the value of the cryptocurrency rises, the borrower may end up owing more than the loan was worth when it was originally taken out.

Crypto loans are still relatively new, so there is still much to learn about them. It is important to carefully consider the risks involved before taking out a crypto loan.

Crypto loans are currently not taxable in the same way as traditional loans. This is due to the fact that crypto loans are not considered a form of currency.

Instead, crypto loans are treated as a form of security. This means that the loan is taxable when it is repaid, just like any other form of security.

This means that if you are in the middle of a crypto loan and you need to repay it, you will have to pay tax on the repayments.

It is important to note that this does not apply to crypto loans that you take out to buy cryptocurrencies. These loans are still considered a form of security, but they are not taxable when repaid.

Crypto loans are not taxable in the United States.

When you take out a loan to purchase cryptocurrency, you may be subject to taxation. This means that you will have to pay taxes on the interest and principal that you borrow, as well as any other associated costs.

If you are a US taxpayer, you will need to report the interest and principal that you borrow on your federal income tax return. You will also need to report any gains or losses that you make on the sale of your crypto loan.

If you are a UK taxpayer, you will need to report the interest and principal that you borrow on your UK tax return. You will also need to report any gains or losses that you make on the sale of your crypto loan.

If you are a Canadian taxpayer, you will need to report the interest and principal that you borrow on your Canadian tax return. You will also need to report any gains or losses that you make on the sale of your crypto loan.

Crypto loans are a new and exciting way of borrowing money that uses blockchain technology. They work by allowing borrowers to borrow money using cryptocurrencies as collateral.

Crypto loans are currently not subject to taxation in the UK. This means that borrowers are not required to pay tax on the interest payments that they receive from their crypto loan.

This is likely to change in the future, as the government is increasingly concerned about tax avoidance and evasion. It is possible that the government will begin to tax crypto loans in the future. However, at this stage, nothing has been confirmed.

If you are looking to borrow money using cryptocurrencies as collateral, then a crypto loan may be a suitable option for you. Remember, however, that at this stage, there is no taxation involved. So, if you decide to take out a crypto loan, be sure to keep this in mind.

Cryptocurrency loans are taxed just like any other loan. The borrower is responsible for paying taxes on the interest and any other income generated from the loan.

Crypto loans are not considered taxable in Australia. This is because they are considered to be loans rather than investments. This means that the interest that is paid on these loans is taxable, just as it would be if the money was borrowed from a traditional lender.

Crypto loans are a new form of lending that uses blockchain technology. Crypto loans are a new way of providing short-term loans to consumers and businesses.

Crypto loans are a new form of lending that uses blockchain technology. Crypto loans are a new way of providing short-term loans to consumers and businesses.

Crypto loans are a new way of providing short-term loans to consumers and businesses.

Crypto loans are a new way of providing short-term loans to consumers and businesses.

Crypto loans are a new way of providing short-term loans to consumers and businesses.

Crypto loans are a new way of providing short-term loans to consumers and businesses.