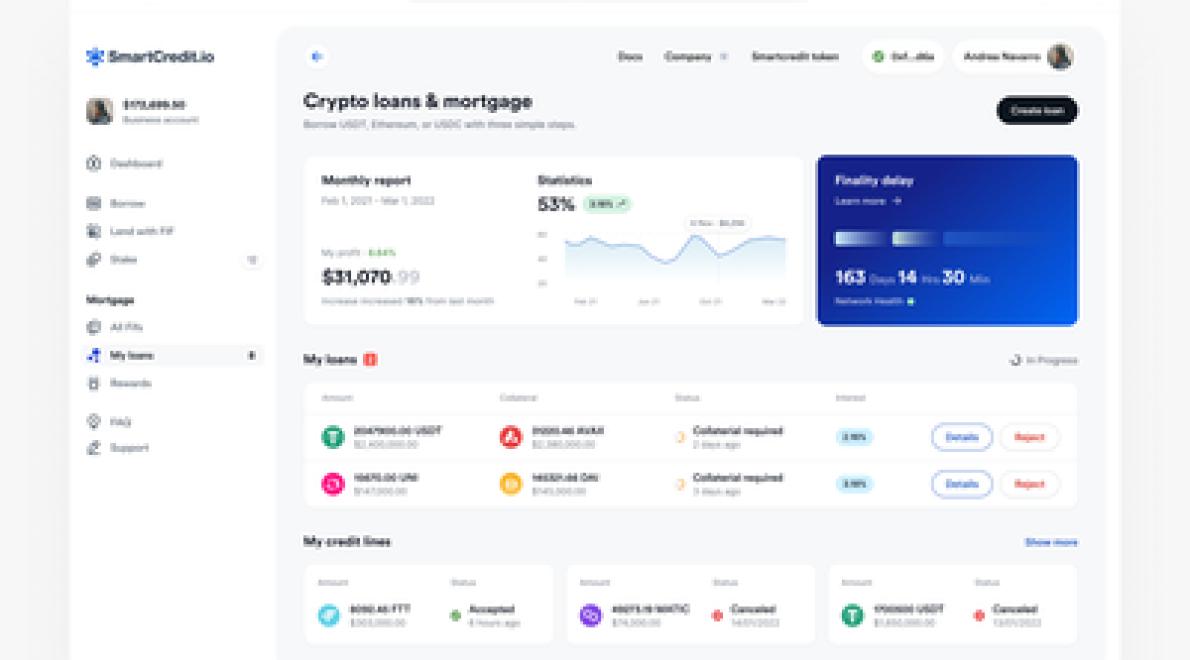

Decentralized finance (DeFi) protocols have been gaining in popularity as a way to earn yield on cryptocurrency holdings. Two popular options for DeFi yield farming are staking and lending. In this article, we compare and contrast these two options to help you decide which one is right for you. Staking is the process of holding cryptocurrency in a wallet to support the operations of a blockchain network. In return for staking their tokens, users earn rewards in the form of newly minted coins or transaction fees. Crypto loans, on the other hand, involve lending your cryptocurrency to borrowers in exchange for interest payments. These loans are often made through decentralized lending protocols that run on smart contracts. Both staking and lending can be profitable ways to earn yield on your cryptocurrency holdings. However, they each come with different risks and rewards. Staking is typically more hands-off than lending, as it does not require active management of your loan portfolio. However, staking rewards are often lower than the interest rates paid on crypto loans. Additionally, staking your tokens can tie up your funds for extended periods of time, which may not be ideal if you need access to your money in the short-term. Crypto loans, on the other hand, offer the potential for higher returns but also come with more risk. Lending platforms typically require borrowers to put up collateral in the form of other cryptocurrency tokens or stablecoins. If the value of the collateral falls below a certain threshold, the borrower may be forced to liquidate their position to repay the loan, resulting in a loss for the lender. Before deciding whether to stake or lend your cryptocurrency, be sure to carefully consider the risks and rewards of each option.

When it comes to cryptocurrency, there are a few different ways to get your hands on some digital coins. The most common way is to buy them on an exchange, but another option is to borrow them from a crypto loan service.

