Crypto loans are loans that are denominated in a cryptocurrency. Crypto loans typically have higher interest rates than traditional loans because they are more risky.

There are a few ways to get the best crypto loan interest rates. One way is to find a reputable lending platform that offers crypto loans. Another way is to find a crypto lending service that specializes in crypto loans.

When looking for a crypto loan, there are a few things to keep in mind.

First, it is important to find a lender that has a good reputation and is reliable. It is also important to research the terms and conditions of the loan before signing up.

Secondly, it is important to understand the crypto loan market before investing. There are a lot of scams in the crypto loan industry, so it is important to do your research before investing.

Finally, it is important to be aware of the risks involved in crypto loans. There is a lot of risk involved in investing in crypto loans, so it is important to be prepared for any potential setbacks.

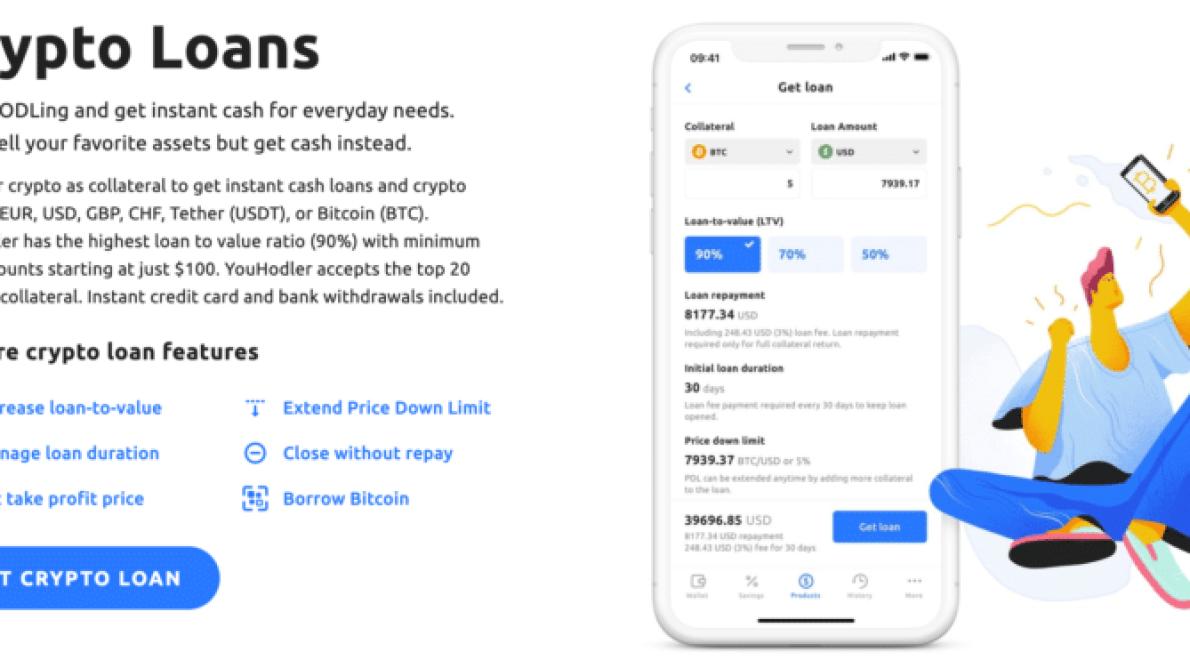

There is no one definitive answer to this question. However, you can calculate your crypto loan interest rate using a few simple steps.

First, determine the amount of money you want to borrow in crypto. This can be done by multiplying your desired loan amount by your crypto lending rate.

Next, calculate the number of days it will take you to repay the loan. This can be done by dividing the amount of money you borrowed by the number of days it will take you to repay it.

Finally, multiply the result of the first two steps together to find your interest rate.

Crypto loans are a new financial product that allow borrowers to borrow cryptocurrency instead of traditional loans. This allows people to use their cryptocurrencies as collateral for the loan, and the interest on these loans is typically much higher than traditional loans.

Cryptocurrency loans are not regulated by the same financial institutions that traditional loans are, so there is a chance that you could lose your money if the loan is not repaid. Additionally, crypto loans are not insured by the government, so you may not be able to get help if you are in trouble.

Cryptocurrency loans are a new financial product that allow borrowers to borrow cryptocurrency instead of traditional loans. This allows people to use their cryptocurrencies as collateral for the loan, and the interest on these loans is typically much higher than traditional loans.

Cryptocurrency loans are not regulated by the same financial institutions that traditional loans are, so there is a chance that you could lose your money if the loan is not repaid. Additionally, crypto loans are not insured by the government, so you may not be able to get help if you are in trouble.

