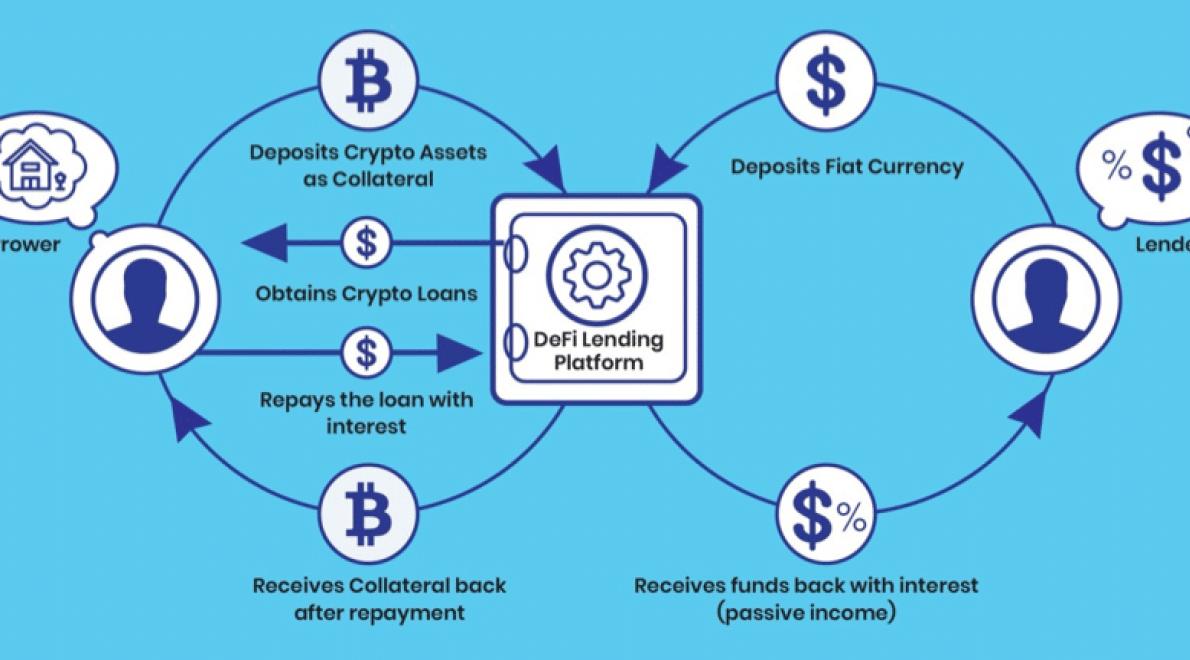

Cryptocurrency loans are becoming more popular as a way to earn interest on your digital assets. Lenders can earn up to 8% annual interest on their crypto deposits, while borrowers can get loans in fiat or cryptocurrency with terms ranging from one week to one year. P2P crypto loans platforms like Nexo and Celsius Network have built up large user bases and offer attractive rates for both lenders and borrowers. However, there are also a number of risks to be aware of before taking out a crypto loan. In this article, we'll take a look at some of the things you need to know about P2P crypto loans.

One way to use peer-to-peer crypto loans to your advantage is to invest in a cryptocurrency that is expected to experience a surge in value. By investing in a cryptocurrency that is expected to experience a surge in value, you are essentially borrowing money from other investors and using the cryptocurrency as collateral. If the value of the cryptocurrency increases, you will be able to repay your loan with a gain. Conversely, if the value of the cryptocurrency decreases, you will be able to repay your loan with a loss.

There are several benefits to taking out a peer-to-peer crypto loan. First and foremost, crypto loans are fast and easy to process. Secondly, crypto loans offer borrowers a high degree of security due to the decentralized nature of crypto lending platforms. Finally, crypto loans offer low interest rates, making them an attractive option for borrowers.

