Crypto-to-crypto loans are a type of loan that allows users to borrow cryptocurrency from a lending platform using their cryptocurrency as collateral. These types of loans can be used to trade or invest in cryptocurrency without having to sell your assets, and can be a good option for those who want to hold onto their cryptocurrency while still being able to use it.

Crypto to crypto loans are a great way to get access to low-interest loans that use the cryptocurrency as the underlying currency. Because these loans are secured by the cryptocurrency rather than traditional assets, they offer an interesting and innovative way to lend money.

Crypto to crypto loans also have a number of other benefits. For example, because the loans are secured by the cryptocurrency, there is no need for collateral or credit checks. This makes them a great option for people who want to get access to low-interest loans but don’t have good credit or who don’t trust traditional lenders.

Crypto to crypto loans also offer a secure and reliable way to borrow money. Because the loans are secured by the cryptocurrency, there is no risk of losing your money if you can’t repay the loan. This makes crypto to crypto loans a great option for people who want to borrow money but don’t want to worry about risk.

Overall, crypto to crypto loans are a great way to get access to low-interest loans that use the cryptocurrency as the underlying currency. They offer a secure and reliable way to borrow money, and they have a number of other benefits such as no risk of losing your money if you can't repay the loan.

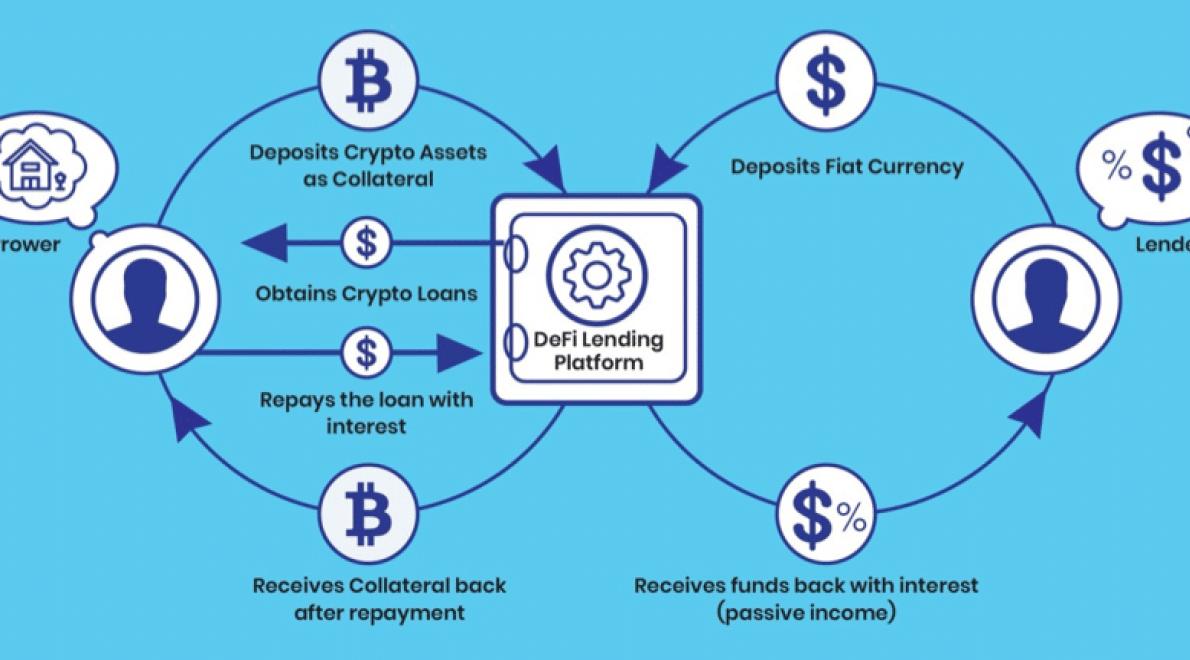

Crypto to crypto loans are a type of lending that use blockchain technology. They work by allowing borrowers to borrow money from lenders in the form of cryptocurrencies. The borrowers then use the borrowed cryptocurrency to purchase other cryptocurrencies or fiat currency. The lenders then receive the purchased cryptocurrencies or fiat currency as repayment.

Crypto to crypto loans are a new and emerging form of lending. They have the potential to revolutionize the lending industry by providing borrowers with access to capital without having to trust third-party lenders. They also have the potential to reduce the costs associated with traditional lending by eliminating the need for collateral.

There are a few advantages of using crypto to crypto loans. The first is that crypto loans are typically much faster and more efficient than traditional loans. This is because there is no need to go through a third party like a bank, which can often take weeks or even months to approve a loan.

Another advantage of using crypto loans is that you are able to keep more of the proceeds from your loan. This is because cryptocurrency is not subject to the same regulations as traditional currency, so it is possible to make loans in fractions of a bitcoin or Ethereum.

Finally, crypto loans are often more secure than traditional loans. This is because cryptocurrency is not subject to the same financial risks as fiat currency. This means that you are less likely to lose all of your money if you cannot repay your loan.

Crypto to Crypto Loans are a great way to get access to funding, but there are some disadvantages to using this approach.

The main disadvantage is that crypto to crypto loans are relatively risky. This is because the lenders have no way of knowing if the borrower will be able to repay the loan, and if they can't, the lenders could lose their money.

Another major disadvantage is that crypto to crypto loans are not regulated by banks or other financial institutions. This means that they can be more risky, and there is no guarantee that the loan will be repaid.

Overall, crypto to crypto loans are a great way to get access to funding, but there are some risks involved that should be taken into account before deciding to take out a loan.

