Decentralized crypto loans are a new way to borrow and lend money using cryptocurrency. With this type of loan, you can use your cryptocurrency as collateral to borrow cash or lending money and earn interest on your loan.

Decentralized crypto loans are the future of lending. They eliminate the need for a middleman, which makes them more secure and efficient. They also allow borrowers and lenders to be located anywhere in the world.

These loans are especially beneficial for people in developing countries who lack access to traditional banking services. They also make it possible for people to borrow money without having to worry about their credit score or collateral.

Decentralized crypto loans are still in their early stages, but they are already proving to be a valuable tool for people who need access to financing.

Decentralized crypto loans could help to change the lending industry. In traditional lending, lenders typically charge high interest rates and require borrowers to adhere to a long list of restrictive lending terms. With decentralized crypto loans, borrowers can borrow money from a wide range of lenders at low interest rates and without having to comply with restrictive lending terms. This could free up borrowers’ time and resources to focus on their businesses instead of worry about meeting stringent lending requirements.

Additionally, decentralized crypto loans could help to reduce the cost of borrowing. Traditional lending institutions typically charge high interest rates in order to make a profit. However, because decentralized crypto loans are peer-to-peer loans, there is no need for lenders to charge high interest rates. This could lead to a reduction in the cost of borrowing for businesses and individuals.

Finally, decentralized crypto loans could help to promote financial stability. Because these loans are peer-to-peer, they are less likely to be disrupted by financial crises. This could lead to a reduction in the number of people who suffer from financial instability and poverty.

Cryptocurrencies are all the rage these days, and for good reason. They offer a secure, decentralized way to store and exchange value. However, one problem with cryptocurrencies is that they don’t offer a good way to borrow and lend money. That’s where decentralized crypto loans come in.

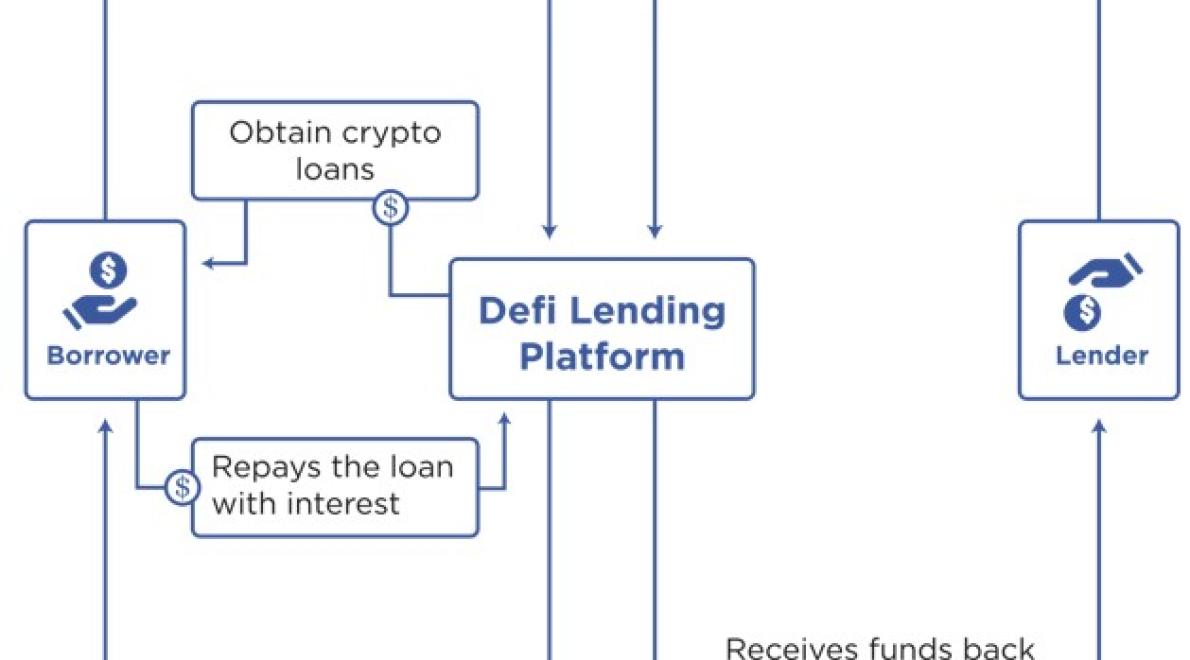

A decentralized crypto loan is a kind of peer-to-peer loan where borrowers and lenders use cryptocurrency to collateralize the loan. The borrower gets a loan in cryptocurrency, and the lender can earn interest on the loan.

There are several benefits to using a decentralized crypto loan. First, it’s a more secure way to borrow money. Cryptocurrencies are decentralized, meaning that there’s no central authority that can take your money or punish you for not paying back the loan.

Second, decentralized crypto loans are cheaper than traditional loans. There’s no need for a middleman, such as a bank, to take part in the loan process. This saves both the borrower and lender money.

