The article discusses loans that are secured by crypto assets. It explains how these types of loans work and why they may be a good option for borrowers.

as an alternative to traditional loans. Bitcoin loans are fast and easy to process, and they are also less risky than traditional loans.

Bitcoin loans are often used to finance small businesses and personal loans. Bitcoin loans are also popular among cryptocurrency investors and traders.

How Bitcoin Loans Work

A bitcoin loan is a short-term loan that is secured by the bitcoins that are deposited in the loan account. The loan is usually funded with a small amount of bitcoin, and the loan terms are typically short.

The borrower can use the bitcoin loan to purchase goods or services, or to pay off debts. The borrower must repay the bitcoin loan with interest, and the repayment period is typically short.

Bitcoin loans are very easy to process. borrowers can apply online, and lenders can approve loans in minutes. There is no need for borrowers to provide any documentation or proof of identity.

Bitcoin loans are less risky than traditional loans. Because the loan is secured by the bitcoins deposited in the loan account, there is no risk of losing the bitcoins if the borrower fails to repay the loan.

Bitcoin Loans Are Popular

Bitcoin loans are becoming increasingly popular as an alternative to traditional loans. Bitcoin loans are fast and easy to process, and they are also less risky than traditional loans.

Bitcoin loans are often used to finance small businesses and personal loans. Bitcoin loans are also popular among cryptocurrency investors and traders.

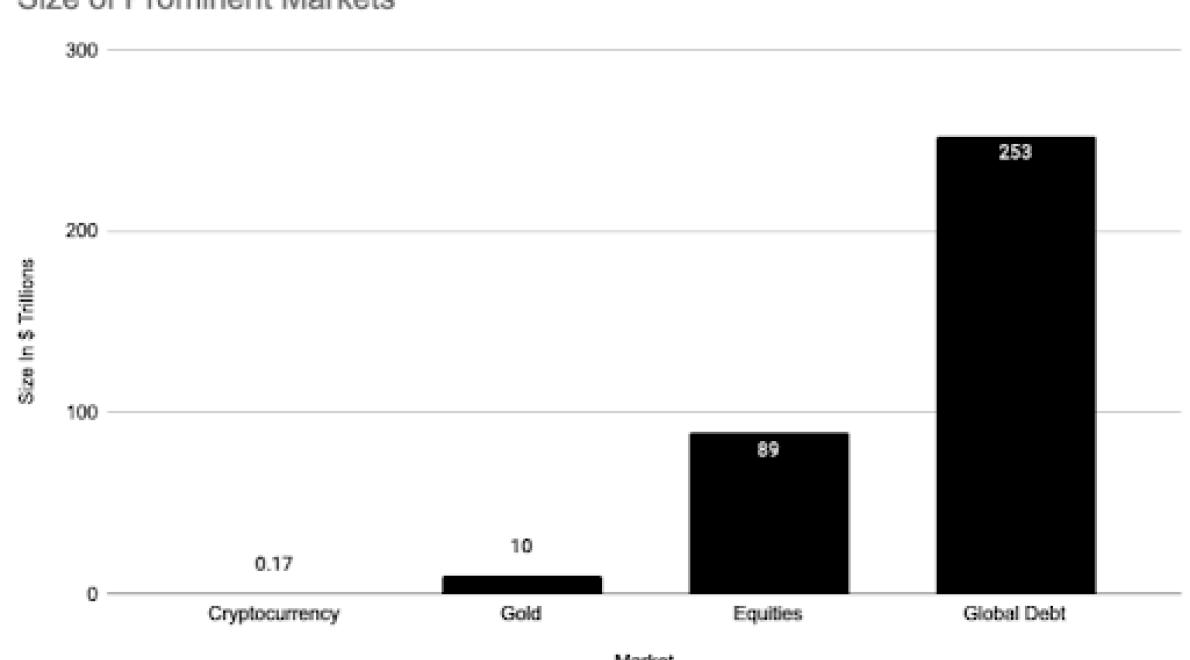

Crypto assets are becoming increasingly popular as a means of securing loans. This is because they offer a number of advantages over traditional loans.

