In the traditional financial system, collateral is a must for taking out a loan. But what if there was a way to get a loan without putting up any collateral? Zero collateral crypto loans are possible thanks to the decentralized nature of blockchain technology. With a decentralized lending platform like ETHLend, borrowers can take out loans using their crypto assets as collateral. And because the platform is built on the Ethereum blockchain, it offers a high degree of security and transparency. So if you're in need of some extra cash but don't want to put up your crypto as collateral, a zero collateral crypto loan could be the perfect solution.

Crypto loans are a recent development in the world of cryptocurrencies. They are similar to traditional loans in that they allow people to borrow money from a lender in exchange for a cryptocurrency. However, the key difference between crypto loans and traditional loans is that the repayment of the loan is contingent on the success of the cryptocurrency project.

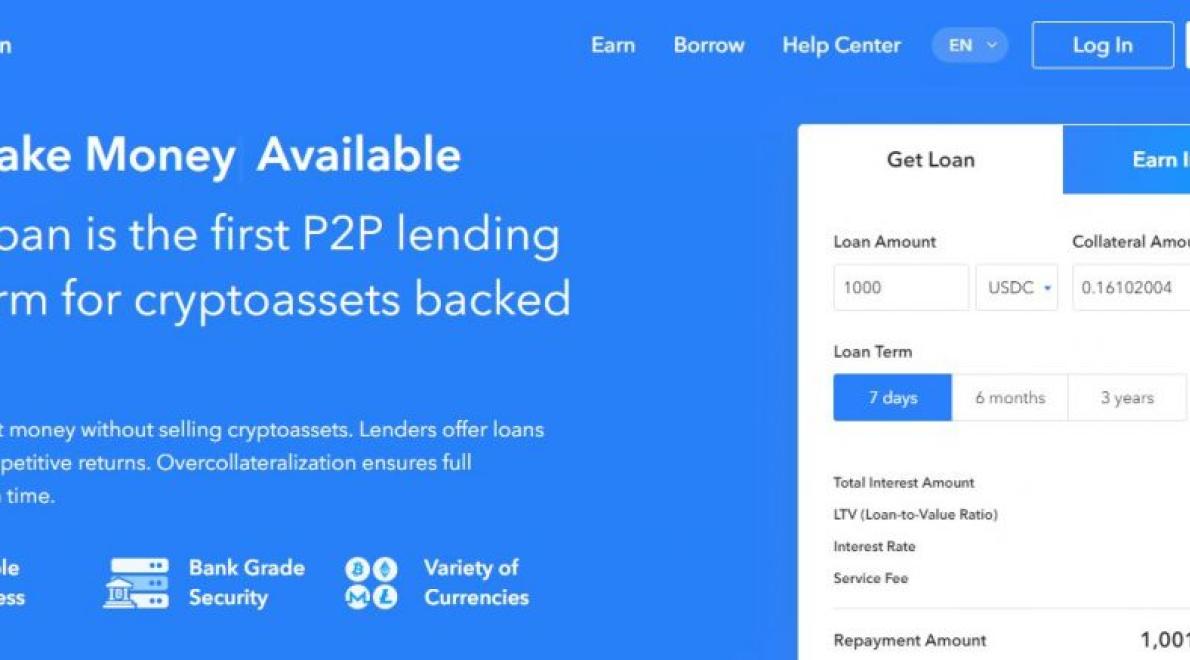

Crypto loans are available from a variety of lenders, and they can be obtained through cryptocurrency exchanges or directly from the lenders themselves. The most common type of crypto loan is a collateral crypto loan, in which the borrower pledges a portion of their cryptocurrency holdings as security for the loan.

The benefits of using a collateral crypto loan include the fact that the borrower does not need to put up any real assets as security for the loan, and they can easily withdraw the loaned cryptocurrency if they need to. Additionally, crypto loans are relatively easy to obtain, and they are not subject to traditional lending standards.

One of the main drawbacks of using a collateral crypto loan is that the value of the cryptocurrency holdings may decline over time. This can make it difficult for the borrower to repay the loan, and it can also lead to losses in the value of the cryptocurrency holdings.

Zero collateral crypto loans offer a number of benefits for borrowers and lenders. For borrowers, zero collateral crypto loans offer the opportunity to borrow money without needing to put up any collateral. This can be beneficial for borrowers who may not have enough collateral to secure a traditional loan or who want to avoid having to sell assets to secure a loan. For lenders, zero collateral crypto loans offer the opportunity to lend money to borrowers without having to worry about the security of the borrower’s assets. This can be beneficial for lenders who want to lend money to borrowers who are considered high-risk or who do not have a good history of paying back loans.

One of the main benefits of using zero collateral crypto loans is that you can save money. This is because you won’t need to pay back any of the money you borrow, as the collateral is in the form of cryptocurrency. This means that you won’t have to pay interest on your loan, and you can also avoid having to pay any fees associated with traditional loans.