There are a few risks associated with crypto to crypto loans. One is that the value of the crypto assets may decrease, which could lead to the borrower not being able to repay the loan. Another risk is that the crypto assets may not be recognized as legal tender, which could result in the lender not being able to get their money back. Additionally, there is the risk that the crypto assets may not be secure, which could lead to the lender losing money.

Crypto to Crypto loans are becoming increasingly popular, but there are some things you should know before you use them. Interest rates on crypto to crypto loans can be high, and there is a risk of not being able to repay the loan. Before using a crypto to crypto loan, make sure you understand the risks involved.

Interest Rates on Crypto to Crypto Loans

Interest rates on crypto to crypto loans can be high. For example, BitLendingClub offers a 2.5% interest rate on its crypto to crypto loans. This is higher than the interest rates on traditional loans, which are typically around 1%.

There is a risk of not being able to repay the loan. If you can't repay the loan, you could lose your investment.

Crypto to Crypto Loans and Your Credit Score

Before using a crypto to crypto loan, make sure you understand the risks involved. One risk is that your credit score could be affected if you can't repay the loan. If you can't repay the loan, your credit score could be affected negatively. This could make it difficult for you to get other loans in the future.

Crypto to Crypto Loans and Taxes

Another risk is that you might have to pay taxes on the loan. Depending on your country of residence, you might have to pay taxes on the interest you earn from the loan.

Crypto to Crypto Loans and Regulations

Another risk is that you might have to comply with regulations when you use a crypto to crypto loan. For example, you might have to comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations.

Before using a crypto to crypto loan, make sure you understand the risks involved. There is a risk of not being able to repay the loan, and your credit score could be affected negatively if you can't repay the loan.

There are a few different ways to use cryptocurrency to make safe, secure loans to others. One option is to use a peer-to-peer lending platform such as Lending Club or Prosper. These platforms allow borrowers and lenders to connect directly and make loans using cryptocurrencies as the currency of choice.

Another option is to use a cryptocurrency exchange to trade cryptocurrencies for traditional currencies, such as USD or EUR. This allows borrowers and lenders to exchange cryptocurrencies for traditional currencies and use those funds to make loans to others.

Finally, borrowers and lenders can also use a cryptocurrency wallet to store their cryptocurrencies and make loans using them. This allows borrowers and lenders to keep their cryptocurrencies safe and easy to access, making it a safer option than traditional banking institutions.

There are some pros and cons to crypto to crypto loans. On the pro side, crypto to crypto loans offer a low-cost way to borrow money, with no need for a traditional loan application or credit check. Additionally, crypto to crypto loans are irreversible, meaning that you will never have to worry about being late on your repayments.

However, there are also some cons to consider when taking out a crypto to crypto loan. First, crypto to crypto loans are not regulated by the same banking institutions as traditional loans, so you may encounter higher interest rates and fewer lending options. Additionally, crypto to crypto loans are not FDIC insured, so you could lose all of your money if something goes wrong with the loan.

There are many reasons to use crypto to crypto loans. Crypto loans are a unique and innovative way to borrow money that is secure, fast, and easy to use. Here are some reasons to consider using crypto loans to borrow money:

1. Security: Crypto loans are secure because they are based on blockchain technology. This technology ensures that the loan is recorded and verified correctly, which makes it a safe and reliable option.

2. Speed: Crypto loans are fast because they are processed through the blockchain network. This network is decentralized, which means that it is not subject to the control of any one institution or individual.

3. Easy to use: Crypto loans are easy to use because they are digital and conducted through a blockchain platform. This platform makes it easy to get a loan without having to go through a traditional financial institution.

4. Low cost: Crypto loans are low cost because they are processed through the blockchain network. This network is decentralized, which means that it is not subject to the control of any one institution or individual.

5. No fees: There are no fees associated with crypto loans, which makes them a cost-effective option for borrowers.

6. No collateral: There is no need for borrowers to provide collateral when borrowing money through a crypto loan.

7. No interest: There is no interest associated with crypto loans, which makes them a cost-effective option for borrowers.

8. No credit checks: There is no need for borrowers to undergo a credit check when borrowing money through a crypto loan.

9. Resilience: Crypto loans are resilient because they are based on blockchain technology. This technology is resilient and can withstand a number of attacks, which makes it a reliable option for borrowers.

10. Transparency: Crypto loans are transparent because they are based on blockchain technology. This technology makes all the details of the loan available online, which makes it easy for borrowers to understand and trust the loan process.

Crypto to Crypto Loans are a great way to get access to a loan without having to give away any personal information. However, there are a few reasons why you might not want to use this type of loan.

1. You May Not Have the Required Crypto Assets

If you don’t have any crypto assets, you won’t be able to use a crypto to crypto loan. You'll need to either purchase crypto assets or get a loan from a traditional lender.

2. You May not be Able to Repay the Loan

If you can't repay the loan, you may end up losing your crypto assets. This is because lenders typically require repayment in cryptocurrency. If you can't repay the loan, your crypto assets may be sold to repay the loan.

3. You May Lose Your Crypto Assets if the Lender Breaks the Contract

If the lender decides to break the contract, you may lose your crypto assets. This is because the lenders typically only offer protection for digital assets. If the lender decides to sell your assets, you may not be able to get them back.

4. You May Not be Able to Use Crypto Assets Outside of the Cryptocurrency System

If you want to use your crypto assets outside of the cryptocurrency system, you may not be able to do so. For example, you might not be able to use them to buy goods or services.