There is no one-size-fits-all answer to this question, as the best peer-to-peer crypto loan for you will depend on your specific needs and preferences. However, some tips on how to find the best P2P crypto loan for you include doing your research, asking around, and checking ratings and reviews.

There are a few risks associated with peer-to-peer crypto loans. The first is that the borrower may not be able to repay the loan in a timely manner, leading to financial difficulty. The second is that borrowers may not be able to understand or properly use the cryptocurrency they are borrowing, which could lead to losses. Finally, there is the risk of fraud, in which a lender may not actually have the cryptocurrency they claim to have lent, or may try to take advantage of borrowers in other ways.

When considering a peer-to-peer crypto loan, it's important to look for certain factors. The first is the lending platform itself. Look for a platform that has a good reputation and is well-established. Additionally, make sure the platform is easy to use and has clear terms and conditions.

Another important factor to consider is the loan amount. It's important to find a loan that fits your needs. For example, if you need a small amount of money, a smaller loan may be better. Conversely, if you have a lot of money to borrow, a larger loan may be more appropriate.

Finally, make sure the loan is secured by cryptocurrency. This means the loan cannot be defaulted on unless the borrower pays back the entire amount of the loan in cryptocurrency. This is important because it ensures that the loan cannot be taken advantage of by third parties.

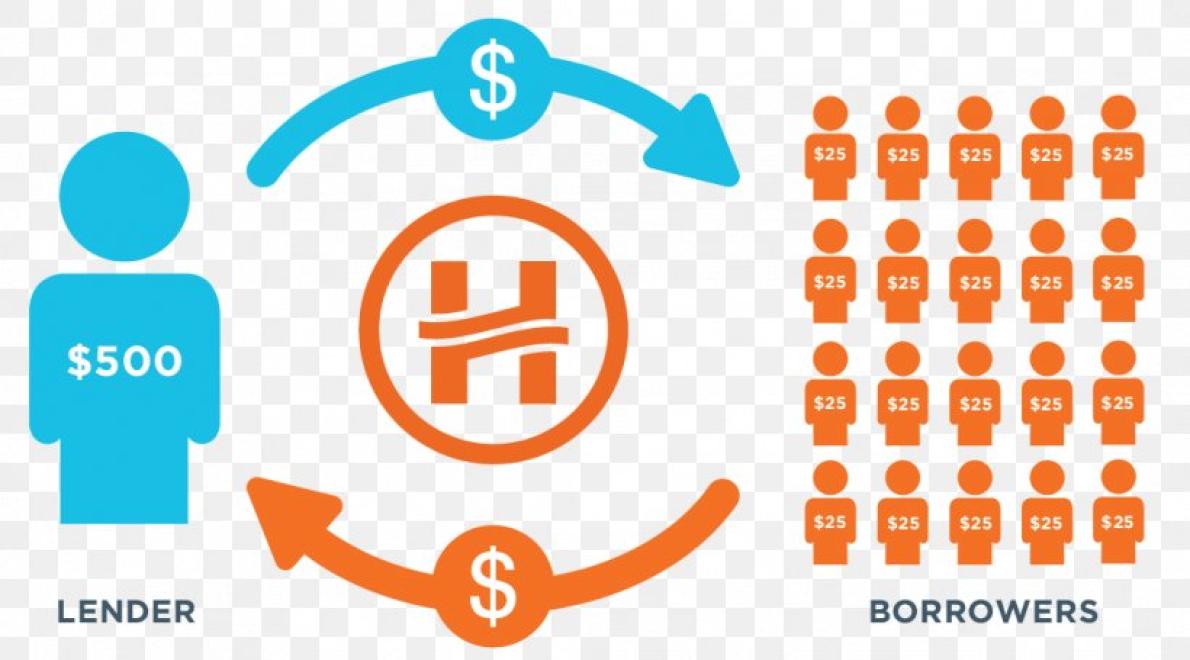

There are a few pros and cons to peer-to-peer crypto loans. On the pro side, they allow borrowers and lenders to connect directly without the need for a third party. This can be helpful if you need quick cash or if you trust the other person involved in the loan.

