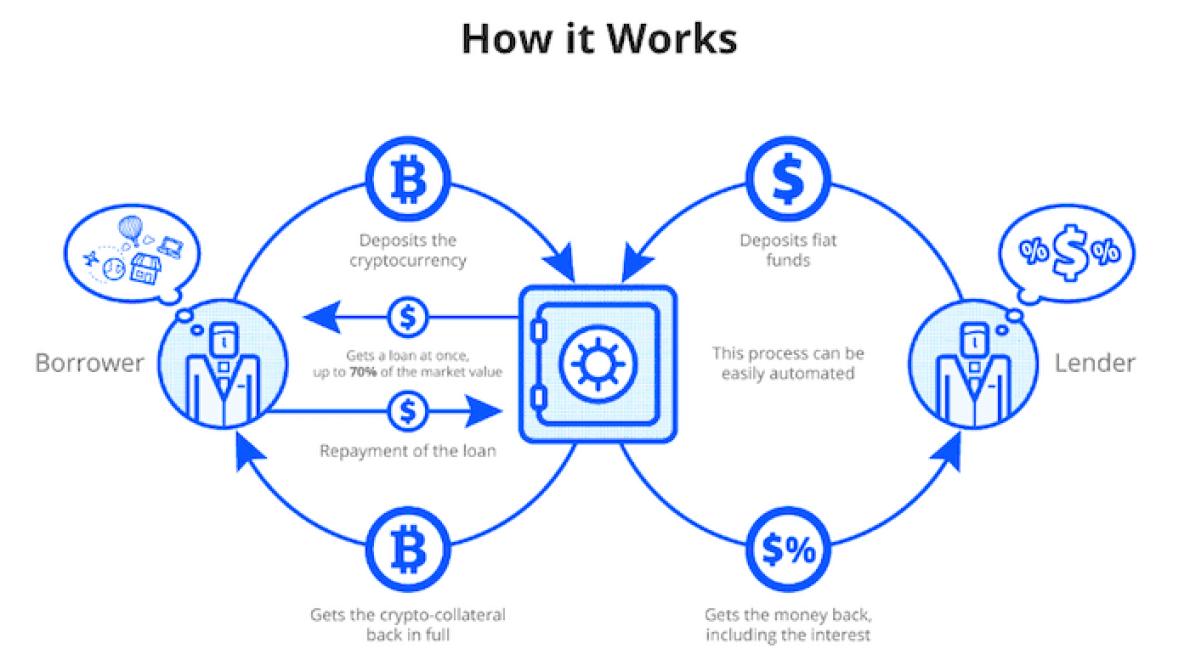

Crypto loans are a new way to get funding using your cryptocurrency as collateral. Here's how they work: you deposit your cryptocurrency into a loan platform, which then uses it as collateral to give you a loan in fiat currency. The loan is typically repaid with interest, and you can get your cryptocurrency back once the loan is paid off.

Crypto loans are a new way of borrowing money that uses cryptocurrencies as collateral. The borrower uses the cryptocurrency to collateralize the loan, and then the lender can use the cryptocurrency to pay back the loan.

Here’s how it works:

1. The borrower uses the cryptocurrency to collateralize the loan. This gives the lender trust that the borrower will be able to repay the loan.

2. The lender pays the borrower in fiat currency (dollars, euros, etc.), and then transfers the cryptocurrency to the borrower’s account.

3. The borrower can now use the cryptocurrency to pay back the loan, or sell it to get fiat currency.

1. Decide if you want a Crypto Loan or a Crypto Investment.

2. Do your research.

3. Choose a reputable lender.

4. Complete the required documents.

5. Agree to terms and conditions.

If you want to borrow money using your cryptocurrency, there are a few things you need to do first. First, you'll need to find a lender who is willing to take on your loan. Second, you'll need to find a cryptocurrency that can be used as collateral. Finally, you'll need to figure out the interest rate and terms of the loan.

Finding a Lender Who Will Take on Your Cryptocurrency Loan

The first step in borrowing money using your cryptocurrency is finding a lender who is willing to take on the loan. There are a number of lenders out there who are interested in lending money using cryptocurrencies, but you'll need to do your research first.

Some of the most popular lenders who are willing to take on cryptocurrency loans are BitLendingClub and BitBond. Both of these lenders offer low interest rates and flexible terms, so you're sure to find a lender that meets your needs.

Figuring Out the Interest Rate and Terms of Your Loan

Once you've found a lender who is willing to take on your cryptocurrency loan, the next step is to figure out the interest rate and terms of the loan. You'll want to make sure that the interest rate is low enough that you can afford the payments, but high enough that the loan will be profitable for the lender.

Finally, you'll need to figure out the terms of the loan. You'll want to make sure that the terms are short enough so that you can repay the loan quickly, but long enough so that the loan will be profitable for the lender.

Wallet

If you need to borrow money against your Bitcoin or Ethereum wallet, there are a few options available.

One option is to use a lending service such as BitLendingClub. BitLendingClub is a peer-to-peer lending platform that allows users to borrow against their Bitcoin and Ethereum holdings.

Another option is to use a cryptocurrency exchange that allows users to borrow against their holdings. For example, Bitfinex allows users to borrow against their Bitcoin and Ethereum holdings.

Finally, you can also use a cryptocurrency wallet that allows you to borrow against your holdings. For example, MyEtherWallet allows you to borrow against your Ethereum holdings.

Crypto loans are a great way to get out of a pinch. With crypto loans, you can borrow money from a cryptocurrency platform in order to cover short-term expenses.

Some of the most popular crypto loans platforms include BitLendingClub and BTCjam. These platforms allow you to borrow up to $100,000 worth of cryptocurrency.

The great thing about these platforms is that you don’t have to worry about interest rates. Instead, the platforms will charge a commission for their services.

So, if you need a quick cash infusion but don’t want to deal with high interest rates or long repayment periods, then a crypto loan might be a good option for you.

When it comes to cryptocurrency loans, you may be wondering what you need to know in order to get one. Here is a rundown of the key things you need to know in order to get a crypto loan.

First, you will need to have some cryptocurrency. This can be Bitcoin, Ethereum, or another digital asset. Second, you will need to have a good credit score. Third, you will need to have a bank account. Fourth, you will need to have a reliable source of income. Fifth, you will need to have a cryptocurrency wallet. Sixth, you will need to have a reliable internet connection. Seventh, you will need to be able to make monthly repayments. Eighth, you will need to be comfortable with the risk of losing your money.

The process of getting a crypto loan is relatively straightforward. You will need to submit an application online, and you will need to provide your credit score, bank account information, and other financial information. You will also need to provide documentation that proves your income and your credit score. Once your application is approved, you will be notified of the terms of your loan, which may include monthly repayments, interest rates, and other conditions.

When looking to take out a crypto loan, it is important to compare rates and terms to ensure you are getting the best deal possible. Some factors to consider when comparing crypto loans include loan amount, interest rate, loan duration, and crypto collateral.

To get the best deal on a crypto loan, it is important to compare rates and terms. Some factors to consider when comparing crypto loans include loan amount, interest rate, loan duration, and crypto collateral.