While both methods have their advantages and disadvantages, staking vs. crypto loans are generally seen as being better options for long-term investment. Here’s a look at the pros and cons of each:

Pros of Staking

1. Higher returns than crypto loans

When you stake your coins, you’re essentially giving them away to a service in exchange for rewards. This means that you’re likely to earn a higher return than you would if you borrowed coins from a crypto loan service.

2. Long-term stability

Unlike with crypto loans, staking is a long-term investment strategy. This means that your coins are likely to be more stable in the long term, as they’ll be locked up and won’t be available for purchase on an exchange.

3. Easier to get started

Staking is usually much easier to get started than borrowing coins. This is because you don’t need to sign up for any kind of account or provide any personal information. You simply deposit your coins into the service and start earning rewards.

4. More control over your coins

Staking also gives you more control over your coins. This is because you can choose which services to contribute to, and you can always withdraw your coins if you decide that you no longer want to participate in the staking program.

5. Diversification benefits

One of the main benefits of staking is that it can help you diversify your investment portfolio. By contributing to multiple staking services, you’ll effectively spread your risk across a variety of different projects. This will help protect you from any one project going bankrupt, and it will also give you a greater chance of earning a high return on your investment.

Cons of Staking

1. Higher initial investment requirement

One of the main drawbacks of staking is that it requires an initial investment. This means that you’ll need to put aside a higher amount of money than if you were to borrow coins from a crypto loan service.

2. Limited availability of rewards

Another downside of staking is that rewards are usually limited. This is because a service needs to generate enough revenue in order to cover the costs associated with providing rewards to investors.

3. More involved than borrowing coins

Staking is usually more involved than borrowing coins. This is because you need to deposit your coins into the service, and you may also need to participate in promotional activities in order to earn rewards.

4. More risky than borrowing coins

Staking is also more risky than borrowing coins. This is because if the project you’re investing in goes bankrupt, your coins could be lost forever.

5. More complicated than borrowing coins

Staking is also more complicated than borrowing coins. This is because you need to understand the various staking services available and make sure that you’re depositing your coins into the right one. If you make a mistake, your coins could be lost forever.

Staking is a process where users earn rewards in cryptocurrency by locking up their tokens in a smart contract. The rewards are paid out based on the amount of tokens locked up, and they can be accessed at any time.

Why Stake?

There are a number of reasons to stake your tokens. For example, staking can generate passive income, help secure the network, and promote decentralization. Staking can also provide a way to contribute to the ecosystem and earn rewards.

How Does It Work?

To stake your tokens, you first need to create a staking wallet. This is a wallet that holds the private keys for your tokens and allows you to stake them. You can then create a staking contract and lock up your tokens in it. The contract will automatically distribute rewards to you based on the amount of tokens locked up.

How Can I Stake My Tokens?

There are a number of ways to stake your tokens. You can use a staking wallet, a staking contract, or a staking platform.

Staking Wallets

Staking wallets allow you to easily stake your tokens. They are similar to regular wallets, but they hold the private keys for your tokens. You can use a staking wallet to stake your tokens with any cryptocurrency.

Staking Contracts

Staking contracts allow you to easily stake your tokens with minimal effort. They are similar to regular contracts, but they hold the private keys for your tokens. You can use a staking contract to stake your tokens with any cryptocurrency.

Staking Platforms

Staking platforms allow you to easily stake your tokens with minimal effort. They are similar to regular platforms, but they hold the private keys for your tokens. You can use a staking platform to stake your tokens with any cryptocurrency.

Crypto loans are a new way to get involved in the cryptocurrency world. These loans are offered by various platforms and can be used to purchase cryptocurrencies, as well as to fund other cryptocurrency-related expenses.

Some potential benefits of crypto loans include the following:

They are fast and easy to obtain: Many crypto loans are available immediately, without the need for a long application process.

Many crypto loans are available immediately, without the need for a long application process. They are accessible to a wider range of people: Crypto loans are available to anyone, regardless of their financial history or credit rating.

Crypto loans are available to anyone, regardless of their financial history or credit rating. They are affordable: Unlike traditional loans, which can be expensive to borrow, crypto loans are often very affordable.

