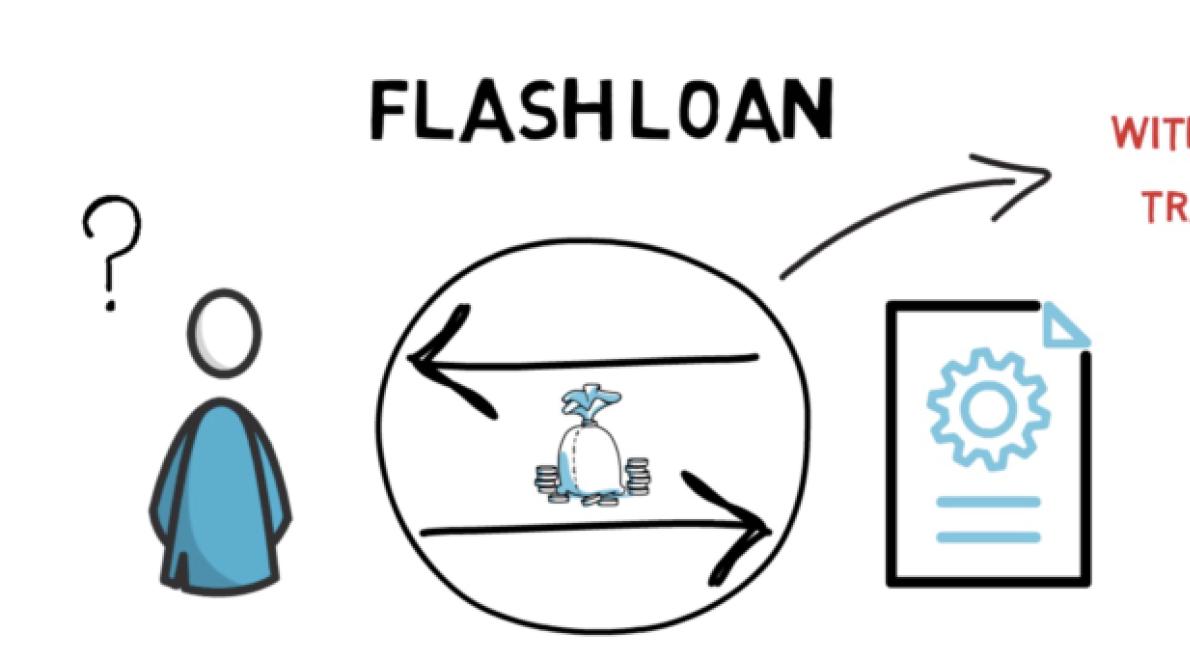

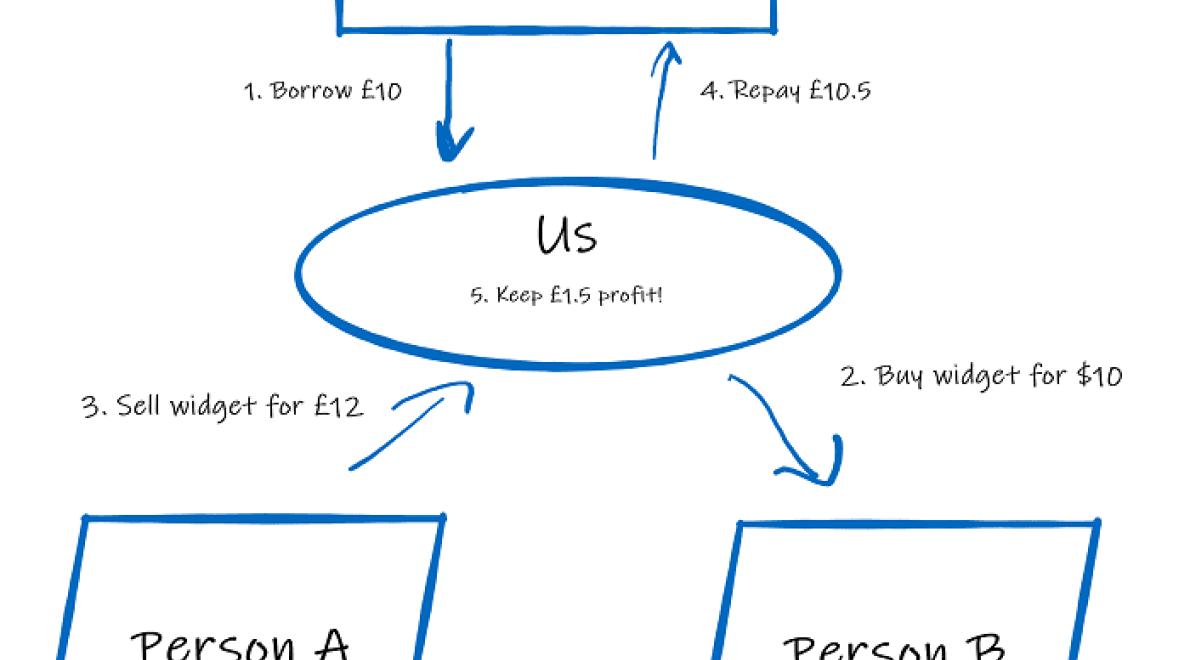

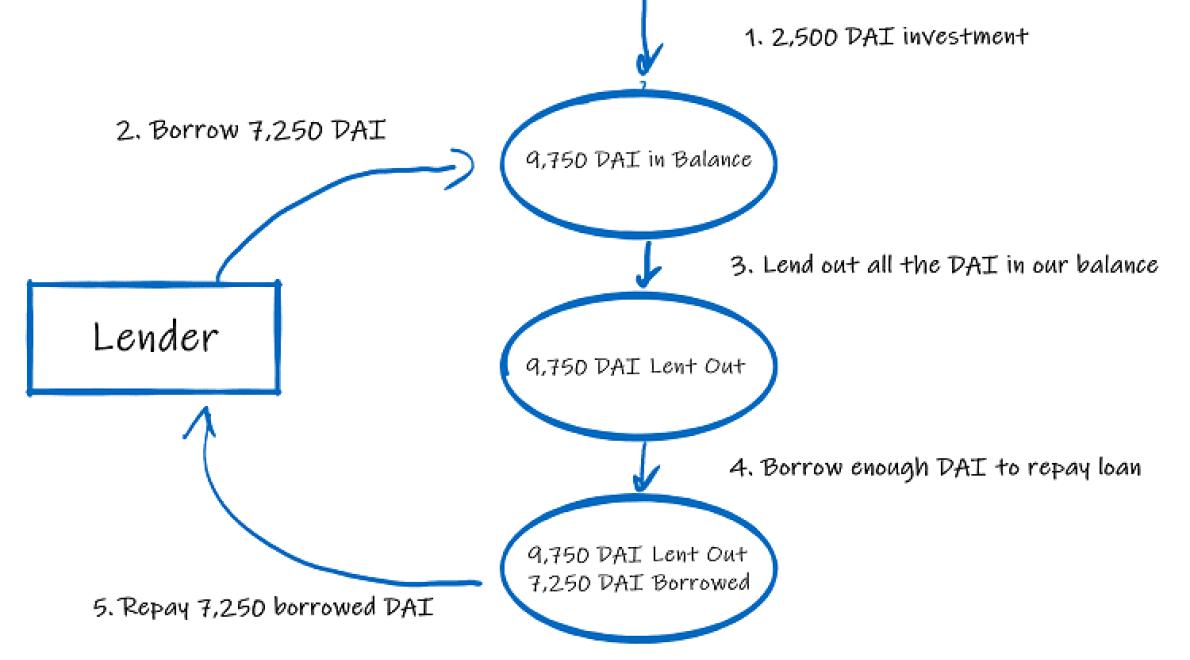

A crypto flash loan is a type of loan that allows borrowers to use their cryptocurrency as collateral to take out a loan in another cryptocurrency. This type of loan can be useful for borrowers who want to take advantage of arbitrage opportunities or who need to access liquidity quickly.

1) First, you will need to create a crypto account. This can be done by visiting a website such as Coinbase or Binance.

2) Next, you will need to generate a secure password. This can be done by entering your birthdate and choosing a strong password.

3) Finally, you will need to deposit your cryptocurrency into your account. This can be done by transferring your coins from a digital wallet such as Bitcoin, Ethereum, or Litecoin to your crypto account.

4) Once your cryptocurrency has been deposited, you will need to open a loan with a reputable crypto lending platform. This can be done by searching for the relevant platform on Google, Yahoo, or Bing.

5) Once you have found the platform, you will need to fill out an application form. This will require information such as your name, address, and loan amount.

6) After completing the application form, you will need to provide your credit history and bank account information. This information will be used to verify your identity and ensure that the loan is safe.

7) Finally, you will need to provide a copy of your identification document. This can be a passport, driver’s license, or government ID card.

