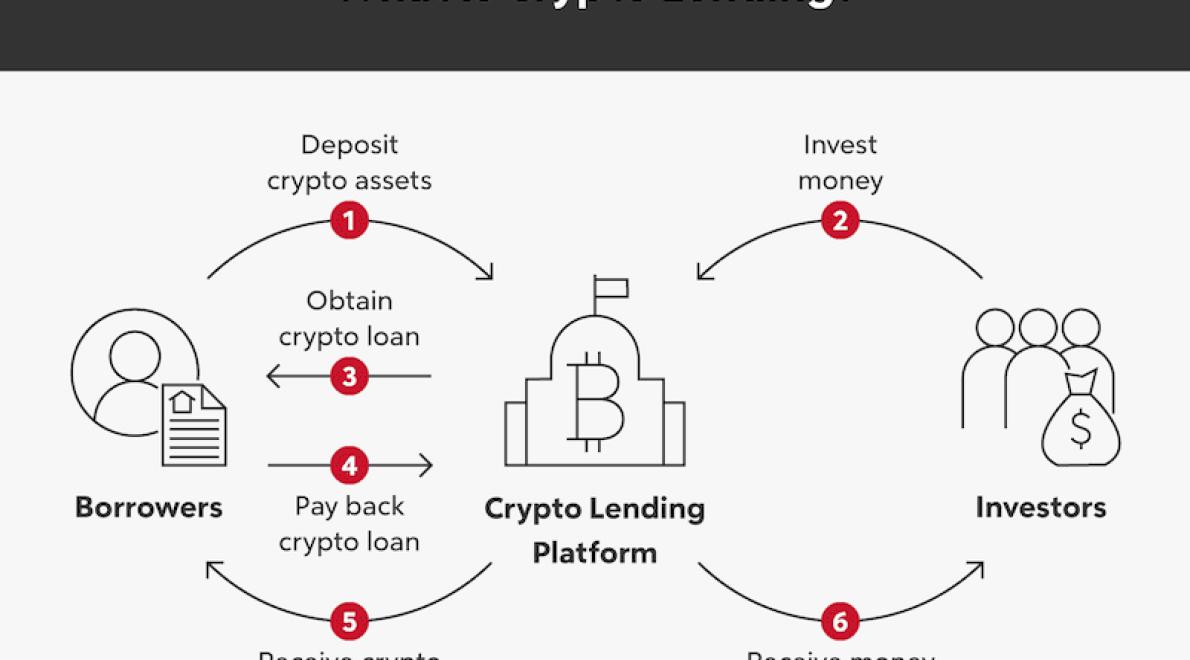

Crypto Back Loans is a new way to get a loan using your cryptocurrency as collateral. With this type of loan, you can borrow against your crypto assets without having to sell them. This means that you can keep your investment while still getting the funds you need.

Crypto loans are becoming more and more popular, as they offer a number of benefits over traditional loans. For example, you don’t have to sell your assets in order to get a crypto loan, and there is usually no interest involved. However, there are a few things to keep in mind if you want to borrow cryptocurrency without selling your assets.

First, you will need to have some cryptocurrency to borrow. Second, you will need to have an account with a crypto lending platform. Finally, you will need to provide your credit score and other relevant information.

Once you have all of the necessary information, you can submit an application for a crypto loan. Depending on the platform you choose, the application process may be easy or difficult, but it should be straightforward overall. Once you have been approved for a loan, you will need to provide the lender with the cryptocurrency you wish to borrow and any other relevant information. In most cases, the lender will then transfer the cryptocurrency to your account.

There is no one-size-fits-all answer to this question, as the best way to obtain a loan using cryptocurrency as collateral will vary depending on the individual circumstances of each case. However, some tips on how to approach this process may include:

1. Find an accredited lender. Lenders that are accredited by the National Credit Union Administration (NCUA) or the Federal Deposit Insurance Corporation (FDIC) are typically more reliable and safe than unaccredited lenders, and they typically offer better rates and terms on loans.

2. Research the available cryptocurrency lending options. There are a number of online platforms that offer loans backed by cryptocurrencies, and it may be helpful to compare the different terms and rates available before making a decision.