For starters, crypto assets are extremely secure. This is because they are not subject to the same regulations as traditional financial assets. This means that they are less likely to be seized by authorities.

Furthermore, crypto assets are also efficient and fast to transfer. This makes them perfect for use in cross-border transactions.

In conclusion, crypto assets are becoming more and more popular as a means of securing loans. This is because they offer a number of advantages over traditional loans.

Crypto loans are becoming more popular because they offer a secure way to borrow money. Crypto loans are also more flexible than traditional loans, allowing borrowers to pay back their loans over time.

Crypto asset-backed loans are a new type of loan that use cryptocurrencies as collateral. The borrowers use the cryptocurrency to borrow money, and then they have to pay back the loan with the same cryptocurrency.

This is different from traditional loans, where the borrower uses traditional currency as collateral. With crypto asset-backed loans, the borrower uses the cryptocurrency as their own personal asset. This makes it more difficult for the borrower to default on the loan, since they would need to sell their cryptocurrency to repay the loan.

This new type of loan has already started to become popular, and there are several companies that offer these loans. One of the most well-known companies is BitLendingClub, which offers loans in bitcoin, Ethereum, and other cryptocurrencies.

There are many benefits to taking out a loan secured by crypto assets. For example, the loan could be used to purchase crypto assets, which would provide a long-term return on investment. In addition, the loan could be used to finance the purchase of other assets, such as real estate or businesses. Finally, the loan could be used to pay off other debts or invest in other ventures.

There are a few key risks to consider when taking out a loan secured by crypto assets.

1. Crypto assets may not have value if the loan is not repaid.

2. If the loan is not repaid, the lender may be able to seize the crypto assets as collateral.

3. If the crypto assets are seized as collateral, the lender may be able to sell them at a lower price than if they had been used to repay the loan.

4. If the value of the crypto assets falls below the amount of the loan, the borrower may be unable to repay the loan.

There are a few important things to consider before taking out a loan secured by crypto assets. First, it's important to understand the terms and conditions of the loan, as well as the risks involved. Second, it's important to make sure that the loan is actually worth taking out, as there is a risk that the value of the crypto assets could decline before the loan is repaid. Finally, it's important to be aware of the potential legal consequences of taking out a loan secured by crypto assets.

Pros

Crypto asset-backed loans provide a way for borrowers to get financing that is secured by digital assets.

Crypto asset-backed loans provide a way for borrowers to get financing that is backed by a liquid and tradable asset.

Crypto asset-backed loans provide a way for borrowers to get financing that is secured by a peer-to-peer network.

Crypto asset-backed loans provide a way for borrowers to get financing that is backed by a digital currency.

Cons

Crypto asset-backed loans carry high interest rates, which can be difficult for borrowers to afford.

Crypto asset-backed loans are not currently available in all countries.

There is no one-size-fits-all answer to this question, as the best way to get the best deal on a loan secured by crypto assets will vary depending on the specific circumstances of each case. However, some tips on how to get the best deal on a loan secured by crypto assets include researching the available options and comparing prices before making a decision. Additionally, it is important to discuss the terms of the loan with the lender beforehand so that both parties are clear on what is being offered and what needs to be done in order to secure the loan.

As crypto assets continue to gain in popularity and legitimacy, it's likely that more loans secured by these assets will be issued in the future. This could be a good thing for both borrowers and lenders, as it would provide increased access to financing for both groups. Additionally, it could lead to a more stable and secure crypto market, as lenders would have more faith in the security of the assets underlying the loans.

There is no easy answer when it comes to whether or not a loan secured by crypto assets is right for you. Ultimately, the decision comes down to your individual financial situation and what type of crypto assets you own.