Crypto collateralized loans are a type of loan where the borrower puts up cryptocurrency as collateral. This can be seen as a way to get a loan without having to sell your crypto, and can be a good option if you think the value of your crypto will go up in the future. There are a few things to keep in mind with this type of loan, such as the fact that you could end up owing more than what you borrowed if the value of your crypto goes down.

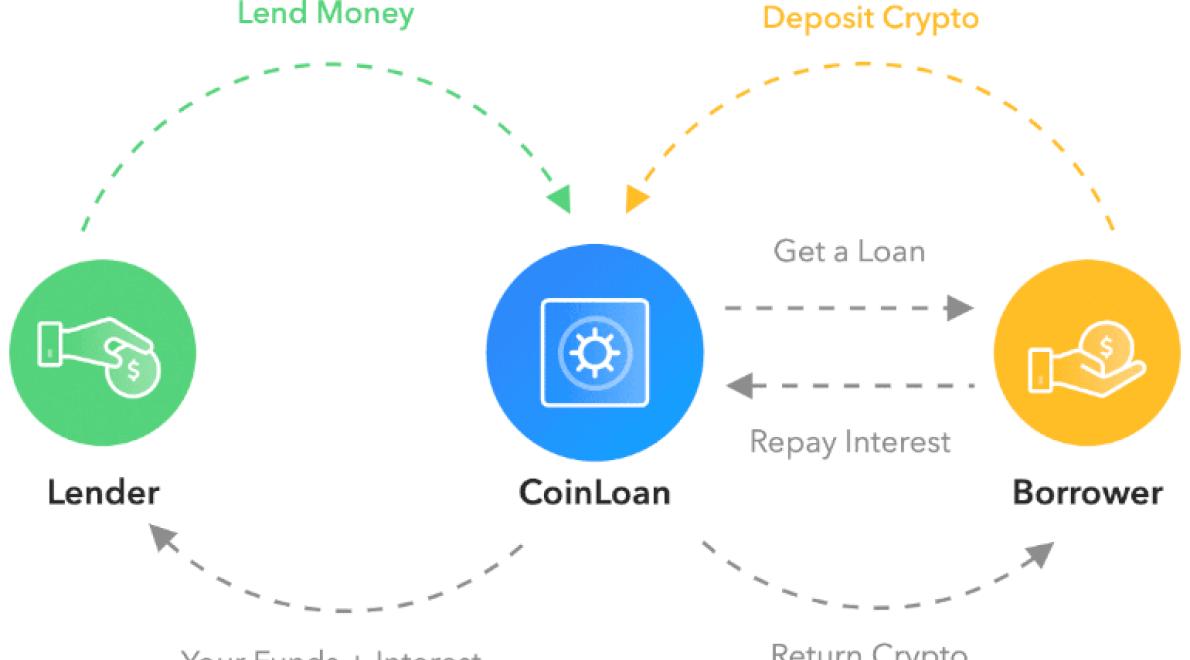

Crypto collateralized loans work in a similar way to traditional loans, except that the loans are secured by crypto assets. This means that the borrowers can use their assets to secure the loan, and in return, the lenders can earn interest on the underlying assets.

There are several benefits to using crypto collateralized loans. First, they provide borrowers with a secure way to borrow money. Second, they allow lenders to earn interest on the underlying assets, which can be a profitable investment. Third, they create a new financial product that can help to revolutionize the lending industry.

Crypto collateralized loans are still in their early stages, and there is still a lot of room for improvement. However, they could be a major player in the lending market, and they could have a big impact on the economy as a whole.

Crypto collateralized loans offer a number of benefits that should be considered when evaluating the option.

First and foremost, crypto collateralized loans offer a more secure way to borrow money. Since the loan is backed by cryptocurrency, there is less chance of the loan being defaulted on. Additionally, since the collateral is in digital form, it is much more difficult for the lender to confiscate or steal the collateral.

Crypto collateralized loans also offer a cheaper way to borrow money. Since the collateral is in digital form, there is no need to pay interest on the loan. This can save borrowers a lot of money over time.

Finally, crypto collateralized loans offer a more secure way to invest money. Since the collateral is in digital form, there is little chance of the investment losing value. This makes crypto collateralized loans a great option for investors who want to minimize their risk.

Crypto collateralized loans are a new type of loan that uses digital assets as collateral. The borrower uses the digital assets to secure the loan, and the lender uses the digital assets to collateralize the loan.

Crypto collateralized loans have many benefits, but they also have some risks. One risk is that the value of the digital assets could decline, which would reduce the value of the loan and could lead to default. Another risk is that the borrower could not repay the loan, which would lead to loss of the digital assets as collateral.

There are a few different types of crypto collateralized loans. These include:

1. Crypto Collateralized Loan - A crypto collateralized loan is a type of loan that uses cryptocurrency as collateral.

2. Ethereum-Based Collateralized Loan - A Ethereum-based collateralized loan is a type of loan that uses Ethereum as collateral.

3. Bitcoin-Based Collateralized Loan - A Bitcoin-based collateralized loan is a type of loan that uses Bitcoin as collateral.

4. Ripple-Based Collateralized Loan - A Ripple-based collateralized loan is a type of loan that uses Ripple as collateral.

5. Lending Club - Lending Club is a peer-to-peer lending platform that uses collateralized loans as one of its core products.

There are a few things to look for when choosing a crypto collateralized loan.

The first is the lending platform’s reputation. Make sure the platform is reputable and has a good track record of providing quality loans.

The second is the loan’s terms. Review the loan terms carefully to make sure they are in line with your needs and expectations.

The third is the loan’s collateral. Look for a loan that offers high-quality crypto collateral. This will help ensure that you receive the most favorable terms possible.

There is no one-size-fits-all answer to this question, as the best way to get the best rates on crypto collateralized loans will vary depending on the specific conditions of the loan. However, some tips on how to get the best rates on crypto collateralized loans include researching the available options and finding a lender with a good reputation. Additionally, borrowers should make sure to provide accurate information about their assets and credit scores when applying for a loan, as this will help lenders determine whether they are a good fit for the loan.

Crypto collateralized loans are a new kind of loan that uses cryptocurrency as collateral. The borrower can use the cryptocurrency to pay back the loan, and the lender can use the cryptocurrency to earn interest on the loan.

The pros of using crypto collateralized loans are that they are fast and easy to process. The borrower can quickly access the cryptocurrency to pay back the loan, and the lender can easily earn interest on the loan.

The cons of using crypto collateralized loans are that they are risky. If the value of the cryptocurrency falls, the borrower may not be able to repay the loan, and the lender may lose money on the loan.

Crypto collateralized loans are a great way to get a loan in cryptocurrency, but only if you’re sure you can repay it. If you can’t, you may end up defaulting on the loan, which could have negative consequences for your cryptocurrency holdings. Before taking out a crypto collateralized loan, be sure to do your research and weigh the pros and cons carefully.