The con side of peer-to-peer crypto loans is that they are more risky than traditional loans. Since there is no middleman, there is no insurance or backup plan in case something goes wrong. If the borrower cannot repay the loan, the lender could lose everything they invested.

Peer-to-peer loans are a great way to make money online. All you need is a peer-to-peer lending platform and an active loan.

1. Choose a peer-to-peer lending platform

There are a number of peer-to-peer lending platforms available online. You can find a list of popular platforms here.

2. Register for an account

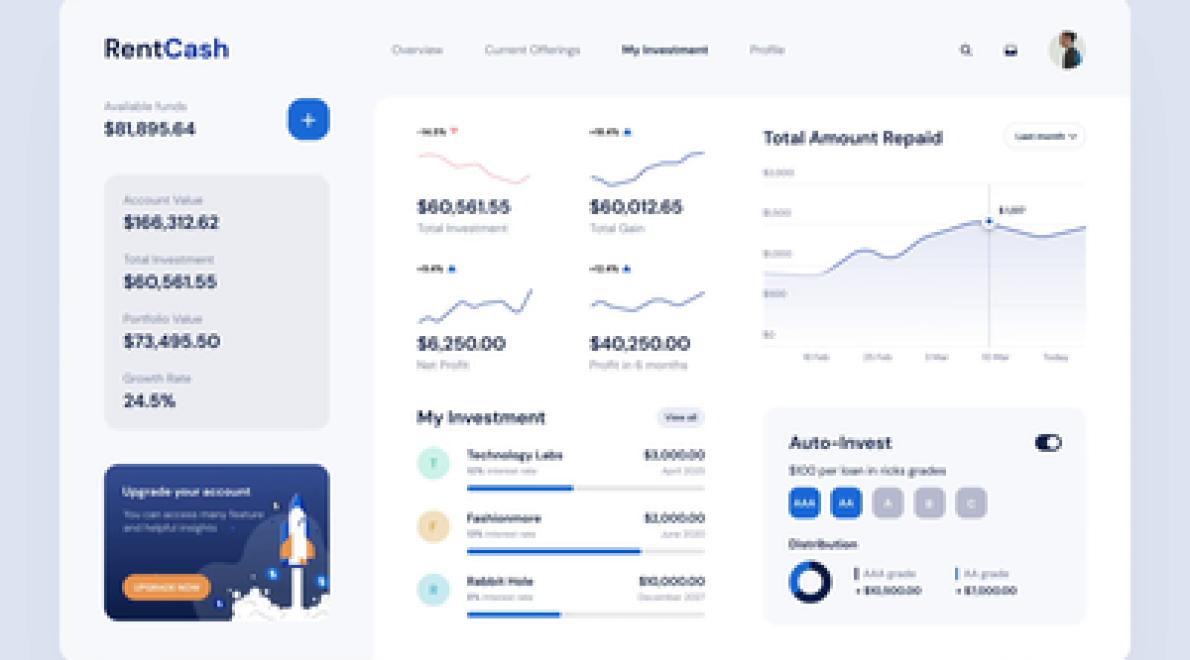

Once you have chosen a peer-to-peer lending platform, you need to register for an account. This will allow you to view and manage your loans.

3. View your loans

Once you have registered for an account, you can view your loans. You will need to enter the details of your loan, such as the amount of money you want to borrow and the interest rate.

4. Make a loan

Once you have viewed your loans and decided which one you want to make a loan to, you can make a loan. You will need to enter the details of the loan, such as the amount of money you want to borrow and the interest rate.

5. Repay your loan

Once you have made a loan, you need to repay it. You can do this by transferring the money you borrowed from the peer-to-peer lending platform to the bank account of the person you borrowed the money from.