Crypto currency loans are becoming more popular as a way to get quick cash. There are a few things to know before getting one of these loans. First, the interest rates can be very high. Make sure you can afford the payments before taking out the loan. Second, many lenders require collateral in the form of another crypto currency or asset. This means if you can't repay the loan, the lender can take your collateral. Be sure you understand the loan agreement before signing anything.

When you need a Crypto currency loan, there are a few things to keep in mind. First, consider your financial needs and how much you are willing to borrow. Second, research the available lenders and find one that meets your needs. Third, create a solid repayment plan and track your progress. Finally, be prepared to repay your loan promptly and in full.

Cryptocurrency loans offer a variety of benefits that can be valuable to borrowers and lenders. Here are some of the most common benefits:

Low interest rates: Cryptocurrency loans typically have low interest rates, which can make them a attractive option for borrowers.

Cryptocurrency loans typically have low interest rates, which can make them a attractive option for borrowers. Increased liquidity: Cryptocurrency loans are typically highly liquid, meaning that they can be easily transferred between lenders and borrowers.

Cryptocurrency loans are typically highly liquid, meaning that they can be easily transferred between lenders and borrowers. Reduced risk: Cryptocurrency loans are typically less risky than traditional loans, which can make them a more attractive option for borrowers.

Cryptocurrency loans are typically less risky than traditional loans, which can make them a more attractive option for borrowers. No need for collateral: Unlike traditional loans, there is usually no need for borrowers to provide collateral when obtaining a cryptocurrency loan.

Unlike traditional loans, there is usually no need for borrowers to provide collateral when obtaining a cryptocurrency loan. Privacy: Because cryptocurrency loans are conducted via blockchain technology, borrowers remain anonymous unless they choose to share their information.

Because cryptocurrency loans are conducted via blockchain technology, borrowers remain anonymous unless they choose to share their information. Lower borrowing costs: Because cryptocurrency loans are issued and backed by cryptocurrencies, there is often little to no processing or lending fees associated with them.

Because cryptocurrency loans are issued and backed by cryptocurrencies, there is often little to no processing or lending fees associated with them. Quick and easy approval: Most cryptocurrency loans are approved within minutes, making them a fast and easy option for borrowers.

Most cryptocurrency loans are approved within minutes, making them a fast and easy option for borrowers. No need for a credit score: Because cryptocurrency loans are conducted through blockchain technology, there is usually no need for borrowers to have a good credit score.

Because cryptocurrency loans are conducted through blockchain technology, there is usually no need for borrowers to have a good credit score. No need to collateralize: Because cryptocurrency loans are not backed by any assets, there is usually no need for borrowers to provide collateral.

Because cryptocurrency loans are not backed by any assets, there is usually no need for borrowers to provide collateral. No interest payments: Unlike traditional loans, there are usually no interest payments associated with cryptocurrency loans.

