In a nutshell, Loans Backed By Crypto are cryptocurrency-backed loans. In other words, you can use your cryptocurrency as collateral to take out a loan in fiat currency. This can be useful if you need cash but don't want to sell your crypto.

Cryptocurrencies are a great way to secure a loan. They offer security and anonymity, which can be helpful in cases where you need to borrow money from a stranger.

To use cryptocurrencies as a security for a loan, you first need to buy some cryptocurrency. You can find exchanges that allow you to buy cryptocurrencies using traditional currency or credit cards. Once you have bought some cryptocurrency, you can use it to secure the loan.

To use cryptocurrency as a security for a loan, you first need to find a lender who is willing to accept it as a security. You can search for lenders online or contact them directly.

Once you have found a lender who is willing to accept cryptocurrency as a security, you will need to create a security agreement. This agreement will outline the terms of the loan, including the loan amount, interest rate, and repayment schedule.

You will also need to provide documentation to support your security claim. This documentation may include copies of your cryptocurrency holdings, proof of ownership of the cryptocurrency assets, or other evidence that you own the assets and are entitled to use them as security for the loan.

Once you have created the security agreement and provided the required documentation, you can begin the loan process. The lender will review your documentation and may ask for additional information or documentation. If the lender is satisfied with your security claim, they will likely approve the loan.

Cryptocurrencies can be a great way to back your loan. There are a few benefits to using crypto to back your loan.

One benefit of using crypto to back your loan is that it is secure. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. This makes them an attractive option for loans, as there is less risk of the loan being defaulted on.

Another benefit of using crypto to back your loan is that it is anonymous. Cryptocurrencies are not tied to any one country or region, meaning they can be used worldwide. This makes them an ideal option for loans that need to be sent across borders, such as loans to businesses in different countries.

Finally, using crypto to back your loan can save you money. The interest rates for loans are typically higher than the interest rates for cryptocurrencies, but using crypto can save you money by eliminating the need to pay interest.

One of the key benefits of using cryptocurrency to back a loan is that it is secure. Cryptocurrency is decentralized, meaning that it is not subject to the control of any one person or institution. This makes it difficult for someone to steal or corrupt the currency. Additionally, cryptocurrency is not subject to government or financial institution regulation, meaning that it is not subject to any restrictions on how it can be used.

However, there are also some risks associated with using cryptocurrency to back a loan. First, cryptocurrency is volatile, meaning that its price can change rapidly. This can make it difficult to predict how much money you will receive in return for your loan, and it can also make it difficult to afford the repayments on your loan. Additionally, cryptocurrency is not backed by any physical assets, so it is not stable in terms of its value. If the value of cryptocurrency falls, your loan will also be worth less.

Overall, there are pros and cons to using cryptocurrency to back a loan. While it is secure and difficult to steal, it is also volatile and not backed by physical assets. Therefore, it is important to carefully consider the risks before deciding to use this approach.

When you are looking to invest in a crypto to back your loan, it is important to do your research. There are a variety of different cryptos out there, so it is important to choose one that is going to be the best fit for your needs.

Some factors to consider when choosing a crypto to back your loan include:

The crypto’s market cap.

The crypto’s usability.

The crypto’s security.

The crypto’s potential for growth.

Once you have considered these factors, it is important to consult with a financial advisor to help you decide which crypto is the best fit for your needs.

Cryptocurrencies are a new way of using digital assets to secure or refund a loan. Cryptocurrencies like Bitcoin and Ethereum allow users to make secure, anonymous, and secure transactions.

Cryptocurrencies are also decentralized, meaning they are not subject to government or financial institution control. This makes them a good option for online transactions where security and anonymity are important.

Now that we have covered what cryptocurrencies are and what they can do, let’s look at how they can be used to secure a loan.