There are many benefits to taking out a crypto loan. Some of the benefits include:

1. Low interest rates – Crypto loans tend to have very low interest rates, which makes them a great option for people who need money quickly.

2. No collateral required – Unlike traditional loans, crypto loans don’t require any collateral. This means that you can borrow money without worry about losing your assets.

3. No credit checks required – Many crypto loans don’t require any credit checks, which means that they are accessible to a wider range of people.

4. No middleman required – Crypto loans are typically direct loans between lenders and borrowers, which eliminates the need for a middleman. This makes the process faster and easier.

5. No long term debt – Because crypto loans are unsecured, you don’t have to worry about getting stuck with a long-term debt burden. You can always repay your loan in full whenever you need to.

There are risks associated with taking out a crypto loan. One of the most common risks is that the borrower will not be able to repay the loan. This can happen if the value of the cryptocurrency falls in value, or if the borrower cannot find a buyer for the cryptocurrency. If the borrower is not able to repay the loan, the lender may seize the cryptocurrency, causing the borrower to lose money.

Crypto lending platforms are becoming increasingly popular as a way for individuals and businesses to borrow money in the cryptocurrency market.

The following are some key features to look for when choosing a crypto lending platform:

1. Minimum loan amount

Some crypto lending platforms require borrowers to have a minimum balance of cryptocurrency in order to borrow money. Others do not have a minimum balance requirement.

2. Loan terms

Crypto lending platforms usually offer a variety of loan terms, including short-term loans, long-term loans, and revolving loans. It is important to choose a platform that offers the best loan terms for your needs.

3. Interest rates

Crypto lending platforms typically charge interest rates that vary based on the length of the loan and the amount borrowed. It is important to choose a platform that offers the best interest rates for your needs.

4. Reputation and customer support

It is important to choose a platform with a good reputation and customer support. If you have any questions or problems during your borrowing process, be sure to contact customer support.

5. Cryptocurrency acceptance

Cryptocurrency acceptance is a key feature of many crypto lending platforms. Be sure to choose a platform that accepts your preferred cryptocurrency.

Crypto loan offers are a great way to secure a loan for cryptocurrency investments. There are a variety of loan options available, so it is important to compare each one carefully before choosing one.

One of the most important factors to consider is the interest rate. Interest rates can range from very low to high, so it is important to find a loan that offers the best rate possible.

Another important factor to consider is the repayment schedule. Many loan offers require a fixed monthly payment, while others allow for more flexible repayment options.

Finally, it is important to compare the terms and conditions of the loan offer. Many loan offers have specific requirements, such as minimum investment amounts or collateral requirements. It is important to understand these requirements before signing up for a loan.

If you are considering a crypto loan as an investment, here are some tips to make sure you get the most out of your experience:

1. Do your research. Before getting involved with a crypto loan, be sure to do your research and understand the risks involved. There are a lot of scams out there, and you don’t want to end up losing your money.

2. be patient. It can take some time to find a good crypto loan provider, so be patient and don’t rush into anything.

3. understand the terms. Before getting involved with a crypto loan, make sure to understand the terms and conditions. Make sure you understand the interest rate, what is included in the loan, and other important details.

4. be prepared to repay. Just like with any other investment, make sure you are prepared to repay the loan in full if you decide to take it. There is no guarantee that you will be able to repay a crypto loan in full, so be prepared for that possibility.

5. be aware of scams. Be aware of scams and avoid getting involved with any companies that seem too good to be true. There are a lot of scams out there, and you don’t want to end up losing your money.

What is a Crypto Loan?

A crypto loan is a type of peer-to-peer loan that uses blockchain technology. Borrowers and lenders use cryptos as collateral for the loans. Cryptocurrencies are also used to pay back the loans.

What are the benefits of using a crypto loan?

The benefits of using a crypto loan include the following:

1. The loans are secured by cryptos, which gives borrowers more security than traditional loans.

2. The loans are available globally, which makes them more accessible to borrowers.

3. The loans are processed quickly, which means borrowers can get the money they need quickly.

4. The payments are made in cryptos, which preserves the value of the currencies.

5. The loans are anonymous, which makes them safer for borrowers.

What are the risks of using a crypto loan?

There are risks associated with using a crypto loan, including the following:

1. The value of the cryptos used as collateral may decline, which could lead to a loss for borrowers.

2. The value of the cryptos used as collateral may not be enough to cover the debt amount, which could lead to a loss for borrowers.

3. The cryptos used as collateral may be stolen, which could lead to a loss for borrowers.

4. The borrower may not be able to repay the debt, which could lead to a loss for borrowers.

5. The blockchain technology used to process the loans may not be secure, which could lead to a loss for borrowers.

6. There is always the risk of fraud, which could lead to a loss for borrowers.