Crypto Fiat Loans is a new way to get crypto without having to go through a traditional exchange. With this method, you can get crypto by using your fiat currency as collateral. This means that you can get crypto without having to sell your fiat currency or use a credit card.

There is no one-size-fits-all answer to this question, as the best way to get a crypto fiat loan will vary depending on the individual circumstances of each case. However, some possible methods of obtaining a crypto fiat loan include seeking out online lenders, contacting cryptocurrency exchanges directly, or contacting private investors.

If you want to use a crypto fiat loan, you will need to find a provider and secure a loan. Once you have done this, you will need to set up an account with the provider and complete the loan application.

A crypto fiat loan is a loan secured by cryptocurrency, which can be used to purchase goods and services.

Crypto fiat loans offer a number of benefits for borrowers and lenders. For borrowers, crypto fiat loans offer a fast and easy way to borrow money without having to sell cryptocurrency. For lenders, crypto fiat loans offer an easy way to earn interest on their investments.

Some potential drawbacks of a crypto fiat loan compared to traditional loans include the following:

1. Higher interest rates: Crypto loans typically carry higher interest rates than traditional loans, as lenders require a higher percentage of interest in order to compensate for the risk of investment.

2. Lower borrowing limits: Crypto loans usually have lower borrowing limits than traditional loans, which may not be available to all borrowers.

3. Less liquidity: Crypto loans tend to have less liquidity than traditional loans, meaning that they are difficult to sell or trade.

4. Greater volatility: Crypto loans are typically more volatile than traditional loans, which may make them risky for investors.

When comparing crypto fiat loans, it is important to consider a few key factors. These include the interest rates offered, the terms of the loan, and the flexibility of the loan agreement.

One of the most important factors to consider when comparing crypto fiat loans is the interest rate. Interest rates for crypto fiat loans can range from very low to very high, depending on the lender and the loan product. Some lenders offer lower interest rates for crypto loans in order to attract more borrowers, while others may offer higher rates in order to compensate for the risk associated with crypto loans.

Another important factor to consider when comparing crypto fiat loans is the term of the loan. Most crypto fiat loans are short-term loans, with terms that range from a few days to a few months.

Finally, another important factor to consider when comparing crypto fiat loans is the flexibility of the loan agreement. Most crypto fiat loans are flexible, allowing borrowers to access the funds they need quickly and easily. In some cases, borrowers may even be able to use the funds immediately.

Crypto fiat loans are a relatively new phenomenon that emerged in the last few years. They are essentially loans that are secured by cryptocurrencies instead of traditional currencies.

The first crypto fiat loan was launched in 2016 by BitLendingClub, which is a peer-to-peer lending platform that uses bitcoin as its primary currency. Since then, there have been a number of other crypto fiat loans launched, including ones from Circle, LendingClub, and Bitfinex.

The main advantages of crypto fiat loans are that they offer a more secure and efficient way of borrowing money. Firstly, because cryptocurrencies are not subject to the same financial risks as traditional currencies, crypto fiat loans are considered to be much safer than traditional loans. Secondly, because cryptocurrencies are not subject to the whims of the stock market, crypto fiat loans are considered to be much more stable than traditional loans.

However, there are also some disadvantages to crypto fiat loans. For example, they can be difficult to obtain, as there is a limited number of lenders who offer them. Additionally, they can be difficult to repay, as borrowers may be reluctant to sell their cryptocurrencies in order to repay the loan.

Crypto fiat loans are a new and innovative way to borrow money using cryptocurrencies. They allow you to borrow money from a crypto lender without having to sell your cryptocurrencies.

Crypto lenders are becoming more and more popular, and there are many different companies that offer crypto fiat loans. Some of the most popular crypto lenders are BitLendingClub, BTCJam, and BlockFi.

Crypto fiat loans are a great way to get access to money quickly and without having to sell your cryptocurrencies. They also have the potential to change the way we borrow money, and they could be the future of crypto lending.

Crypto fiat loans are a great way to get access to cryptocurrencies without having to buy them outright. They allow you to borrow cryptocurrency against the value of your regular currency, which can be helpful if you need to purchase cryptocurrencies but don’t have enough money to do so outright.

