Cryptocurrency loans are becoming increasingly popular as a way to collateralize digital assets and obtain a loan without having to sell them. This article discusses the benefits and risks of using crypto loans as a way to obtain funding.

Collateralized crypto loans are a new and innovative way to lend money to cryptocurrency holders. The idea is to use a pool of collateralized crypto loans to provide liquidity to the cryptocurrency market.

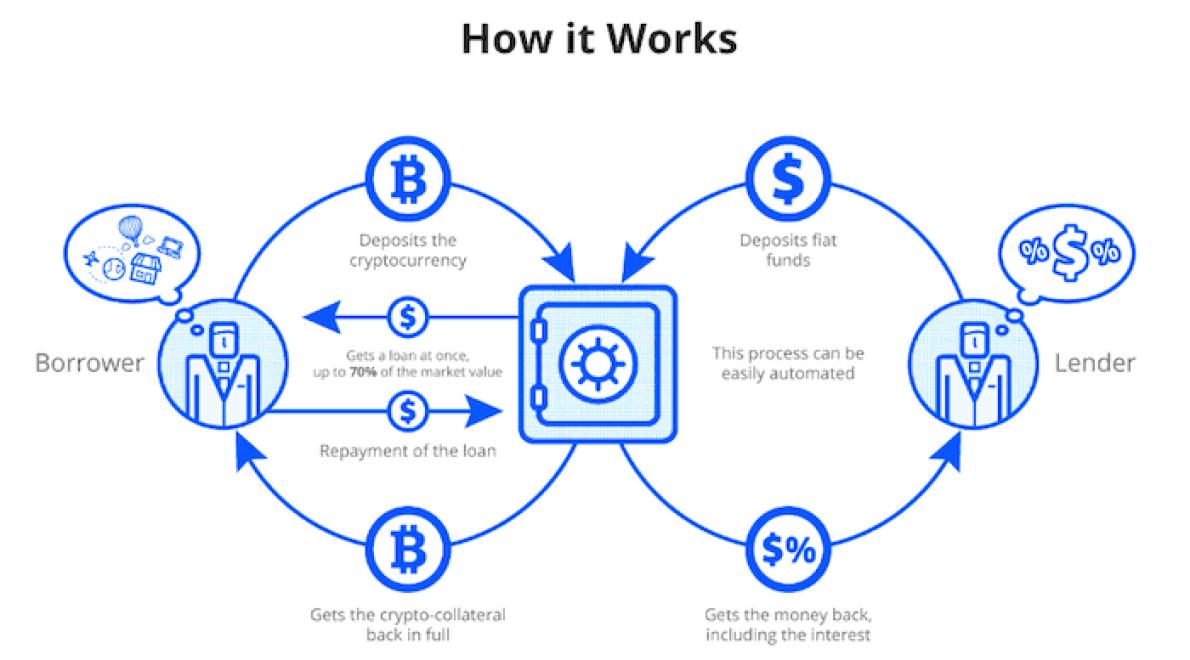

The basic concept is that lenders can borrow money against a set amount of cryptocurrency holdings. The loan can be paid back in either fiat currency or cryptocurrency. The collateralized crypto loans provide an extra layer of security for lenders and help to stabilize the cryptocurrency market.

