The Crypto Loans Tax is a proposed tax on loans made in cryptocurrencies. The tax would be levied on the interest earned on such loans. The proposal has been made by the European Commission, and is currently under consideration by the European Parliament.

Crypto loans are becoming increasingly popular as an investment option. However, before you invest, you should be aware of the tax implications.

Crypto Loans and Taxes

When you receive a loan in cryptocurrency, the IRS will treat it as taxable income. The same goes for any interest or dividends that you receive on the loan.

If you’re using the crypto loan to purchase a cryptocurrency, then the IRS will consider that to be a sale of the cryptocurrency. This means that you’ll have to report the sale and pay taxes on the profits.

Bear in mind that these rules vary depending on your tax bracket. If you’re in the top tax bracket, you could be liable for up to 30% of the profits from the sale of the cryptocurrency. If you’re in the lower tax bracket, you might only have to pay taxes on a fraction of the profits.

So, make sure you explore all your options before investing in a crypto loan. You don’t want to end up paying taxes on profits you never expected to make.

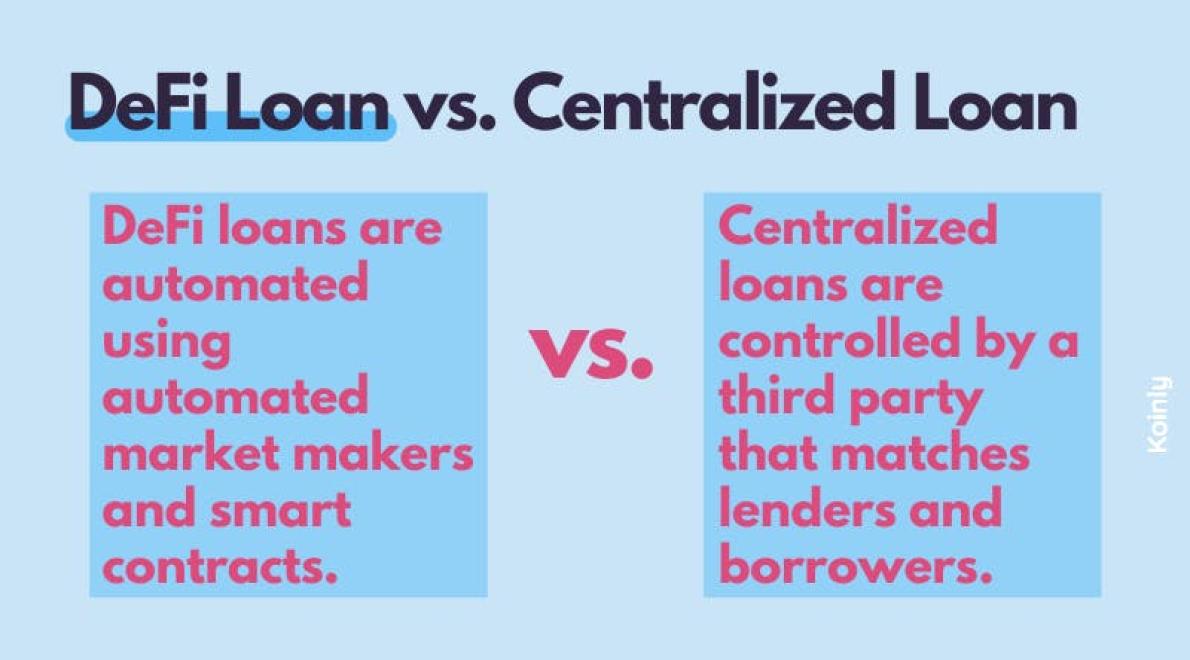

Crypto loans are a type of lending that uses blockchain technology to secure the loan. Crypto loans are also known as cryptocurrency loans, cryptocurrency lending, and blockchain lending.

Crypto loans are a type of lending that uses blockchain technology to secure the loan. Crypto loans are also known as cryptocurrency loans, cryptocurrency lending, and blockchain lending.

Crypto loans are a type of lending that uses blockchain technology to secure the loan. Crypto loans are also known as cryptocurrency loans, cryptocurrency lending, and blockchain lending.

Crypto loans are a type of lending that uses blockchain technology to secure the loan. Crypto loans are also known as cryptocurrency loans, cryptocurrency lending, and blockchain lending.

Crypto loans are a type of lending that uses blockchain technology to secure the loan. Crypto loans are also known as cryptocurrency loans, cryptocurrency lending, and blockchain lending.

Crypto loans are a type of lending that uses blockchain technology to secure the loan. Crypto loans are also known as cryptocurrency loans, cryptocurrency lending, and blockchain lending.

Crypto loans are a type of lending that uses blockchain technology to secure the loan. Crypto loans are also known as cryptocurrency loans, cryptocurrency lending, and blockchain lending.

Crypto loans are a type of lending that uses blockchain technology to secure the loan. Crypto loans are also known as cryptocurrency loans, cryptocurrency lending, and blockchain lending.

Crypto loans are a type of lending that uses blockchain technology to secure the loan. Crypto loans are also known as cryptocurrency loans, cryptocurrency lending, and blockchain lending.

