If you're looking for the best LTV crypto loans, you've come to the right place. In this article, we'll show you the top 5 LTV crypto loans on the market today. We'll also provide a brief overview of each loan so you can make an informed decision about which one is right for you.

If you have some cryptocurrency assets that you can use as collateral, you may be able to get a loan using them. There are a few different ways to go about this, and each has its own set of pros and cons.

One option is to use cryptocurrency loans as a way to boost your credit score. This is because lenders will view your crypto loans as a form of stable, long-term investment. However, this option may be more difficult to obtain than traditional loans, and it may require a higher credit score than you may currently have.

Another option is to use cryptocurrency loans as a way to get access to capital that you may not be able to get from traditional lenders. This is because cryptocurrency loans are typically secured by your cryptocurrency assets, rather than your personal credit history. This means that you may be able to get a loan much faster than you would with a traditional loan, and you may not need to provide as much collateral. However, this option may be more risky, because there is no guarantee that you will be able to repay the loan.

Ultimately, it is important to decide which option is best for you. If you are unsure whether cryptocurrency loans are right for you, speak to a financial advisor to see if they can help guide you in the right direction.

There are a few places where you can get a crypto loan. One option is to look online for crypto lending platforms. These platforms allow you to borrow cryptocurrency in exchange for a fixed interest rate. Another option is to look for crypto loan providers in your local area. These providers can offer you a loan in cryptocurrency or fiat currency.

The best loan terms for crypto assets depend on the type of crypto asset and the lender. For example, Bitcoin and Ethereum have different loan terms depending on the lender.

Bitcoin Loans

Bitcoin loans are the most common type of crypto loan. Bitcoin loans are typically longer term and have lower interest rates than other types of loans.

To get a Bitcoin loan, you will need to find a lender who is willing to lend you money using Bitcoin. There are many lenders available, but the best way to find one is to search online.

Ethereum Loans

Ethereum loans are similar to Bitcoin loans, but they are designed for Ethereum assets. Ethereum loans have higher interest rates than Bitcoin loans, but they also have shorter terms.

To get an Ethereum loan, you will need to find a lender who is willing to lend you money using Ethereum. There are many lenders available, but the best way to find one is to search online.

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are not legal tender and are not backed by any country or central bank. Their value is based on supply and demand, and they can be traded on decentralized exchanges.

Cryptocurrencies are not insured by the government and can be stolen or lost. Care should be taken when investing in cryptocurrencies, as there is a high risk of losing your money.

Cryptocurrencies can be extremely volatile, and prices can change quickly. It is important to do your homework before investing in cryptocurrencies, as there is a high risk of losing your money.

There is no need to get a loan against your bitcoin or other cryptocurrency. Cryptocurrencies are not legal tender and are not backed by any government or financial institution. There is no guarantee that the value of cryptocurrencies will remain stable or increase in value over time.

There are a few different ways to get a crypto loan. One option is to find a loan company that specializes in crypto lending. These companies typically have a high approval rate and offer competitive interest rates. Another option is to find a crypto lending peer-to-peer (P2P) lender. These lenders typically have lower approval rates and may not offer as competitive interest rates, but they are easier to find and have more flexible terms.

Cryptocurrencies are a great way to get a loan. There are a number of platforms that allow you to borrow using cryptocurrencies.

Some platforms that allow you to borrow using cryptocurrencies include BitLendingClub, BitBond, and Kiva. You can also get a loan from a bank or other lending institution.

Before you borrow using cryptocurrencies, it is important to understand the risks involved. Cryptocurrencies are not backed by any government or financial institution, and they are subject to price fluctuations. There is also the risk that you won't be able to repay the loan.

If you are interested in borrowing using cryptocurrencies, be sure to research the available platforms and make sure you understand the risks involved.

There are both pros and cons to getting a crypto loan. On the one hand, borrowing money in crypto can be a very cost-effective way to get access to funds you need quickly. This is because crypto loans are typically short-term, with interest rates that are much lower than traditional loans. Additionally, crypto loans are often secured by crypto assets, meaning you don't have to worry about your security or credit history when taking out a loan in this way.