3. Secure a digital asset insurance policy. It is important to ensure that you have adequate insurance coverage in case of a loss in your cryptocurrency portfolio, and this may include purchasing a digital asset insurance policy from a reputable provider.

4. Review the terms and conditions of the loan agreement carefully. It is important to understand all of the terms and conditions of the loan before signing on the dotted line.

5. Have a financial advisor review the loan agreement. A financial advisor can help you understand the risks involved with the loan and make sure that the terms are fair and reasonable.

There is no one-size-fits-all answer to this question, as the best way to get a loan backed by cryptocurrency may vary depending on your individual circumstances. However, some methods you may want to explore include:

Using a cryptocurrency lending platform.

Finding a lender who is willing to work with cryptocurrency.

Obtaining a loan from a traditional financial institution.

Contacting a cryptocurrency investment firm that specializes in this type of financing.

There are many benefits to getting a loan backed by cryptocurrency. Some of the benefits include:

1. Security: Loans backed by cryptocurrency are more secure than traditional loans. This is because cryptocurrency is not subject to the same risks as traditional currencies.

2. Low interest rates: Because cryptocurrency is a new and innovative form of currency, banks usually offer lower interest rates for loans backed by it. This is because there is little risk associated with lending money to someone who uses cryptocurrency.

3. Faster processing time: The processing time for a loan backed by cryptocurrency is usually much faster than for a traditional loan. This is because there is no need to go through the traditional lending process.

4. Increased flexibility: Loans backed by cryptocurrency are more flexible than traditional loans. This is because they allow you to borrow money in any amount you need and at any time.

5. Reduced risk of defaults: Loans backed by cryptocurrency are considered to be much less risky than traditional loans. This is because there is little chance of defaulting on them.

There are a few risks associated with getting a loan backed by cryptocurrency. One is that the value of the cryptocurrency may decline, rendering the loan worthless. Another risk is that the cryptocurrency may not be accepted as a valid form of payment, meaning the borrower may not be able to repay the loan. Additionally, if the cryptocurrency issuer goes bankrupt, the loans may become worthless as well.

There is no one-size-fits-all answer to this question, as the best crypto loan for you will depend on your individual circumstances. However, some tips on how to find the best crypto loan for you include doing your research, speaking to a financial advisor, and checking out online reviews.

A crypto loan is a type of loan that is based on blockchain technology. This type of loan allows borrowers to access funds without having to go through a traditional lending institution.

A regular loan is a type of loan that is based on traditional banking systems. This type of loan allows borrowers to access funds from a variety of lenders.

Cryptocurrency loans are a great way to get started in the world of cryptocurrency, but there are a few things you should consider before you decide to take out a loan.

1. Understand the risks

Cryptocurrency loans are not without risk. Before you decide to take out a loan, be sure to understand the risks involved.

2. Consider your financial situation

Before you take out a loan, make sure you have a good understanding of your financial situation. Your credit score and other factors will affect your chances of getting a loan.

3. Understand the terms of the loan

Before you take out a loan, make sure you understand the terms of the loan. Be sure to read the loan agreement carefully to understand all of the risks and rewards associated with it.

4. Have a backup plan

If something goes wrong with the loan, have a backup plan ready. Have enough money saved up to cover the costs of the loan and any associated fees.

Crypto loans can be repaid in a variety of ways. One option is to sell the cryptocurrency back to the lender. Another option is to wait until the loan is repaid and then sell the cryptocurrency.

There are many benefits and drawbacks to getting a crypto loan. Some of the benefits include the ability to access funds quickly and easily, the lack of traditional lending requirements, and the potential for high returns.

However, there are also some potential risks associated with crypto loans, such as the possibility of not being able to repay the loan in a timely manner, being exposed to volatility and risk, and losing money if the value of the cryptocurrency drops. It is important to carefully consider all the factors before getting a crypto loan, in order to make the best decision for your needs.

There are a few alternatives to getting a crypto loan. One option is to invest in a crypto-related project. Another option is to get a loan from a traditional financial institution.

Crypto loans are a great option for people who want to get access to cryptocurrencies but don't have the money to do so upfront. You can borrow cryptocurrencies from a crypto loan provider and then use them to purchase cryptocurrencies or other cryptocurrency-related assets.