Binance, the world’s largest cryptocurrency exchange by trading volume, is now offering crypto loans. The new service will allow users to borrow money against their cryptocurrency holdings. The loans will be denominated in either U.S. dollars or stablecoins, and will have to be repaid with interest. Binance says that the interest rates for the loans will start at 4.5% per year.

Binance is one of the most popular exchanges in the world and they offer crypto loans with interest rates as low as 1%. This makes Binance one of the most affordable and convenient places to borrow cryptocurrencies.

Binance also offers a loyalty program that rewards users for using their platform. This loyalty program offers a variety of rewards, including free coins and discounts on future transactions.

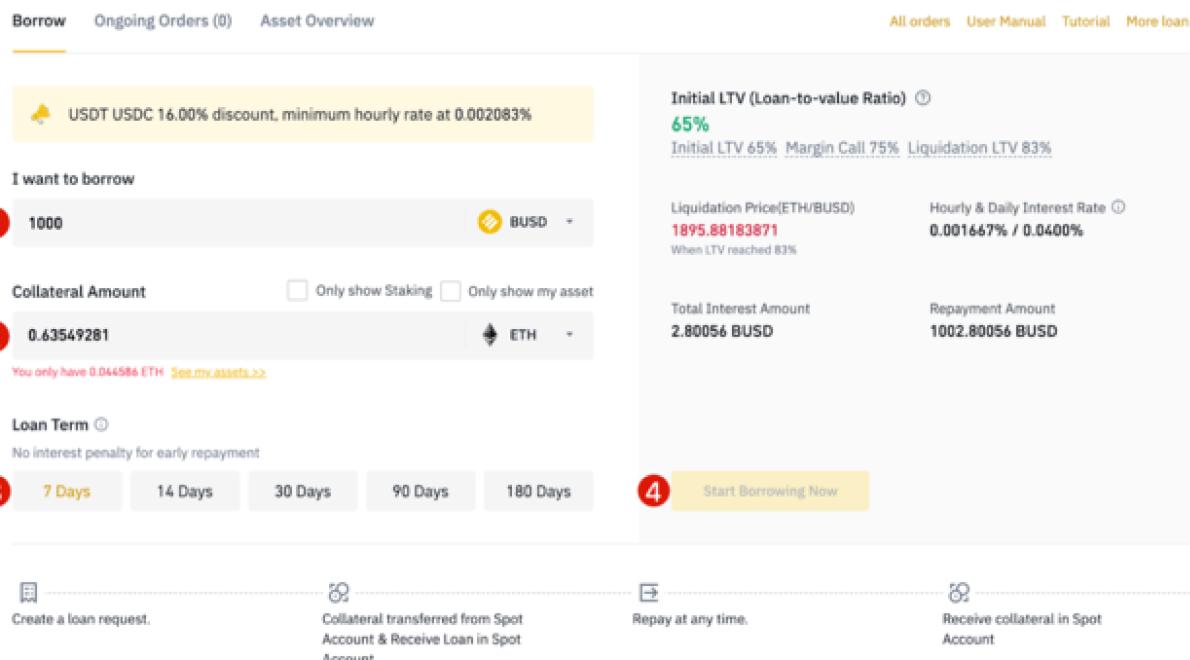

1. Visit Binance.com and create an account.

2. Click on the “Funds” tab and select the “Loan” option.

3. Enter the amount of money you need and choose the repayment schedule.

4. Click on the “Apply” button to submit your request.

Binance, the world’s leading cryptocurrency exchange, has announced the launch of a new crypto loan platform.

The platform will allow users to borrow and lend cryptocurrencies, as well as fiat currencies, using blockchain technology.

Binance says that the platform will provide “unparalleled access” to liquidity and security for both borrowers and lenders.

The platform will initially offer a range of loans for different cryptocurrencies, including Bitcoin, Ethereum, and Binance Coin.

Binance CEO Yi He said: “Our mission is to create the most user-friendly and accessible trading platform in the world.

“We are excited to launch our new crypto loan platform and provide unparalleled access to liquidity and security for both borrowers and lenders.”

This is a great option if you want to get a loan but don’t have the traditional collateral. You can use your crypto as collateral to get a loan from a reputable lender. There are a few things you need to keep in mind when using this option:

1. Make sure you are fully aware of the risks involved – using crypto as collateral means that you are taking on some risk. There is the potential for the value of your crypto to decline, which could lead to you not being able to repay the loan.

2. Compare different lenders – there are a lot of reputable lenders out there, so it is important to compare different offers before deciding on a lender.

3. Make sure the terms of the loan are appropriate – make sure that the terms of the loan are fair and reasonable. You don’t want to end up paying too much interest on the loan, or having to repay it early.

4. Make sure you understand the repayment process – make sure you understand the repayment process so that you are prepared should something happen and you need to start repaying the loan early.

5. Keep copies of all relevant documents – make sure you keep copies of all relevant documents, in case you need to refer to them in future. This includes your loan agreement, your credit report, and any documentation that proves your identity.