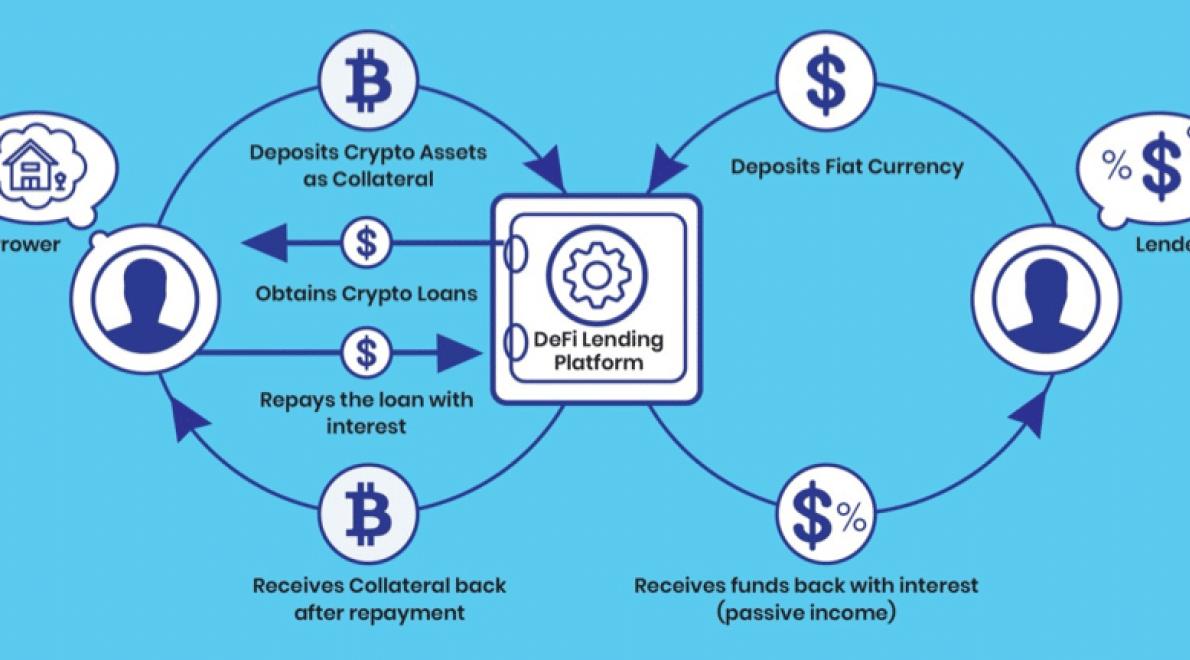

How Cryptocurrency Loans Work

A cryptocurrency loan is a short-term loan that is based on the value of cryptocurrencies. The borrower borrows money from a lender in exchange for a set period of time and then pays back the borrowed amount in cryptocurrency. Because the loan is based on the value of the cryptocurrencies involved, the interest rate associated with the loan is usually very low.

The main advantage of cryptocurrency loans is that they are highly liquid. This means that borrowers can easily transfer the borrowed money between themselves and the lenders. Additionally, because cryptocurrency loans are not backed by any assets, there is usually no need for borrowers to provide collateral. This makes them a less risky option than traditional loans.

Cryptocurrency loans are also quick and easy to approve. Most lenders approve loans within minutes of being submitted. Additionally, because cryptocurrency loans are conducted through blockchain technology, there is no need for borrowers to have a good credit score. This makes them a more accessible option for those who may not be able to qualify for traditional loans.

Cryptocurrency loans are a new and innovative way to borrow money. They allow people to borrow money in the form of cryptocurrency, which is a digital asset that uses cryptography to secure its transactions and to control the creation of new units.

Cryptocurrency loans are risky because they are not regulated by the banking system. This means that there is no guarantee that the borrower will be able to repay the loan. Additionally, cryptocurrency loans are not insured by the government, so if something goes wrong with the loan, the borrower may not be able to get help from the insurance system.

Because cryptocurrency loans are not regulated by the government, there is also a risk of fraud. If someone is trying to scam someone else out of their money, they may be able to do so using a cryptocurrency loan.

Crypto currency loans are a new type of loan that uses blockchain technology. They are a type of peer-to-peer lending platform that uses cryptocurrencies as the underlying asset.

The most common type of crypto currency loan is a short-term loan that is used to finance a specific investment. These loans are usually given between 2 and 5 days and have a maximum term of 30 days.

Another type of crypto currency loan is a long-term loan that is used to finance a larger investment. These loans are usually given between 6 and 12 months and have a maximum term of 2 years.

Finally, there is a crypto currency collateral loan that is used to secure a crypto currency loan. This type of loan is usually given between 1 and 3 months and has a maximum term of 6 months.

Crypto currency loans can be a great way to get started in the cryptocurrency world, but there are also some drawbacks to consider. Here are the pros and cons of taking out a crypto currency loan:

Pros

-Cryptocurrency loans can provide a low-risk way to get started in the crypto world.

-Lenders may be more willing to lend money to people who are investing in cryptocurrencies.

-Cryptocurrency loans may offer a higher interest rate than traditional loans.

-Cryptocurrency loans may be easier to get than traditional loans because there is less paperwork involved.

-Cryptocurrency loans may be easier to repay than traditional loans.

-Cryptocurrency loans may be safer than traditional loans because they are not subject to the financial crisis that affected the banking system in 2008.

Cons

-Cryptocurrency loans can be risky because the value of a cryptocurrency can fluctuate.

-Cryptocurrency loans are not insured, so borrowers could lose all of their money if something goes wrong with the loan.

-Cryptocurrency loans are not backed by anything, so they are not as safe as traditional loans.

Cryptocurrency loans are a new and emerging form of lending that use cryptocurrencies as the underlying asset. This type of lending allows borrowers to borrow money using cryptocurrencies as collateral, with the lender providing a short-term loan in return.

Cryptocurrency loans are a relatively new phenomenon, and there is still much uncertainty surrounding their legitimacy and potential risks. Before you consider a cryptocurrency loan, it is important to carefully consider the risks involved and make sure that the loan is appropriate for your needs.

