If you're interested in taking out a loan using cryptocurrency as collateral, there are a few things you should know. In this article, we'll explain how crypto loans work and what you need to be aware of before taking one out.

Crypto loans are becoming increasingly popular as a way to get access to cryptocurrencies without having to sell your own cryptocurrency. You can find crypto loans from a variety of lenders, but here are three examples.

1. Lending Club

Lending Club is one of the most popular platforms for finding crypto loans. You can find loans from a variety of lenders, and you can usually borrow between $5,000 and $100,000.

2. BitLendingClub

BitLendingClub is another popular platform for finding crypto loans. You can find loans from a variety of lenders, and you can usually borrow between $5,000 and $100,000.

3. Coinbase

Coinbase is one of the most popular platforms for buying and selling cryptocurrencies, and they also offer crypto loans. You can usually borrow between $10,000 and $200,000.

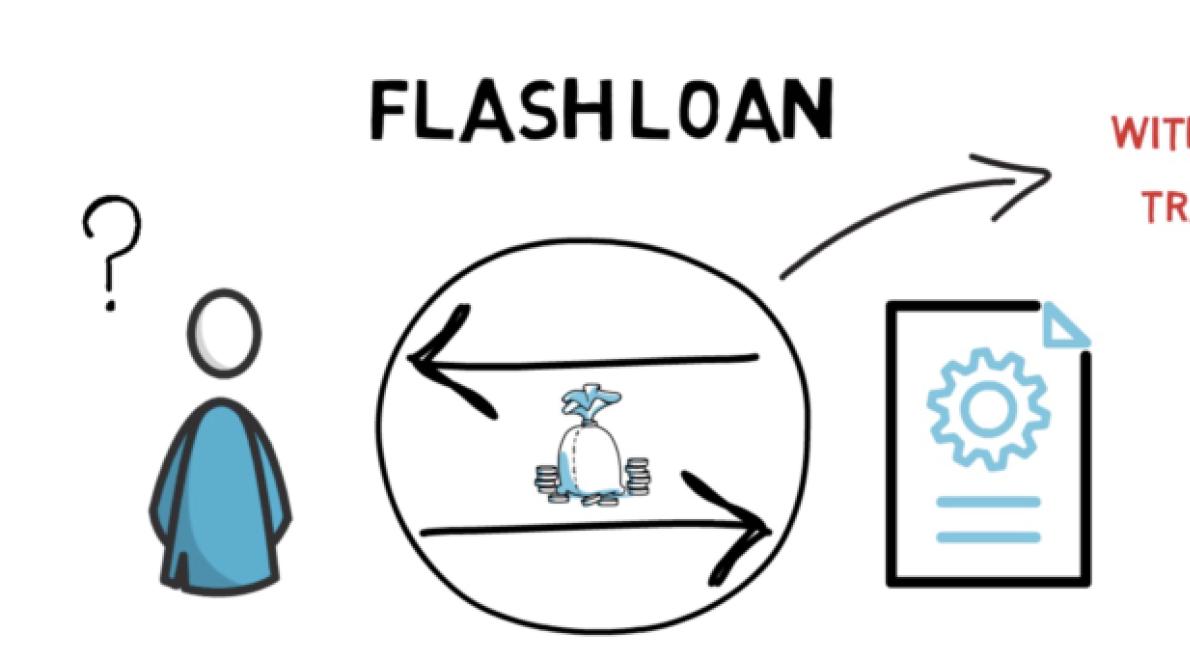

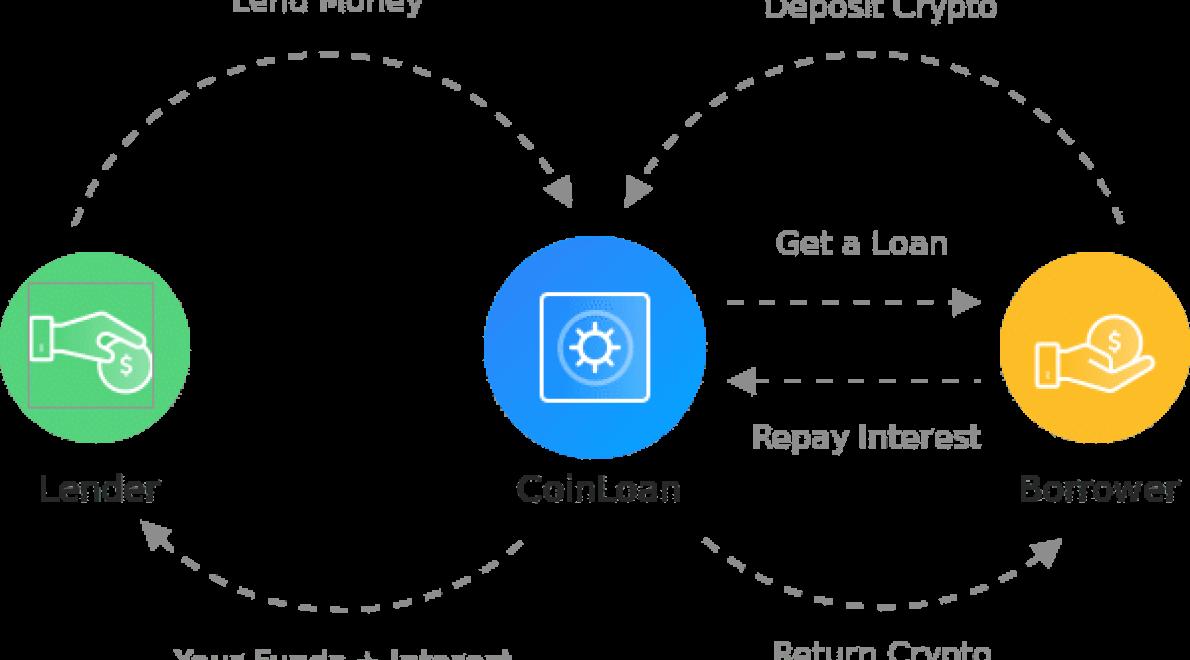

A crypto loan is a type of lending that uses cryptocurrencies, such as Bitcoin or Ethereum. The borrower uses the cryptocurrency to borrow money from the lender, and the lender returns the cryptocurrency to the borrower at a later date. This allows borrowers to use cryptocurrencies as collateral for the loan, which can protect them from losing their money if the lender decides to not repay the loan.

Crypto loans offer a number of benefits that can be valuable to borrowers and lenders. Crypto loans are fast, easy and affordable to process, meaning they can be used to finance a wide range of transactions. They also offer a high degree of security, as lenders are typically required to hold a large percentage of the loan value in reserve. Finally, crypto loans are often exempt from traditional lending criteria, such as credit checks and collateral requirements, making them an attractive choice for borrowers with limited options.

There is no set repayment schedule for crypto loans, as each situation is unique. However, many borrowers opt to repay their loans in cryptocurrency, as this is the most efficient way to move the funds around.