There are a few things to consider when choosing a crypto fiat loan. First, you need to decide what type of cryptocurrency you want to borrow. Some crypto fiat loans allow you to borrow Bitcoin, Ethereum, or other cryptocurrencies. Other loans allow you to borrow fiat currencies like USD, EUR, and GBP.

Second, you need to decide how much money you want to borrow. Some loans allow you to borrow up to a certain amount of cryptocurrency, while other loans allow you to borrow a set amount of fiat currency.

Finally, you need to decide how long you want the loan to last. Some loans allow you to borrow for a set period of time, while other loans allow you to borrow as long as you need.

1. Crypto fiat loans are a new form of lending that allow borrowers to borrow fiat currency against cryptocurrency holdings.

2. Crypto fiat loans are typically available in a number of different currencies, including USD, EUR, and GBP.

3. Crypto fiat loans are often offered by online lenders who work with exchanges that offer cryptocurrencies as collateral.

4. Crypto fiat loans are typically short-term loans that can be repaid in as little as a few hours or days.

5. Crypto fiat loans are becoming increasingly popular as an alternative to traditional loan products, and there is a growing number of lenders available to consumers.

1. Not doing your homework. Before getting a crypto fiat loan, be sure to do your research and understand the risks. There are a lot of scams out there, and you don’t want to end up losing your money.

2. Not being realistic about the loan. Don’t expect to get a loan that’s equal to your entire crypto holdings – you’ll likely be required to put down a security or collateral.

3. Failing to repay the loan. If you can’t repay the loan on time, your lender may take legal action to get their money back.