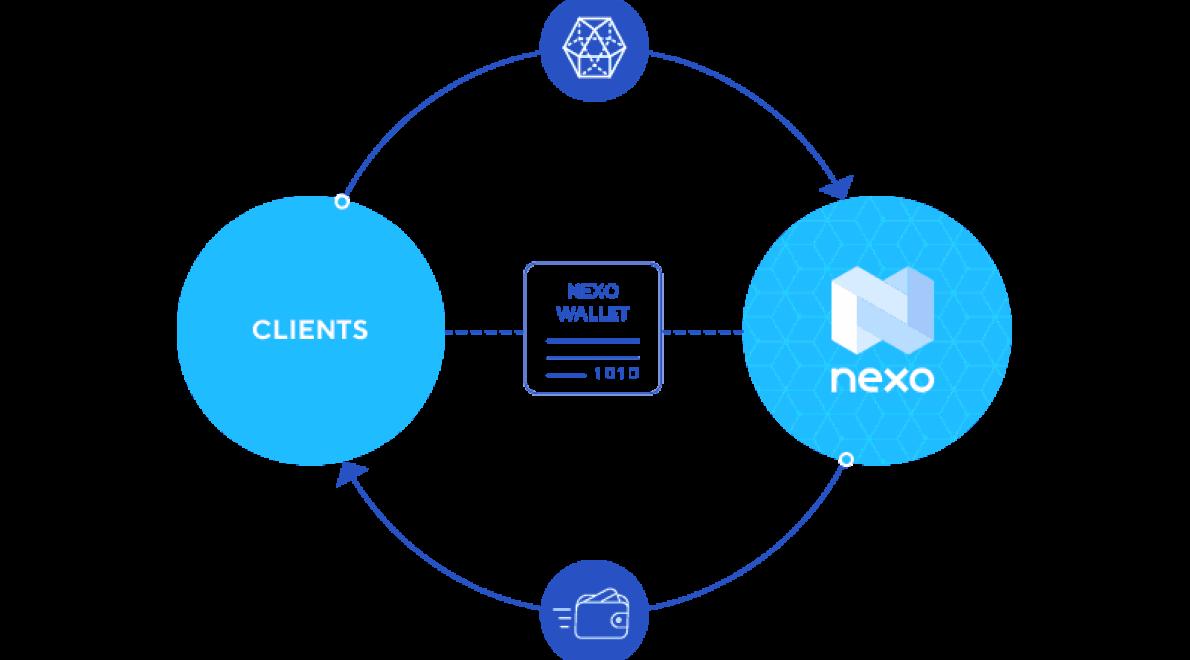

Collateralized crypto loans are currently available in the form of a peer-to-peer lending platform. Lenders can access the platform to borrow money against their cryptocurrency holdings. The platform also offers borrowers the ability to borrow money against their fiat currency holdings.

The peer-to-peer lending platform is currently available in the United States. The platform is designed to offer borrowers and lenders a safe and easy way to borrow money. The platform is also designed to offer borrowers and lenders the opportunity to borrow money against their cryptocurrency and fiat currency holdings.

The peer-to-peer lending platform is currently available in the form of a web application. The web application is designed to allow borrowers and lenders to access the platform from anywhere in the world. The web application also allows borrowers and lenders to borrow money against their cryptocurrency and fiat currency holdings.

The peer-to-peer lending platform is currently available in the form of a mobile app. The mobile app is designed to allow borrowers and lenders to access the platform from anywhere in the world. The mobile app also allows borrowers and lenders to borrow money against their cryptocurrency and fiat currency holdings.

The peer-to-peer lending platform is currently available in the form of a desktop application. The desktop application is designed to allow borrowers and lenders to access the platform from anywhere in the world. The desktop application also allows borrowers and lenders to borrow money against their cryptocurrency and fiat currency holdings.

The peer-to-peer lending platform offers a wide range of features that make borrowing money against your cryptocurrency and fiat currency holdings easy and convenient. The platform offers borrowers the ability to borrow money against their cryptocurrency and fiat currency holdings at a low interest rate. The platform also offers lenders the ability to borrow money against their cryptocurrency and fiat currency holdings at a low interest rate.

The peer-to-peer lending platform offers a wide range of features that make borrowing money against your cryptocurrency and fiat currency holdings easy and convenient. The platform offers borrowers the ability to borrow money against their cryptocurrency and fiat currency holdings at a low interest rate. The platform also offers lenders the ability to borrow money against their cryptocurrency and fiat currency holdings at a low interest rate.

The peer-to-peer lending platform offers a wide range of features that make borrowing money against your cryptocurrency and fiat currency holdings easy and convenient. The platform offers borrowers the ability to borrow money against their cryptocurrency and fiat currency holdings at a low interest rate. The platform also offers lenders the ability to borrow money against their cryptocurrency and fiat currency holdings at a low interest rate.

The peer-to-peer lending platform offers a wide range of features that make borrowing money against your cryptocurrency and fiat currency holdings easy and convenient. The platform offers borrowers the ability to borrow money against their cryptocurrency and fiat currency holdings at a low interest rate. The platform also offers lenders the ability to borrow money against their cryptocurrency and fiat currency holdings at a low interest rate.