8) Once you have completed all of the required information, the lending platform will review your application and contact you to confirm the terms of the loan.

There are many crypto flash loans available on the market. Here are the best ones in 2020:

1. BitLendingClub

BitLendingClub is a popular crypto flash loan provider. They offer short-term loans in bitcoin, ethereum, and other cryptocurrencies. Their loans are usually available within minutes and have low interest rates.

2. BTCJam

BTCJam is another popular crypto flash loan provider. They offer short-term loans in bitcoin and other cryptocurrencies. Their loans are usually available within minutes and have low interest rates.

3. Unocoin

Unocoin is one of the leading crypto flash loan providers. They offer short-term loans in bitcoin, ethereum, and other cryptocurrencies. Their loans are usually available within minutes and have low interest rates.

4. Bitbond

Bitbond is another popular crypto flash loan provider. They offer short-term loans in bitcoin, ethereum, and other cryptocurrencies. Their loans are usually available within minutes and have low interest rates.

5. ETHLend

ETHLend is another popular crypto flash loan provider. They offer short-term loans in bitcoin, ethereum, and other cryptocurrencies. Their loans are usually available within minutes and have low interest rates.

Crypto flash loans are the future of lending. They are fast, efficient, and secure. They also have low interest rates, which makes them an attractive option for borrowers.

Crypto flash loans have become a popular way to borrow money without having to provide any personal information. Essentially, these loans work by allowing borrowers to access a small amount of money in exchange for providing a security deposit.

Since these loans are secured by the assets of the borrower, they offer a high degree of security. In addition, since these loans are short-term in nature, they are perfect for people who need money quickly.

Overall, crypto flash loans are a great way to get quick access to money without having to worry about pesky paperwork or lending institutions. If you find yourself in a situation where you need some cash but don’t want to deal with the hassle of traditional borrowing methods, consider using a crypto flash loan.

There are pros and cons to using crypto flash loans, depending on your needs.

Pros

Some of the benefits of using crypto flash loans include:

- Reduced processing time: Due to the decentralized nature of blockchain technology, crypto flash loans are processed quickly and without the need for a middleman.

- Reduced lending costs: The fees associated with traditional lending institutions can be significantly higher than those charged by crypto flash lenders.

- Greater security: Since crypto flash loans are handled through a secure and transparent blockchain network, borrowers can be sure that their information is protected.

- Reduced risk: Since crypto flash loans are not issued or backed by any physical assets, there is no risk of default.

Cons

While there are some advantages to using crypto flash loans, there are also some drawbacks. Some of the most common disadvantages include:

- High interest rates: Because crypto flash loans are issued and backed by cryptocurrencies, the interest rates charged can be high.

- Limited availability: Crypto flash loans are not available in all countries, so they may not be available in your area.

Crypto flash loans are a new form of online lending that allow you to borrow money using cryptocurrency. They work like traditional loans, but you can borrow money using digital assets like bitcoin, Ethereum, and Litecoin.

The process of borrowing money through a crypto flash loan is simple. You sign up for an account with a lending platform, deposit your cryptocurrency into the account, and then submit a loan request. The lending platform will then process your loan request and return your funds in cryptocurrency.

There are a few caveats to consider when using crypto flash loans. First, the interest rates on these loans are typically high. Second, crypto flash loans are not regulated by the government, so there is a risk that you may not be able to get your money back if the lending platform goes bankrupt. Finally, crypto flash loans are not available in all countries.

Crypto flash loans are a great way to get some quick cash, but they come with a few risks. First, you may not be able to get your money back if you need to. Second, you may have to pay interest on the loan, which can add up quickly. Third, the cryptocurrency you borrow may not be worth as much when you get it back, so you may have to spend a lot of extra money to get your original investment back. Finally, crypto flash loans are not regulated by the government, so there is no guarantee that you will be able to get your money back if something goes wrong.

Crypto flash loans offer a fast and easy way for people to borrow money, with minimal paperwork. This is appealing to people who want to borrow money quickly and without having to go through the hassle of traditional lending processes.

Crypto flash loans also offer borrowers a high degree of security and transparency. Loans are typically secured by cryptocurrencies, which means borrowers can be sure that their money will be returned. And since loans are typically short-term, borrowers can get money they need right away without having to wait long periods of time.

Finally, crypto flash loans are relatively affordable. The interest rates offered are usually lower than those offered by traditional lenders, which means that borrowers can get a high-quality loan at a competitive price.