Here are some key things to keep in mind when borrowing cryptocurrency:

Cryptocurrency loans are not regulated by the traditional banking system, and there is a risk that the loan may not be repaid.

Cryptocurrency loans are typically short-term loans, with the duration typically ranging from a few days to a couple of weeks.

Cryptocurrency loans are not backed by any physical assets, and there is a risk that the value of the cryptocurrency may decline in value.

Cryptocurrency loans are not insured by the government or any other financial institution, and there is a risk that you may not be able to get your money back if the loan is not repaid.

Before you take out a cryptocurrency loan, it is important to carefully consider the risks and benefits involved. Make sure that you understand the terms of the loan and the potential risks involved, and consult with a qualified financial advisor if you have any questions.

Crypto currency loans are a great way to get started in the cryptocurrency world. However, not all crypto currency loans are created equal. Here are some tips to help you choose the right one for you:

1. Understand Your Needs

Before you even start looking for a crypto currency loan, you need to understand your needs. What are you looking to do with the money? Are you looking for a short-term solution, or do you want a long-term solution? Are you looking for a loan that will help you purchase cryptocurrency, or are you looking for a loan that will help you invest in cryptocurrency?

2. Consider Your Credit Score

One of the most important things to consider when choosing a crypto currency loan is your credit score. Not all lenders will approve you for a loan based on your credit score, so it’s important to know what factors will impact your approval.

3. Research the Lenders

Before you apply for a crypto currency loan, it’s important to research the lenders. There are a lot of bad actors in the crypto currency lending world, so it’s important to do your research and find a lender that you can trust.

4. Consider Your Financial Situation

Another important thing to consider when choosing a crypto currency loan is your financial situation. Are you able to repay the loan quickly? Is the interest rate high enough for you?

5. Compare Interest Rates and Terms

Once you have decided on the lenders and the terms of the loan, it’s important to compare interest rates and terms. There are a lot of good and bad lenders out there, so it’s important to find one that has a good interest rate and terms that fit your needs.

Bitcoin loans are one of the most popular crypto currency loans on the market. Bitcoin loans allow you to borrow money against your bitcoin holdings. This allows you to get a loan without having to sell your bitcoin holdings.

Litecoin loans are also popular on the market. Litecoin loans allow you to borrow money against your litecoin holdings. This allows you to get a loan without having to sell your litecoin holdings.

Bitcoin and Litecoin loans are the most popular on the market, but there are other crypto currency loans available. Ethereum loans are also popular, and allow you to borrow money against your Ethereum holdings.

Crypto currency loans are a great way to get a quick loan. They are also a safe way to invest your money. All you need is a bank account, and you can get a crypto currency loan.

When you're considering a crypto currency loan, it's important to be aware of the risks. Before you apply, it's worth doing your own research to make sure you understand the risks involved.

Here are some things to consider when borrowing cryptocurrency:

-There is no government or financial institution backing cryptocurrencies, meaning that there is no guarantee of repayment.

-Cryptocurrencies are not regulated or insured, meaning that you may not be able to get help if something goes wrong.

-Cryptocurrencies are highly volatile, meaning that their value can change quickly.

-Cryptocurrency loans are often difficult to get approved, and there is a high risk of losing your money if you don't repay the loan.

When looking to take out a crypto currency loan, it is important to do your research first. There are a variety of different loans available, and it can be difficult to know which one is the best for you. Here are some tips on how to get the most out of your crypto currency loan:

1. Make sure you understand the terms of the loan.

Before you take out a loan, it is important to understand the terms. You should know what interest rate you are paying, how long the loan will last, and what happens if you do not repay the loan in time.

2. Compare crypto currency loans.

There are a variety of different loans available, so it is important to compare them before taking out one. Compare interest rates, terms, and conditions.

3. Ask for help from a financial advisor.

If you are not sure how to take out a crypto currency loan, or if you have any questions about the terms, you should ask a financial advisor. A financial advisor can help you understand the loan options available to you, and they can help you decide which is the best for you.

There are a few things to avoid when taking out a crypto currency loan. First, make sure you fully understand the risks involved. Second, be sure to have a solid repayment plan in place. Finally, be prepared to pay back your loan in a timely manner.

Cryptocurrency loans are a relatively new form of lending that allows users to borrow money in exchange for cryptocurrency. These loans are typically offered by online lenders and can be used to finance a variety of purposes, including purchasing cryptocurrencies, paying off debt, and investing in cryptocurrency projects. While crypto currency loans are not regulated by the same authorities as traditional loans, they are generally considered to be safe and secure investments, and they offer some unique benefits relative to other forms of lending.