How Cryptocurrencies Can be Used to Secure a Loan

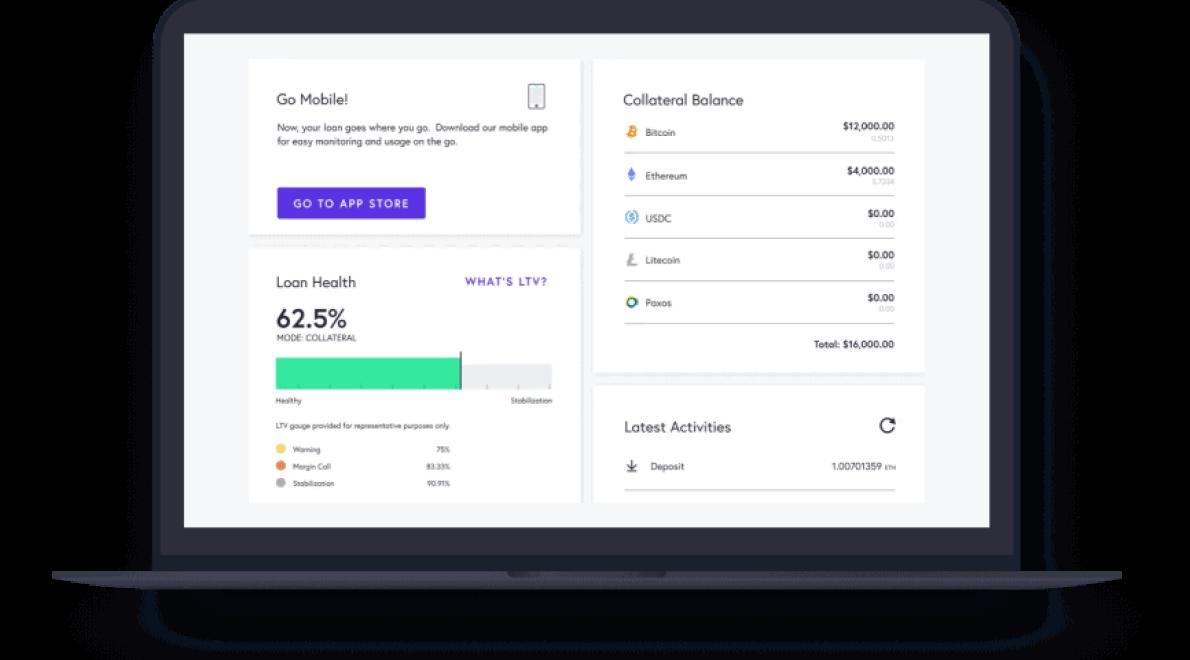

Cryptocurrencies can be used to secure a loan in a few different ways. One way is to use them as collateral. Collateral is something that is used to guarantee the repayment of a loan.

When someone uses cryptocurrency as collateral, they are borrowing money using the cryptocurrency as security. The lender can then use the cryptocurrency to pay back the loan.

Another way cryptocurrencies can be used to secure a loan is by using them as payment. When someone uses cryptocurrencies to pay for a loan, the lender accepts the cryptocurrencies as payment.

This means the lender does not have to hold any physical currency. Instead, the lender can hold the cryptocurrency. This is similar to how banks work.

The final way cryptocurrencies can be used to secure a loan is by using them as the basis for a new loan. When someone uses cryptocurrencies as the basis for a new loan, they are borrowing money using the cryptocurrency as the security.

The new loan is then based on the value of the cryptocurrency. This means the value of the cryptocurrency can go up or down, but the loan will still be paid back.

Conclusion

Cryptocurrencies are a new way of using digital assets to secure or refund a loan. Cryptocurrencies like Bitcoin and Ethereum allow users to make secure, anonymous, and secure transactions.

Cryptocurrencies are also decentralized, meaning they are not subject to government or financial institution control. This makes them a good option for online transactions where security and anonymity are important.

Now that you have a better understanding of how cryptocurrencies can be used to secure a loan, it is time to explore different options available.

When you use cryptocurrency to back your loan, lenders are looking for a number of things. First and foremost, they are looking for a secure and reliable system. They also want to be sure that the cryptocurrency is backed by something tangible, such as real estate or other assets. Finally, lenders want to be sure that the cryptocurrency can be converted into fiat currency if necessary.

Cryptocurrencies are a hot topic right now, with a growing number of people looking into them as a way to invest or store their money. While there are many different types of cryptocurrencies, the most common ones are Bitcoin and Ethereum.

One way to use cryptocurrencies to back your loan is to use Ethereum. Ethereum is a blockchain-based platform that allows for the secure, transparent and automated transfer of value. This means that you can use Ethereum to back your loan because it is a secure and reliable way to transfer money.

Additionally, using Ethereum means that you can avoid paying interest on your loan. When you use a cryptocurrency to back your loan, you are essentially lending that currency to the lender. This means that you are essentially earning interest on the currency that you are lending. By using Ethereum, you can avoid paying interest on your loan, which can save you money over time.

Overall, using Ethereum to back your loan can be a cost-effective way to secure your loan and avoid paying interest.