If you don't want to sell your cryptocurrency assets, you can get a loan from a financial institution. You will need to provide documentation of your cryptocurrency holdings and your identity. You will also need to agree to terms and conditions of the loan, such as interest rates and repayment terms.

Binance is one of the most popular exchanges in the world. It offers a wide range of services, including crypto loans. This allows users to borrow cryptocurrency and trade it for other cryptocurrencies or fiat currencies.

Binance offers the lowest interest rates on crypto loans. This makes it a great option for users who need to borrow small amounts of cryptocurrency to start trading. The interest rates are also very low, making it a very affordable option.

Binance also offers a wide range of loan terms. This allows users to find the perfect loan agreement for their needs. The exchange offers short-term loans as well as long-term loans.

Binance also offers a variety of repayment options. This includes both traditional and cryptocurrency loans. users can also choose to repay their loans in multiple installments.

Overall, Binance is a great option for users who need to borrow small amounts of cryptocurrency to start trading. The low interest rates and wide range of loan terms make it a great option for users of all levels of experience.

Binance is one of the most popular cryptocurrency exchanges in the world. It offers a variety of services, including crypto loans. This guide will help you understand crypto loans on Binance and how to use them.

What are crypto loans?

Crypto loans are short-term loans that you can use to purchase cryptocurrencies or tokens. They are peer-to-peer loans that are collateralized by the cryptocurrency you borrow.

How do I use a crypto loan on Binance?

To use a crypto loan on Binance, first create an account. Next, click on the “Binance” button in the top left corner of the screen. This will take you to the Binance platform.

Click on the “Coins” tab. This will display all of the coins that you can trade on Binance.

Click on the “Cryptocurrencies” tab. This will display all of the cryptocurrencies that you can trade on Binance.

Click on the “Loan” button. This will open the Binance loan interface.

Click on the “Crypto Loan” button. This will open the Binance crypto loan interface.

Click on the “Apply” button. This will open the Binance application form.

Complete the form and click on the “Submit” button. This will submit your application for a crypto loan on Binance.

Wait for a response from Binance. Once you receive a response, you will know whether you have been approved for a crypto loan on Binance or not.

How much can I borrow?

The amount that you can borrow varies depending on the cryptocurrency that you are using as collateral. For example, you can borrow Bitcoin, Ethereum, and Litecoin amounts ranging from 0.01 to 100,000 ETH.

How long do I have to repay my crypto loan?

The repayment period for a crypto loan on Binance ranges from 24 to 72 hours. You must repay your crypto loan within this time period or your collateral will be seized by Binance.

What are the risks associated with using a crypto loan on Binance?

There are a few risks associated with using a crypto loan on Binance. First, there is the risk that you won’t be able to repay your loan in time. Second, there is the risk that you won’t be able to repay your loan at all. Third, there is the risk that your collateral will be seized by Binance if you don’t repay your loan in time. Fourth, there is the risk that you will lose your money if Binance goes bankrupt. Finally, there is the risk that the price of your cryptocurrency will decline before you can repay your loan.

Should I use a crypto loan on Binance?

There is no one-size-fits-all answer to this question. Depending on your financial situation, you may or may not want to use a crypto loan on Binance. If you are comfortable with the risks associated with using a crypto loan on Binance, then go ahead and do so.

To use Binance's crypto loan feature, first create an account on the exchange. Once you have an account, head to the "Funds" section and select "Crypto Loan."

Next, you will need to input the amount of cryptocurrency you want to loan and the duration of the loan. You will also need to provide your personal information, including your name, email address, and phone number. Binance will then process your loan and send you a notification when it is due.

1. Binance offers crypto loans as a way to help its customers access liquidity and expand their holdings.

2. The crypto loans are available in a variety of currencies, including Bitcoin, Ethereum, and Binance Coin.

3. The loans have a minimum loan amount of $10,000 and a maximum loan amount of $100 million.

4. The interest rates for crypto loans are set at 3.5%.

5. Binance plans to use the proceeds from the crypto loans to expand its operations and support the growth of the crypto market.

6. The crypto loans are available to users in more than 100 countries.

7. Binance has already issued more than $500 million in crypto loans.

8. Binance is currently in the process of expanding its crypto lending operation to Japan, Southeast Asia, and South America.

9. Binance is also planning to launch a margin trading platform and a fiat-to-crypto exchange.

10. Binance is one of the most popular cryptocurrency exchanges in the world, with more than 1.4 million active users.

If you are looking to borrow money from Binance, then the first thing you need to do is sign up for an account. Once you have an account, you can head over to the lending section of the website and begin the process of applying for a loan.

There are a few things that you will need to provide in order to apply for a loan with Binance. First, you will need to provide your name, email address, and phone number. Next, you will need to provide your banking information, such as your bank account number and the IBAN of your bank. Finally, you will need to provide your credit score.

Once you have completed the necessary information, it is time to submit your application. Binance will review your application and determine whether or not you are eligible for a loan. If you are approved for a loan, Binance will contact you to set up a meeting to discuss the terms of the loan.