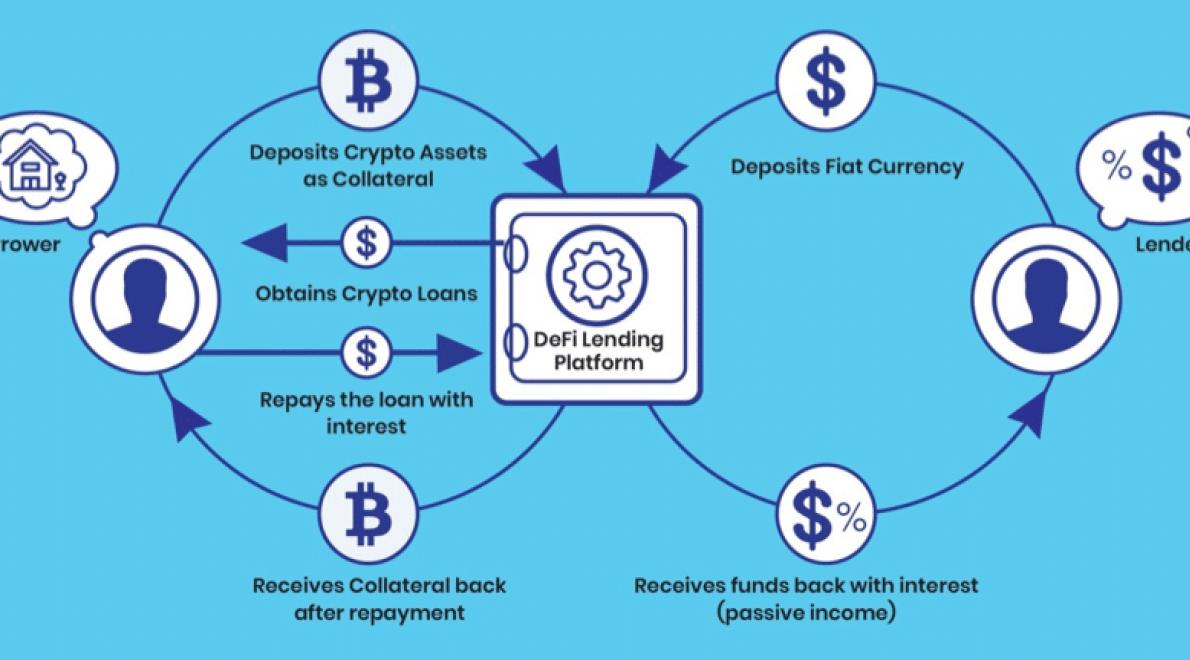

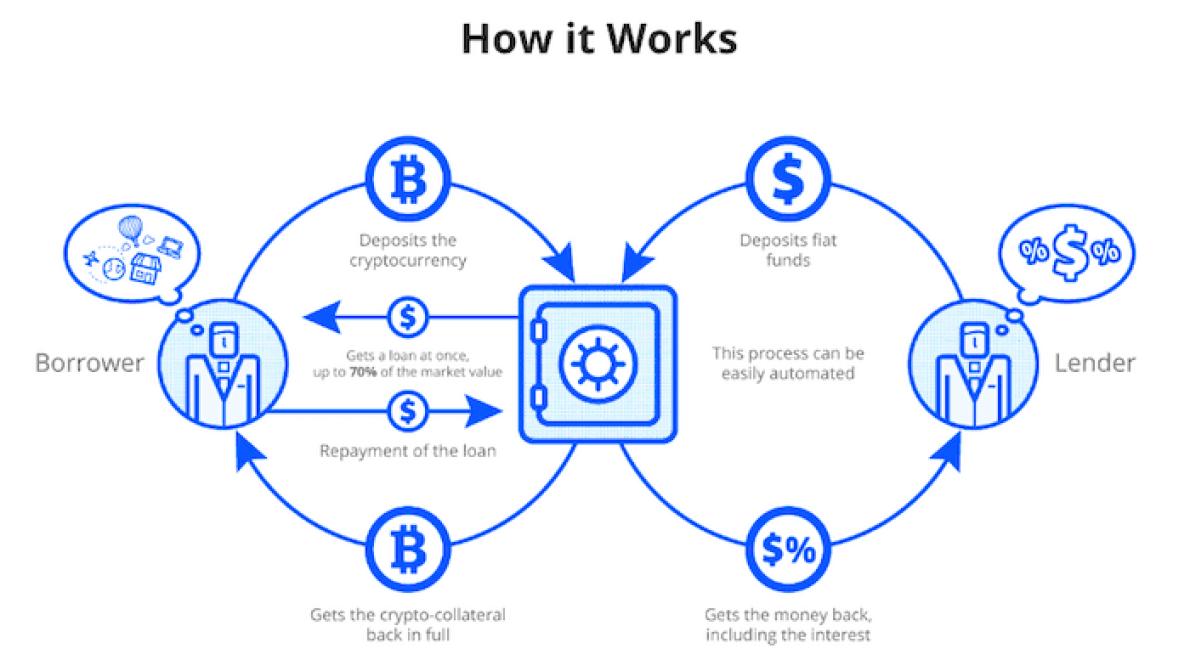

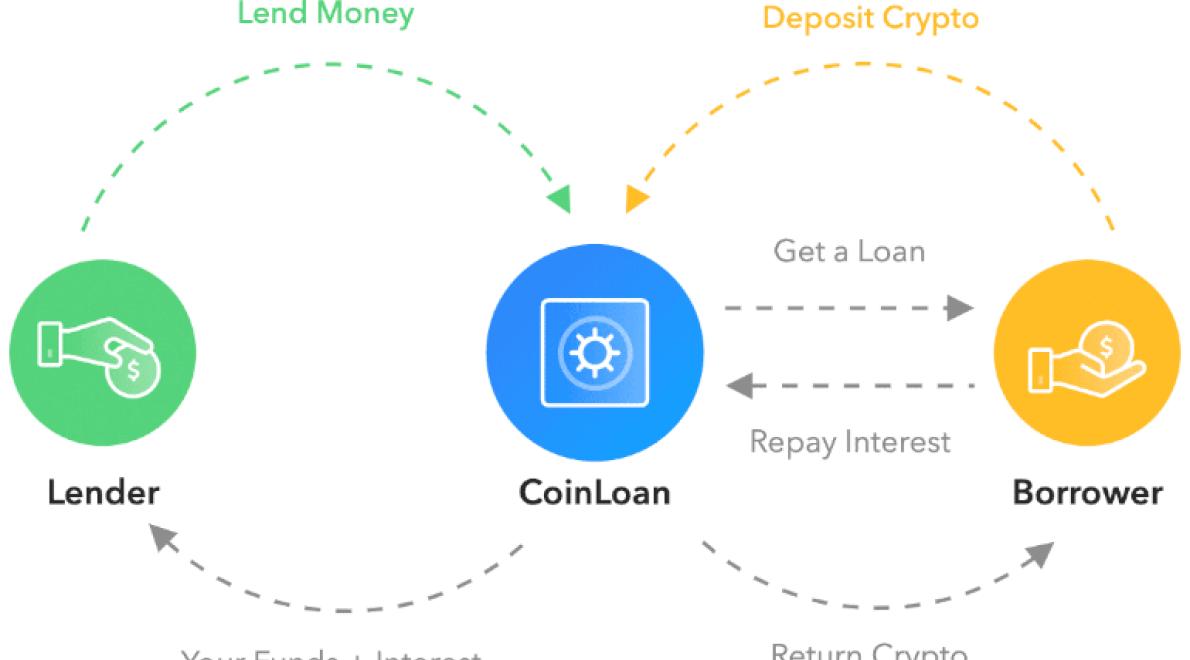

Crypto-fiat loans are a new way of borrowing money that uses cryptocurrencies as the collateral. This eliminates the need for traditional lenders, and allows borrowers to get loans in a much faster and more efficient way.

Before getting started with crypto-fiat loans, it is important to understand the basics of cryptocurrencies and blockchain technology. Cryptocurrencies are digital or virtual assets that use cryptography to secure their transactions and to control the creation of new units. Blockchain is a digital ledger of all cryptocurrency transactions that is constantly growing as “completed” blocks are added to it with a new set of recordings.

Crypto-fiat loans work a lot like regular loans. The borrower borrows money from a lender, and then uses the cryptocurrency as collateral. The lender then uses the cryptocurrency to pay the borrower back.

There are a few things to keep in mind when borrowing money through crypto-fiat loans:

The interest rate on crypto-fiat loans is usually higher than traditional loans.

The repayment period for crypto-fiat loans is usually shorter than traditional loans.

Cryptocurrencies are not always stable, and may lose value over time. This could affect the value of the cryptocurrency used as collateral.

Before getting started with a crypto-fiat loan, it is important to understand the risks involved. There are a few things you can do to minimize these risks:

Check the rates and terms of the loan carefully. Make sure you understand the interest rate, repayment period, and other terms of the loan.

Make sure you understand the interest rate, repayment period, and other terms of the loan. Verify the legitimacy of the cryptocurrency used as collateral. Check to see if the cryptocurrency is actually worth anything, and if it has been properly registered with the relevant authorities.

Check to see if the cryptocurrency is actually worth anything, and if it has been properly registered with the relevant authorities. Avoid borrowing money from unknown sources. Only borrow from trusted sources.