Crypto loans carry a high risk of default. If the borrower cannot repay the loan, the lender may lose all of their money. Additionally, crypto loans are often not FDIC-insured, which means that the lender could lose all of their money if the borrower fails to repay the loan.

Crypto loans are typically offered with interest rates in the 5-7% range.

Crypto loan terms and conditions will vary depending on the lender. Generally, crypto loans are available with low interest rates and a longer repayment period than traditional loans.

There are three types of crypto loans: fiat-to-crypto, crypto-to-crypto and crypto-to-fiat. A fiat-to-crypto loan allows you to borrow money in fiat currency and use it to purchase cryptocurrency. A crypto-to-crypto loan allows you to borrow money in cryptocurrency and use it to purchase another cryptocurrency. A crypto-to-fiat loan allows you to borrow money in fiat currency and use it to purchase cryptocurrency.

Crypto loans offer a way to borrow money in cryptocurrency without having to sell your coins. The loan can be repaid with interest, and the repayment schedule can be flexible.

There is no definitive answer to this question, as it depends on a variety of factors specific to each individual case. However, some tips on when to take out a crypto loan may include:

If you need to replenish a depleted crypto portfolio quickly and without too much hassle

If you have a high risk tolerance and feel comfortable with the associated risks

If you have access to a strong credit history

If you are confident that you can repay the loan in a timely manner

Crypto loans are available to anyone who has a bank account and is registered with a crypto lending platform.

There are a few places that offer crypto loans. Some of these platforms accept cryptocurrency as collateral, while others only work with traditional loans.

One popular platform that offers crypto loans is BitLendingClub. BitLendingClub is a peer-to-peer lending platform that allows users to borrow and lend digital assets. The platform charges interest rates of between 5 and 12 percent, which depends on the loan amount.

Another platform that offers crypto loans is BitBond. BitBond is a blockchain-based lending platform that allows users to borrow and lend digital assets. The platform charges interest rates of between 3 and 7 percent, which depends on the loan amount.