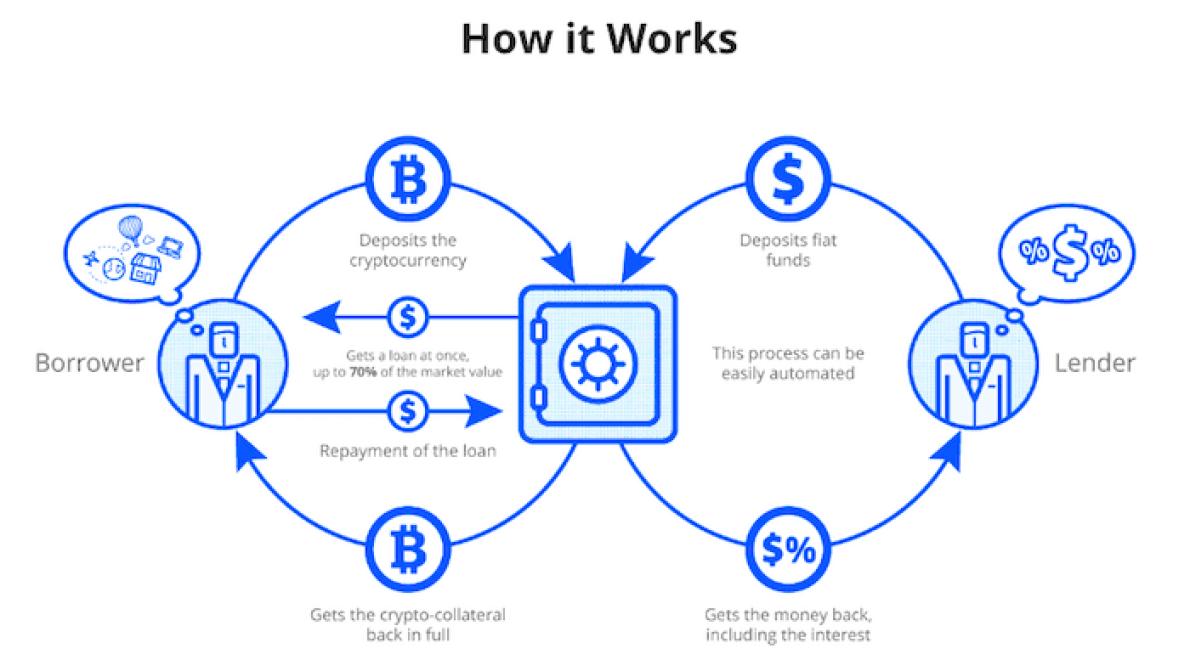

Crypto loans work by allowing borrowers to use their cryptocurrency as collateral for a loan. This means that borrowers can get a loan without having to sell their cryptocurrency, and they can use the loan for any purpose. The interest rate on a crypto loan is generally lower than the interest rate on a traditional loan, and the loan can be repaid in either fiat currency or cryptocurrency.

Cryptocurrency loans are a new type of lending that use blockchain technology. Crypto loans are created by a company that provides a digital platform for borrowers and lenders. The platform allows borrowers to borrow cryptocurrency and pay back the loan with interest. lenders can also earn interest on their loans.

If you want to get a crypto loan, you first need to find a lender. There are a number of online lenders that offer crypto loans, but be sure to do your research before choosing one.

Once you find a lender, you will need to complete an application form and provide documentation such as a copy of your ID, a loan agreement, and proof of deposit. You will also need to provide your cryptocurrency address and the amount of money you want to borrow.

Once you have completed the application process, the lender will review your information and determine whether or not they are willing to loan you money. If the lender approves your application, they will send you a loan agreement to sign. Once you have signed the agreement, the lender will transfer the requested amount of cryptocurrency to your account.

Crypto Loans are a new type of loan that uses cryptocurrencies as the underlying asset. The loan is secured by the crypto collateral and is issued on a blockchain platform.

Crypto Loans are a great way to get access to cryptocurrencies without having to buy them outright. They also provide a safe and secure way to borrow money against your crypto holdings.

Crypto loans are a new and innovative form of financing that allows borrowers to get financial assistance in the form of cryptocurrency. These loans are typically short-term, and borrowers can use the cryptocurrency they receive as collateral.

Benefits of using crypto loans include:

The speed of transactions – Crypto loans are quick and easy to complete, meaning that borrowers can get help quickly without having to wait long periods of time.

The security of the loan – Cryptocurrency is a secure form of currency, and borrowers can be sure that their loans will be repaid.

The flexibility of the loan – Crypto loans offer a lot of flexibility in terms of how the money can be used. borrowers can choose to use the money to purchase goods and services, or to invest in altcoins.

The low interest rates – As compared to traditional loans, crypto loans typically have very low interest rates. This means that borrowers can get a great deal on their financing, while still being able to afford to repay the loan.