Only borrow from trusted sources. Store your cryptocurrency in a safe place. If something happens and you cannot repay your loan, your cryptocurrency could be lost forever.

If something happens and you cannot repay your loan, your cryptocurrency could be lost forever. Understand the risks involved in investing in cryptocurrencies. Bitcoin, Ethereum, and other cryptocurrencies are highly volatile, and could lose all of their value over time. Before investing, make sure you understand the risks involved.

Crypto-fiat loans are a newer way of borrowing money that uses cryptocurrencies as the collateral. This eliminates the need for traditional lenders, and allows borrowers to get loans in a much faster and more efficient way. Before getting started with crypto-fiat loans, it is important to understand the basics of cryptocurrencies and blockchain technology. There are a few things to keep in mind when borrowing money through crypto-fiat loans: The interest rate on crypto-fiat loans is usually higher than traditional loans. The repayment period for crypto-fiat loans is usually shorter than traditional loans. Cryptocurrencies are not always stable, and may lose value over time. This could affect the value of the cryptocurrency used as collateral. Before getting started with a crypto-fiat loan, it is important to understand the risks involved. There are a few things you can do to minimize these risks: Check the rates and terms of the loan carefully. Make sure you understand the interest rate, repayment period, and other terms of the loan. Verify the legitimacy of the cryptocurrency used as collateral. Check to see if the cryptocurrency is actually worth anything, and if it has been properly registered with the relevant authorities. Avoid borrowing money from unknown sources. Only borrow from trusted sources. Store your cryptocurrency in a safe place. If something happens and you cannot repay your loan, your cryptocurrency could be lost forever. Understand the risks involved in investing in cryptocurrencies. Bitcoin, Ethereum, and other cryptocurrencies are highly volatile, and could lose all of their value over time. Before investing, make sure you understand the risks involved.