However, there are also some potential drawbacks to getting a crypto loan. For example, it can be difficult to find a lender who is willing to offer a loan in this currency, and you may have to wait a long time before you can receive the funds you need. Additionally, if the value of your crypto assets falls significantly during the loan period, you may end up owing more money than you originally borrowed.

When looking for a crypto loan, there are a few things to consider.

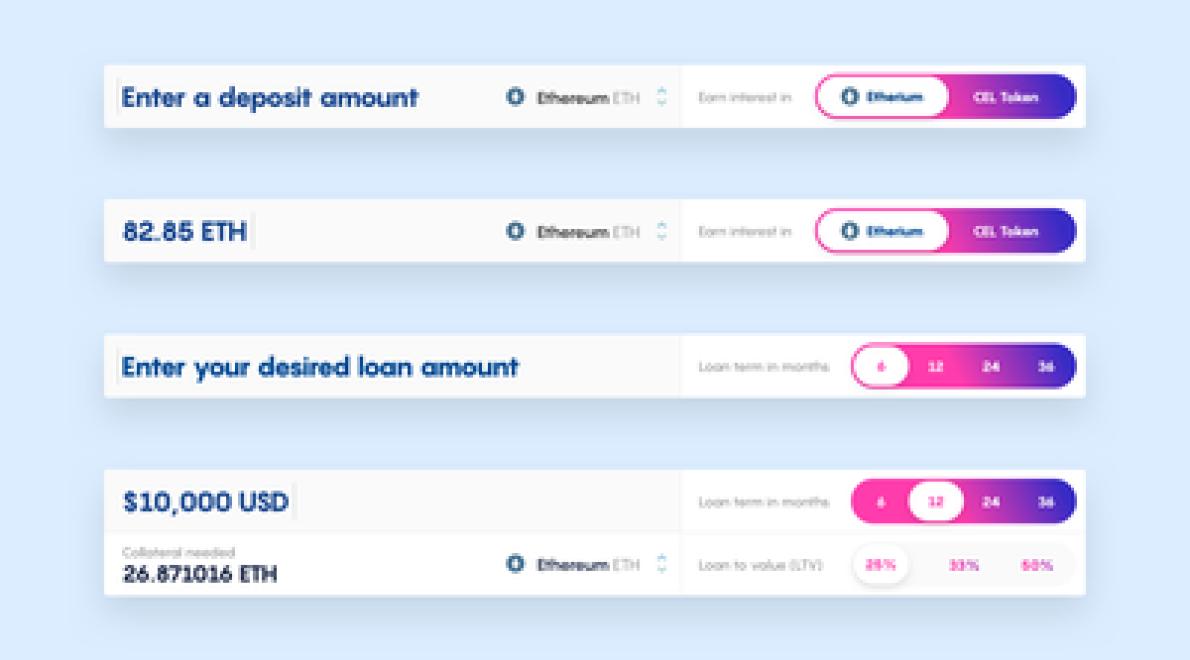

The Loan Amount

The amount of the loan is important, as it should be large enough to cover the anticipated costs but not so large that it becomes unmanageable.

The Interest Rate

The interest rate should be high enough to cover the costs of borrowing but not so high that it becomes burdensome.

The Terms of the Loan

The terms of the loan should be reasonable, taking into account the risks and rewards associated with the loan.

The Duration of the Loan

The duration of the loan should be long enough to cover the anticipated needs but not so long that it becomes burdensome.

If you are looking for a way to get the most out of your crypto loan, here are a few tips to follow:

1. Make sure you understand the terms and conditions of the loan.

2. Get advice from a financial advisor or other expert if you have questions about how to best use your loan.

3. Be sure to keep track of your loan repayment schedule and make sure you are always on top of your payments.

4. Monitor your crypto loan account closely to ensure that you are getting the most out of your investment.