Unlike traditional loans, which can be expensive to borrow, crypto loans are often very affordable. They offer flexibility: Crypto loans offer the flexibility to use the money in any way you want, without having to worry about collateral or overdrafts.

While crypto loans offer many benefits, they do have some potential drawbacks as well. For example, crypto loans are not insured, so if something goes wrong with the loan, you may not be able to get help from the platform. Additionally, crypto loans are not legal tender, so you cannot use them to pay for goods and services. Finally, crypto loans are not guaranteed, so you could lose all of your money if the platform folds.

Overall, crypto loans offer an interesting alternative to traditional investments such as staking. They are fast and easy to obtain, and offer a great deal of flexibility and affordability. However, they should only be used in conjunction with caution, as there is a risk that they may not be safe or profitable.

Cryptocurrency staking is a way for holders of cryptocurrencies to earn rewards, or “stake,” for holding the coins. The reward is in the form of new coins generated by the cryptocurrency’s blockchain network.

The process of staking works like this: When a holder of a cryptocurrency wants to earn rewards, they deposit their coins into a “staking pool.” The staking pool then divides the deposited coins among all its members based on their relative stake in the pool. The member with the biggest stake in the pool earns the rewards.

Cryptocurrency loans are similar to staking pools in that they allow holders of cryptocurrencies to loan their coins out to other users. The difference is that cryptocurrency loans do not generate rewards for the lender. Instead, the loaned coins are used to finance the borrowing user’s various expenses.

Crypto loans are a newer form of lending that uses cryptocurrency as the collateral. With crypto loans, you borrow cryptocurrency from a lender and then you have to pay back the loan with interest. The difference between staking and crypto loans is that staking is when you have a Coinbase account and you lock your coins up in a stake. This means that you are lending your coins to the network and you are hoping for a return. With crypto loans, you are borrowing the cryptocurrency and you are not actually holding the coins.

There is no single answer to this question as it depends on your specific needs and goals. Some people may prefer staking as it offers a more passive income stream, while others may prefer using crypto loans to build a more immediate financial return. Ultimately, the best solution for you will depend on your specific needs and goals.

There are a few key benefits to choosing to stake over taking a crypto loan.

First and foremost, staking allows users to have a more permanent hold on their coins, as opposed to loans that can be taken out and then repaid. This can be important for those who don’t want to risk their coins being lost if the loan is not repaid on time.

Another key benefit of staking is that it allows users to earn interest on their coins. This can be a great way to make extra money, as long as the coin is held in a wallet that offers staking rewards.

Finally, staking can help increase the security of a coin. By holding onto coins in a staking wallet, users are helping to ensure that the coin is not easily stolen or destroyed.

There are a few key risks when deciding to stake vs. borrow for cryptocurrency:

1. The risk of not being able to repay the loan. If you cannot repay the loan, you may lose your stake in the blockchain.

2. The risk of not being able to get your money back from the lender. If the lender decides to stop lending, you may not be able to get your money back.

3. The risk of the cryptocurrency not being worth anything at the end of the loan. If the value of the cryptocurrency falls, you may not be able to repay the loan.

4. The risk of the cryptocurrency price going up and you not being able to repay the loan. If the cryptocurrency price goes up, the value of the loan may also go up, but you may still not be able to repay it.

While it is difficult to predict the future of staking and crypto loans, it is likely that this type of investing will become more popular in the future. In particular, blockchain technology is likely to continue to grow in popularity, which could lead to an increase in demand for staking and crypto loans. Additionally, there is potential for these products to become more mainstream as more investors become familiar with them.

When it comes to cryptocurrency, there are a few different ways to make money. One option is to simply hold onto your cryptocurrencies and hope that they appreciate in value. This is called “staking”.

Another option is to borrow cryptocurrencies and then hope that the value of the cryptocurrency increases enough to pay back the loan. This is called “crypto lending”.

There are pros and cons to both staking and crypto lending.

Pros of Staking

One pro of staking is that you can earn interest on your holdings. This can be useful if you plan to hold onto your cryptocurrencies for a long period of time.

Another pro of staking is that you don’t need to worry about the price of the cryptocurrency going down. If the price of the cryptocurrency goes down, your stake will still be worth something.

