Cryptocurrencies have become a popular investment over the past few years, and as a result, there has been an increase in the number of people looking for ways to borrow against their digital assets. One option that has emerged is non collateralized crypto loans, which allow borrowers to put up their cryptocurrency as collateral for a loan. These loans can be used for a variety of purposes, including investing in other cryptocurrencies, paying off debt, or funding a business venture. While they can be a useful tool, it is important to understand the risks involved before taking out a non collateralized crypto loan.

Cryptocurrencies are not collateralized, which means that there is no physical asset that can be seized in the event of a default. This makes them risky for lenders, as there is no way to ensure that the borrower will be able to repay the loan.

One way to get around this risk is to seek a non-collateralized crypto loan. This type of loan does not rely on any physical assets, so the lender is not as concerned about the borrower's ability to repay.

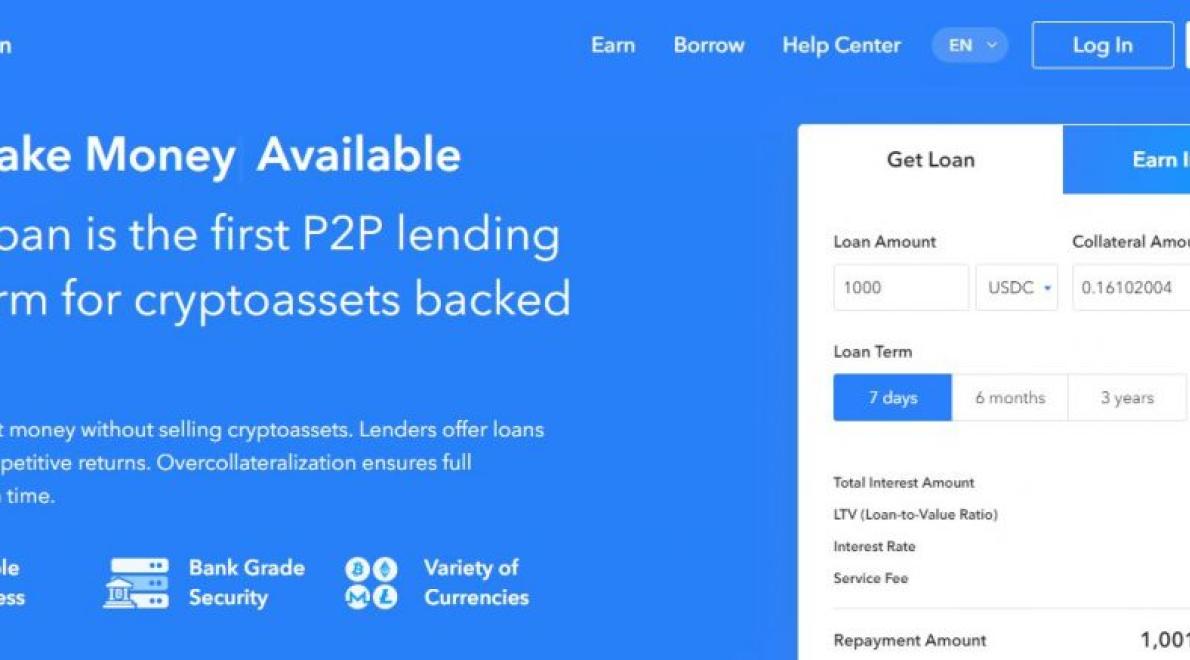

To find a non-collateralized crypto loan, you will need to look for lenders who specialise in this type of financing. You can also try online platforms like lendingblock.com or lendingtree.com. These platforms allow you to search for lenders who offer crypto loans and compare notes with other borrowers.

Be sure to research the terms and conditions of any potential loan before signing up. Make sure you understand the risks involved and what you may need to do in the event of a default.

Cryptocurrencies are known for their volatility, which can make it difficult for people to get loans in fiat currency. However, there are some benefits to using non-collateralized crypto loans instead of traditional loans.

Non-collateralized crypto loans are more affordable. Instead of having to put up collateral, borrowers can use cryptocurrency as the collateral. This means that the loan is much cheaper than a traditional loan, and there is no need to pay interest.

Non-collateralized crypto loans are easier to get. Because there is no collateral, lenders don’t have to go through the hassle of verifying your credit score. This makes it easier for people to get a loan, regardless of their credit history.

Non-collateralized crypto loans are more secure. Because cryptocurrency is not backed by anything physical, it is considered more secure than traditional loans. This means that you won’t have to worry about your lender stealing your money or defaulting on the loan.

Overall, using non-collateralized crypto loans is a great way to improve your financial situation. They are affordable, easy to get, and secure.

Non-collateralized crypto loans are a high-risk proposition. The borrowers may not be able to repay the loans in a timely manner, and the lenders may lose all or part of their investments.

If you’re looking for a non-collateralized crypto loan, here are the five best options:

1. Bitbond: Bitbond is a global lending platform that offers loans in bitcoin and other cryptocurrencies. Bitbond allows borrowers to choose from a range of loan terms and provides a variety of financial features, such as insurance.

2. BTCJam: BTCJam is a peer-to-peer lending platform that allows users to borrow and lend in bitcoin and other cryptocurrencies. BTCJam provides a wide range of loan terms and features, including insurance.

3. Circle: Circle is a bitcoin company that offers a range of financial products and services, including loans in bitcoin and other cryptocurrencies. Circle allows borrowers to choose from a range of loan terms and features, including insurance.

4. CoinLoan: CoinLoan is a bitcoin-based lending platform that allows borrowers to borrow and lend in bitcoin, litecoin, and other cryptocurrencies. CoinLoan provides a wide range of loan terms and features, including insurance.

5. Kabbage: Kabbage is a bitcoin-based lending platform that allows borrowers to borrow and lend in bitcoin and other cryptocurrencies. Kabbage provides a wide range of loan terms and features, including insurance.

1. BitConnect

2. Airbitz

3. CCN

4. Bitfinex

5. Bittrex

There is no one-size-fits-all answer to this question, as the decision of whether or not to get a non-collateralized crypto loan will vary depending on your individual circumstances. However, some factors to consider when making this decision include:

Your ability to repay the loan.

The riskiness of the crypto market.

The interest rate offered by the lenders.

If you have a good credit score and can repay the loan in a timely manner, then a non-collateralized crypto loan might be a good option for you. However, if the crypto market is risky or the interest rate offered by the lenders is high, then it might not be a good idea to take out a loan in this category.