The potential for growth – Crypto loans offer a high level of potential for growth, as the value of cryptocurrencies can fluctuate widely. This means that borrowers can make a lot of money from their loans, if the value of their cryptocurrency rises as expected.

Crypto loans are a new and innovative way of financing that has a lot of benefits for both borrowers and lenders. These loans are quick and easy to complete, and offer a high level of potential for growth.

Crypto loans are a new kind of lending product that allows borrowers to borrow money using cryptocurrencies.

The main risk with crypto loans is that the value of the cryptocurrency may decline, causing the borrower to lose money. If the value of the cryptocurrency falls below the value of the loan, the borrower may have to repay the entire loan in cash.

Another risk is that the borrower may not be able to repay the loan in a timely manner if the value of the cryptocurrency decreases. If the borrower cannot repay the loan in a timely manner, the lender may decide to sell the cryptocurrency and repay the loan in cash.

The process of repaying a crypto loan can vary depending on the specific loan arrangement, but typically there are a few steps involved.

First, the borrower must liquidate any remaining crypto holdings in order to afford the repayment. This may involve selling off some of the cryptocurrency at a lower price or exchanging it for other assets.

Once the crypto holdings are sold, the borrower must deposit the proceeds into a fiat currency account. This can be done through a traditional bank or through an exchange that accepts crypto as a form of payment.

Next, the borrower must send the fiat currency deposit to the lender. This can be done through a wire transfer or by exchanging the cryptocurrency for fiat currency on an exchange.

Finally, the lender will typically release the debt to the borrower once the fiat currency deposit has been received.

If you can't repay a crypto loan, the lender may take various actions, including:

1. Remove funds from your account.

2. Cancel your account.

3. Sell your crypto assets.

4. Charge you interest and penalties.

Crypto loans are a new type of financing that allows users to borrow money in cryptoassets. Unlike traditional loans, which are secured by assets, crypto loans are unsecured and rely on the trust of the borrower and the security of the crypto asset.

Crypto loans can be divided into two categories: fiat-to-crypto and crypto-to-crypto.

Fiat-to-crypto loans allow borrowers to use their fiat currency to borrow money in cryptoassets. The loan is then repaid in the same cryptocurrency.

Crypto-to-crypto loans allow borrowers to use their cryptoassets to borrow money in other cryptoassets. The loan is then repaid in the same cryptocurrency.

Crypto loans are a new type of financing that allows users to borrow money in cryptoassets.

Unlike traditional loans, which are secured by assets, crypto loans are unsecured and rely on the trust of the borrower and the security of the crypto asset.

Crypto loans can be divided into two categories: fiat-to-crypto and crypto-to-crypto.

Fiat-to-crypto loans allow borrowers to use their fiat currency to borrow money in cryptoassets. The loan is then repaid in the same cryptocurrency.

Crypto-to-crypto loans allow borrowers to use their cryptoassets to borrow money in other cryptoassets. The loan is then repaid in the same cryptocurrency.

Crypto loans are becoming popular because they allow borrowers to borrow money using cryptocurrencies as collateral. This is different from traditional loans, which usually use assets like mortgages, car loans, or credit cards as collateral.

What are the benefits of using crypto loans as collateral?

The main benefit of using crypto loans as collateral is that they provide a way to borrow money using cryptocurrencies that are not subject to traditional financial regulations. This means that borrowers can get loans without having to worry about their credit score, and they can also avoid the high interest rates that are often associated with traditional loans.

Another benefit of using crypto loans as collateral is that they provide a way to diversify your portfolio. By borrowing money using cryptocurrencies as collateral, you can reduce the risk of investing in a single cryptocurrency project. This can help you to protect your investment in case the value of the cryptocurrency falls.

What are the disadvantages of using crypto loans as collateral?

There are a few potential disadvantages of using crypto loans as collateral. First, it can be difficult to find a lender that is willing to offer loans using this type of collateral. Second, crypto loans are not insured by the government, so you may have to bear the risk of loss if the value of the cryptocurrency falls. Finally, crypto loans are not guaranteed, so you may not be able to get your money back if the borrower fails to repay the loan.

Crypto loans are a great way to save money. They are a form of peer-to-peer lending where you borrow money from friends or family members in the form of cryptocurrencies. This allows you to get access to funds without having to go through a traditional lending institution.

One of the biggest benefits of crypto loans is that they are very low-risk. Unlike traditional loans, you don’t have to worry about interest rates or collateral requirements. This makes crypto loans an ideal way to get access to funds when you need them without having to worry about getting stuck in a high-interest debt trap.

Another big benefit of crypto loans is that you can use them to finance a wide range of activities. You can use them to pay for bills, invest in cryptocurrencies, or cover short-term expenses. There is no limit to the amount of money you can borrow, so you can always find a way to use these loans to save money.

Overall, crypto loans are a great way to save money and cover short-term expenses. They are low-risk and easy to use, so you can always find a way to benefit from them.