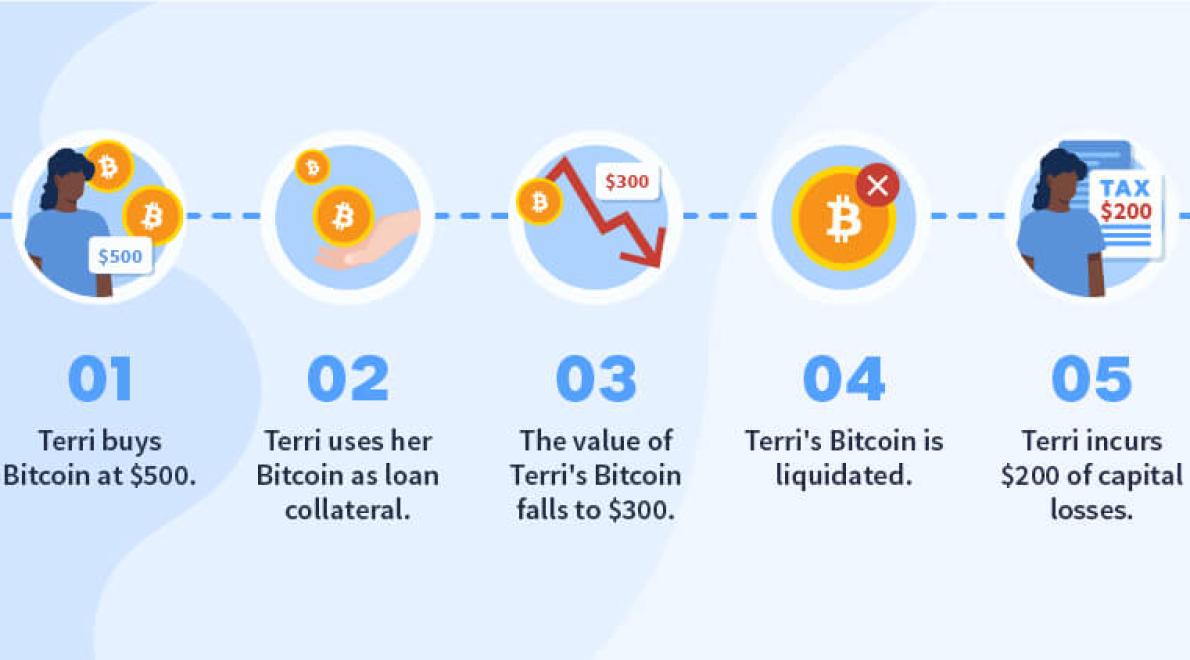

Crypto loans are a new and controversial form of financial assistance. They allow people to borrow money in the form of cryptocurrencies, rather than traditional loans. The tax implications of taking out a crypto loan depend on the specifics of the loan, but in general, crypto loans are treated as taxable income.

For example, if you borrow $10,000 in cryptocurrency and you pay back the loan in full within a year, the $10,000 would be considered taxable income. If you fail to repay the loan, or if the loan is converted to traditional currency before you repay it, the $10,000 would be considered taxable income and you would likely owe capital gains taxes on it.

Crypto loans are not without their risks, and it is important to research the specific loan before taking it out. If you are considering taking out a crypto loan, be sure to speak to a tax specialist to get advice on the best way to handle the tax implications.

When you take out a crypto loan, you are essentially borrowing money against your cryptocurrency holdings. This means that your taxable income will be impacted in the same way as any other loan. For example, if you borrow $10,000 worth of Bitcoin, your taxable income for the year would be $10,000.

There is no definitive answer, as the tax treatment of cryptocurrency loans varies from country to country. In some cases, such as in the United States, cryptocurrency loans are considered taxable income. Other countries, such as China, may not consider them taxable at all. Ultimately, it depends on the laws of the specific country in question.

There are a few different types of taxes that you may have to pay when taking out a crypto loan. These include federal, state, and local taxes. It is important to consult with a tax professional to determine which taxes apply to you and to figure out the best way to pay them.

There is no definitive answer to this question, as the tax code is complex and varies from country to country. Generally speaking, you would need to consult with a tax specialist in order to determine whether you are able to deduct interest paid on a crypto loan from your taxes.

There is no definitive answer to this question since crypto loan taxes vary depending on the country in which you reside. However, in most cases, you will likely owe taxes on any crypto loan proceeds you receive.

The answer to this question depends on the jurisdiction in which you reside. In some cases, you may have to pay taxes on a crypto loan as soon as you receive it. In others, you may have to wait until you sell the crypto loaned amount back to a digital currency.

If you do not pay taxes on a crypto loan, the IRS may consider the loan to be a taxable event. In this case, you may have to pay taxes on the interest, the principal, and possibly penalties.

When you take out a crypto loan, you may be wondering what to do about your taxes. Cryptocurrencies are not considered taxable assets for federal income tax purposes, but they may be subject to state and local taxes.

If you are a U.S. taxpayer, you should consult with a tax professional to determine your specific tax obligations. In general, however, you will likely have to report any income you earn from your crypto loan on your tax return. You will also likely have to pay taxes on the interest you receive on your loan.