Finally, decentralized crypto loans are faster and easier to get than traditional loans. Most traditional loans require a long application process and can take weeks or even months to be approved. With a decentralized crypto loan, you can often get approval within minutes.

There are a few drawbacks to using a decentralized crypto loan, however. First, there’s a risk that the value of the cryptocurrency used as collateral could decline in value. Second, the interest rates on decentralized crypto loans are typically lower than interest rates on traditional loans.

There are many benefits to decentralized crypto loans, the most obvious of which is that there is no central point of failure. If a crypto loan provider goes out of business, borrowers are not left high and dry – their loans are automatically transferred to other providers.

Another benefit is that there is no need to trust third-party lenders. Decentralized crypto loans are peer-to-peer, meaning that borrowers and lenders interact directly. This eliminates the possibility of fraud or abuse, as well as the risk of a lender going out of business or banning customers from accessing their funds.

Finally, decentralized crypto loans are more secure than traditional loans. Since borrowers and lenders interact directly, there is no need for a middleman to hold onto the funds. This means that the funds are always available to be used, and there is no risk of theft or fraud.

A decentralized crypto loan works in a slightly different way than a traditional loan. In a decentralized crypto loan, borrowers and lenders directly interact with each other without the need for a middleman. This eliminates the risk of fraud and enables borrowers to get loans in a much faster and more efficient way.

The process of getting a decentralized crypto loan is simple. First, you need to find a lender who is willing to provide you with a loan. Next, you need to create an account on a decentralized crypto lending platform. Once you have created your account, you will need to provide your unique lending profile and loan request. Lenders will then be able to review your loan request and decide whether or not they are interested in providing you with a loan.

Once a lender has decided to provide you with a loan, they will need to send you the relevant details. This includes the loan amount, interest rate, and repayment schedule. You will then need to sign the loan agreement and submit it to the lending platform. Once the agreement has been approved, the lending platform will transfer the funds to your account.

Overall, decentralized crypto loans are a fast and easy way to get a loan. They eliminate the risk of fraud and make it easier for borrowers to get the money they need.

Pros

1. There is no central point of failure, so the network is more resilient to hacks and DDoS attacks.

2. There is no need to trust a third-party to manage and distribute loans, since the loans themselves are decentralized.

3. The loans can be customized to meet the needs of borrowers and lenders, which gives borrowers more choice and flexibility.

4. The loans can be exchanged and traded on decentralized exchanges, which gives borrowers and lenders more opportunities to make money.

5. There is no need to pay interest on decentralized crypto loans, which can be a major advantage over conventional loans.

6. The loans are not subject to legal or economic restrictions, which means they can be used in a variety of contexts and industries.

7. There is no need to worry about defaults or late payments, since the loans are automatically repaid if borrowers fail to repay them.

8. The loans are not subject to government regulation, which gives them an advantage over conventional loans.

9. The loans can be used to finance a wide range of activities, including but not limited to business ventures, property purchases, and student loans.

10. The loans are accessible to a much wider range of people than traditional loans, which can make them more affordable for borrowers.

11. The loans are not tied to any specific currency or asset, so they can be used in a variety of contexts and industries.

12. The loans are immune to inflation, which makes them more valuable over time.

13. The loans can be used to finance a wide range of activities, including but not limited to business ventures, property purchases, and student loans.

14. The loans are accessible to a much wider range of people than traditional loans, which can make them more affordable for borrowers.

15. The loans are not tied to any specific currency or asset, so they can be used in a variety of contexts and industries.

16. The loans are immune to inflation, which makes them more valuable over time.

17. The decentralized nature of the loans makes it easier for borrowers and lenders to communicate and work together.

18. The loans are not subject to government regulation, which gives them an advantage over conventional loans.

19. The loans can be used to finance a wide range of activities, including but not limited to business ventures, property purchases, and student loans.

20. The loans are accessible to a much wider range of people than traditional loans, which can make them more affordable for borrowers.

There is no one-size-fits-all answer to this question, as the best way to borrow cryptocurrency depends on your individual needs and financial situation. However, some potential benefits of borrowing cryptocurrency through a decentralized platform include the following:

• No need to trust a third party – Unlike traditional lending platforms, which often require users to trust third-party lenders with their sensitive information, lending cryptocurrencies through a decentralized platform eliminates the need for such trust.

• Higher borrowing limits – Unlike centralized platforms, which typically limit borrowers to smaller amounts, decentralized platforms offer wider borrowing limits, making them more suitable for larger transactions.

• More secure lending platforms – As lending cryptocurrencies through a decentralized platform is done through peer-to-peer networks, it is considerably more secure than lending through centralized platforms.

It is important to note that, while borrowing cryptocurrencies through a decentralized platform may be more secure and flexible than traditional lending platforms, it is not without risks. For example, if the borrower fails to pay back the loan, the platform may become insolvent and the borrowed cryptocurrency may be lost forever. Therefore, it is important to carefully consider all the factors involved before deciding whether a decentralized crypto loan is right for you.