If you're looking for a way to get a loan using your cryptocurrency as collateral, then Instant Crypto Backed Loans is the perfect solution. With this service, you can get a loan in as little as 24 hours, and the best part is that you don't have to sell your cryptocurrency.

There is no one-size-fits-all answer to this question, as the best way to get an instant crypto loan will vary depending on your individual circumstances. However, some of the most popular ways to get an instant crypto loan include using a peer-to-peer lending platform, finding a bank that offers crypto lending services, or contacting a cryptocurrency broker.

There are many benefits to getting an instant crypto loan. For starters, it can help you access funds quickly and easily. Additionally, the loan process is typically fast and easy, so you won’t have to wait long to get your money back. Finally, crypto loans are usually 100% secure and reliable, so you can rest assured that you’ll be able to repay your loan in a timely manner.

Once you have some crypto, you can use it as collateral for a loan. This will give you access to funds that you can use to purchase assets or pay off debts.

1. Find a lender that accepts cryptocurrency as collateral

There are a number of lenders that accept cryptocurrency as collateral. You can search for lenders by using a keyword such as "cryptocurrency collateral loans."

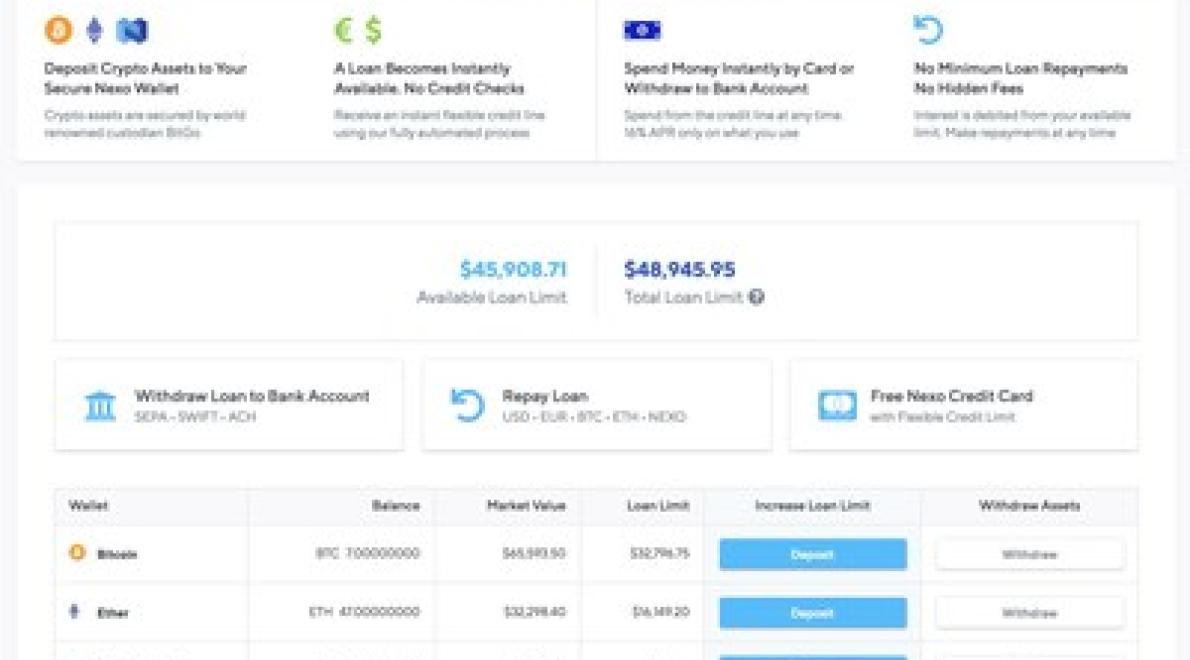

2. Set up a lending account with the lender

Once you've found a lender that accepts cryptocurrency as collateral, you'll need to set up a lending account with them. This will allow you to borrow money using your crypto as collateral.

3. Deposit your cryptocurrency into your lending account

Once you've set up your lending account, you'll need to deposit your cryptocurrency into it. This will allow the lender to evaluate your assets as collateral.

4. Submit an application for a loan

Once you've deposited your cryptocurrency into your lending account, you'll need to submit an application for a loan. This will allow the lender to assess your eligibility for a loan and determine the terms of your loan.

There are a number of instant crypto loans on the market, but some are better than others. Here are the best instant crypto loans:

1. BitLendingClub

BitLendingClub is one of the most popular instant crypto loans on the market. The loan process is simple and fast, and the loans are available in a variety of currencies. BitLendingClub also has a good reputation and is considered one of the safest and easiest to use instant crypto loans on the market.

2. BTCJam

BTCJam is another popular instant crypto loan on the market. The loan process is simple and fast, and the loans are available in a variety of currencies. BTCJam also has a good reputation and is considered one of the safest and easiest to use instant crypto loans on the market.

3. LendingClub

LendingClub is another popular instant crypto loan on the market. The loan process is simple and fast, and the loans are available in a variety of currencies. LendingClub also has a good reputation and is considered one of the safest and easiest to use instant crypto loans on the market.

4. CoinLend

CoinLend is another popular instant crypto loan on the market. The loan process is simple and fast, and the loans are available in a variety of currencies. CoinLend also has a good reputation and is considered one of the safest and easiest to use instant crypto loans on the market.

There is no one-size-fits-all answer to this question, as the best way to get an instant loan using Bitcoin as collateral will vary depending on the individual circumstances. However, some methods that may work include using a lending platform such as BitLendingClub or BitBond, or searching for peer-to-peer lenders that accept Bitcoin as collateral.

There are several advantages to using crypto as collateral for a loan. Crypto is a secure asset and can be used as collateral for a loan without any risk of losing the cryptocurrency. Additionally, crypto can be used as a form of payment in many cases, which can increase the chances of getting a loan approved.

There is no one answer to this question as the best loan terms for your needs will vary depending on your specific situation. However, some tips on how to find the best loan terms for your needs include researching different loan options available to you, understanding your credit score, and considering your budget.

There are a few things that you can do to make the most of an instant crypto loan.

1. Make sure that you understand the terms of the loan.

2. Make sure that you have a solid credit history.

3. Make sure that you have a stable source of income.

4. Make sure that you have enough collateral to secure the loan.

When looking for an instant crypto loan provider, you should be sure to consider the following factors:

The company’s legitimacy and history.

The company’s lending terms.

The company’s customer service.

The company’s track record.

There are a few ways to get an affordable instant crypto loan. One way is to find a lending platform that offers crypto loans. Another way is to find a peer-to-peer lending platform that offers crypto loans.

There are a few pros and cons to using crypto as collateral for a loan. On the pro side, crypto is relatively safe and secure, meaning it won't be easy for the lender to steal the collateral. Additionally, crypto can be easily transferred between different wallets, making it an easy and convenient form of collateral.

On the con side, crypto is not as liquid as traditional assets, meaning it may take a while for the collateral to be converted into fiat currency. Additionally, crypto is not backed by any physical assets, so if the borrower fails to repay the loan, the value of the crypto may go down.

There are a few things that you need to know before getting an instant crypto loan. First, you will need to have a solid understanding of crypto and blockchain technology. Secondly, you will need to have a good credit score. Lastly, you will need to be able to provide documentation that shows that you own the cryptocurrency that you are borrowing.