Cons of Staking

One con of staking is that you may not be able to sell your stake in the event that you want to move on to another investment.

Another con of staking is that if the price of the cryptocurrency goes up, your stake may not be worth as much as it was before.

Pros of Crypto Loans

One pro of crypto lending is that you can earn a significant return on your investment. This can be useful if you plan to borrow a large amount of cryptocurrency.

Another pro of crypto lending is that you don’t need to worry about the price of the cryptocurrency going down. If the price of the cryptocurrency goes down, your loan will still be worth something.

Cons of Crypto Loans

One con of crypto lending is that you may not be able to sell your loan in the event that you want to move on to another investment.

Another con of crypto lending is that if the price of the cryptocurrency goes up, your loan may not be worth as much as it was before.

There is no one-size-fits-all answer to this question, as the best way to invest in cryptocurrency depends on your specific financial situation and goals. However, some experts believe that staking (holding a cryptocurrency in order to earn rewards) is more secure than taking out crypto loans.

Some reasons why staking may be more secure than taking out crypto loans include:

A stake in a cryptocurrency is always guaranteed, even if the coin's value drops. This is not the case with crypto loans, where the lender's interest can fluctuate based on the market conditions.

Staking also requires a minimum investment, whereas taking out a crypto loan requires only a small down payment. This means that there is less of an opportunity for a crypto loan to become completely worthless if the market crashes.

Finally, staking rewards are usually higher than those offered by most crypto loans. This means that, over time, holders of a stake in a cryptocurrency will usually come out ahead financially than those who take out a loan.

There are pros and cons to both staking and crypto loans.

Pros of Staking

1. Higher returns. With a staking strategy, you can expect to earn higher returns than with a crypto loan strategy. This is because staking rewards your coin holdings with extra returns, while a crypto loan simply pays you back the principal plus interest.

2. Greater security. With a staking strategy, your coins are locked up in a secure wallet until they are either claimed by the staker or redeemed by the network. This protects your investment from theft or loss.

3. Reduced risk. Since your coins are not exposed to market volatility, you are less likely to lose money if the value of your coins falls.

4. Reduced fees. Since staking rewards you for holding coins rather than lending them out, you will typically pay lower fees than when using a crypto loan.

5. Easier to track your portfolio. Since staking requires you to keep track of your individual holdings, it is easier than using a crypto loan to monitor your overall portfolio position and performance.

6. More control over your investments. With a staking strategy, you have more control over your investments than when using a crypto loan. You can choose which coins to stake and how much you are willing to risk.

7. Fewer coin requirements. With a staking strategy, you do not need as many coins to participate in the network. This means you can join the network even if you do not have a large number of coins.

8. Reduced risks associated with altcoins. With a staking strategy, you are less likely to lose money if the value of your altcoins falls. This is because your coins are locked up in a secure wallet and are not exposed to market volatility.

9. Greater flexibility. With a staking strategy, you can join and leave the network at any time without losing your rewards. This is useful if you want to temporarily suspend your participation in the network or if the price of your chosen coin falls below your desired level of investment.

10. Increased security. By locking up your coins in a secure wallet, you increase your security against theft or loss.

Cons of Staking

1. Lower returns. Unlike with a crypto loan, staking rewards you with lower returns than you would earn if you simply deposited your coins into the network.

2. Greater risk. With a staking strategy, you are more likely to lose money if the value of your coins falls.

3. Reduced flexibility. Unlike with a crypto loan, staking does not allow you to join and leave the network at any time without losing your rewards. This can be limiting if you need to temporarily suspend your participation in the network or if the price of your chosen coin falls below your desired investment level.

4. Larger initial investment requirement. To participate in a staking strategy, you will typically need to invest a larger amount of money than when using a crypto loan.

5. More complex setup process. To participate in a staking strategy, you will need to set up a dedicated wallet and track your individual holdings. This can be more complex than using a crypto loan strategy, which requires only that you deposit your coins into the network.

6. Less flexibility. Unlike with a crypto loan, staking does not allow you to borrow coins from the network. This can be limiting if you need to use coins that are not currently available on the network.