Another benefit of using zero collateral crypto loans is that you can access money quickly. This is because you don’t need to wait for your loan to be approved or for the funds to be transferred to your bank account. You can also use zero collateral crypto loans to finance your own projects, without having to worry about risking your own money.

Overall, using zero collateral crypto loans can be a beneficial way to save money and access money quickly. If you are looking for a way to finance your projects without risking your own money, these loans are a good option.

Cryptocurrency loans are a new and exciting way to get loans. They work by using cryptography to secure the transactions and make it difficult for others to track or copy the loan.

The biggest risk of zero collateral cryptocurrency loans is that the borrower may not be able to repay the loan. This is because the value of the cryptocurrency may decrease, making the loan worth less than the original value.

Another risk of zero collateral cryptocurrencies loans is that the borrower may not be able to find a buyer for the cryptocurrency. If no one is willing to buy the cryptocurrency, the borrower may be unable to repay the loan.

Zero collateral crypto loans are a new kind of lending product that allows borrowers to borrow money without needing to secure any collateral. This type of lending product is different from traditional loans because borrowers do not need to put up any assets as security for the loan.

The main benefit of zero collateral crypto loans is that they offer borrowers a low-cost way to borrow money. Because there is no need for borrowers to put up any assets as security, zero collateral crypto loans are much cheaper than traditional loans.

Another benefit of zero collateral crypto loans is that they allow borrowers to borrow money from a wide range of lenders. Because there is no need for borrowers to verify their creditworthiness, zero collateral crypto loans are available to a wide range of borrowers.

One potential downside of zero collateral crypto loans is that they are not backed by anything tangible. This means that borrowers could lose all of their money if the loans go bad.

Overall, zero collateral crypto loans are a new kind of lending product that offers a low-cost way to borrow money and a wide range of lenders. While there are some potential downsides, overall these loans are a valuable option for borrowers.

There is no one definitive answer to this question, as the best rate on a zero collateral crypto loan will vary depending on the specific loan terms and conditions. However, some tips on how to get the best rate on a zero collateral crypto loan include researching different lending platforms and assessing your credit score. Additionally, it is important to ensure that you have a solid understanding of the cryptocurrency you are lending on before entering into a loan agreement. Lastly, always consult with a financial advisor before making a loan decision.

Zero collateral crypto loans are perfect for those looking for a fast and easy way to get started in the cryptocurrency world. With no required investment, these loans are a great way to get your feet wet in the world of cryptocurrency. The downside is that these loans are not always the most stable option, so be sure to do your research before taking out a loan.

A zero collateral crypto loan is an ideal option for borrowers who have little to no collateral to offer. This type of loan is typically offered to individuals or small businesses who cannot offer traditional forms of collateral such as stocks, bonds, or real estate.

Zero collateral crypto loans are a safe and secure option for borrowers because the lenders do not require any form of collateral. This makes these loans ideal for people who may not have access to traditional banking options. Additionally, zero collateral crypto loans are typically more affordable than traditional loans because lenders do not require borrowers to put up any collateral.

There are a few reasons why people might choose to use a zero collateral crypto loan. For starters, there is little to no risk involved in using a zero collateral crypto loan. Secondly, these loans are often much faster and easier to get than traditional bank loans. Finally, zero collateral crypto loans often have much lower interest rates than traditional loans.

There are pros and cons to zero collateral crypto loans. The pro side is that there is no need to collateralize the loan, meaning the lender does not need to worry about losing money if the borrower fails to repay the loan. Additionally, there is no need to worry about the creditworthiness of the borrower, as the loan is secured only by the cryptocurrency itself.

The con side of zero collateral crypto loans is that they are risky, as the borrower could lose all of their cryptocurrency if they fail to repay the loan. Additionally, if the cryptocurrency does not appreciate in value, the borrower may be left with a negative balance on the loan.

Zero collateral crypto loans are a new type of loan that allow you to borrow money without having to put up any collateral. This means that you don’t need to worry about losing your money if you can’t pay back the loan.

The benefits of using zero collateral crypto loans include:

You can borrow money quickly and easily.

You don’t need to worry about losing your money if you can’t pay back the loan.

You can borrow money from a wide range of lenders.

The cost of using zero collateral crypto loans is lower than traditional loans.

The risks associated with zero collateral crypto loans include:

You may not be able to repay the loan.

There is a risk that the value of the cryptocurrency you are borrowing will decline.

Zero collateral crypto loans are a new type of loan that allow you to borrow money without having to put up any collateral. This means that you don’t need to worry about losing your money if you can’t pay back the loan. The benefits of using zero collateral crypto loans include: You can borrow money quickly and easily. You don’t need to worry about losing your money if you can’t pay back the loan. You can borrow money from a wide range of lenders. The cost of using zero collateral crypto loans is lower than traditional loans. The risks associated with zero collateral crypto loans include: You may not be able to repay the loan. There is a risk that the value of the cryptocurrency you are borrowing will decline.