A collateralized crypto loan is a type of crypto loan where borrowers use Bitcoin or other cryptocurrencies as collateral. This allows borrowers to secure a loan against the value of their cryptocurrencies, rather than using traditional assets like real estate or stocks.

Borrowers use their cryptocurrencies as collateral to secure a loan from a crypto lender. The crypto lender then uses the collateral to secure a loan from a traditional lender. The traditional lender then uses the loan to invest in cryptocurrencies or other digital assets.

This type of loan allows borrowers to use their cryptocurrencies as a form of security, while also allowing them to access traditional lending options.

There are many pros and cons of collateralized crypto loans. Here are a few of the pros:

1. Collateralized crypto loans provide an easy way for crypto investors to get access to capital.

2. Collateralized crypto loans provide a safe and secure way for crypto investors to fund their projects.

3. Collateralized crypto loans offer investors the opportunity to earn high returns while mitigating risk.

4. Collateralized crypto loans allow investors to diversify their holdings and access new opportunities.

5. Collateralized crypto loans allow investors to reduce their risk by investing in a diversified portfolio of projects.

6. Collateralized crypto loans provide a stable investment platform for crypto investors.

7. Collateralized crypto loans offer a low-risk way for investors to get started in the crypto market.

8. Collateralized crypto loans offer a high degree of liquidity and transparency.

9. Collateralized crypto loans provide a unique opportunity for investors to gain exposure to a variety of cryptos.

10. Collateralized crypto loans provide a safe and secure way for crypto investors to get started in the crypto market.

Collateralized crypto loans are a relatively new and relatively unregulated type of lending product. That being said, there are a few things to keep in mind when considering whether or not collateralized crypto loans are safe.

First and foremost, it is important to understand that these loans are not traditional loans. That means that you will not be able to get a traditional loan from a bank or other financial institution and then use the money to purchase cryptocurrency. Instead, you will need to use the cryptocurrency that you are lending as collateral for the loan.

Second, it is important to understand that these loans are not regulated by the government. That means that there is no guarantee that the money that you lend will be repaid. Instead, the risk of default rests with the borrower.

Finally, it is important to understand that these loans are not insured by the government. That means that if something goes wrong and the borrower cannot repay the loan, you could lose your entire investment.

There are a few different ways to get the best rate on a collateralized crypto loan. One way is to find a peer-to-peer lending platform that specializes in this type of lending. Another option is to find a specialized lender that offers crypto loans. Finally, you can search for online lenders that offer crypto loans with high interest rates.

1. Understand the risks: When borrowing money to invest in cryptocurrencies, there are a number of risks you need to be aware of. Not only are you taking on the risk of a loss in your investment, but you are also exposing yourself to the risk of not being able to repay the loan.

2. Consider your financial stability: Before taking out a collateralized crypto loan, make sure you have a strong financial stability. If you are not able to repay the loan, you could end up losing your entire investment.

3. Double-check the terms of the loan: Before taking out a collateralized crypto loan, make sure you understand the terms of the loan. Make sure you understand what is required in order to repay the loan, and be aware of any penalties that may apply if you fail to repay the loan on time.

4. Discuss the loan with a financial advisor: Before taking out a collateralized crypto loan, it is important to discuss the loan with a financial advisor. They can help you understand the risks associated with the loan, and help you make the best decision for your financial situation.

5. Be prepared to lose your investment: When taking out a collateralized crypto loan, be prepared to lose your entire investment. Make sure you have a backup plan in case you are not able to repay the loan on time.

One of the biggest benefits of collateralized crypto loans is that they provide a way to secure a loan without having to sell cryptocurrency. This means that borrowers can still hold their cryptocurrencies, even if they need to use them to repay the loan.

However, there are also some risks associated with collateralized crypto loans. First, if the value of the underlying cryptocurrency declines, then the value of the collateral may also decline, which could lead to the loan being defaulted on. Second, if the borrower fails to repay the loan, then the collateral may be seized by the lender.

Overall, collateralized crypto loans are an intriguing and potentially lucrative way to borrow money. However, they come with a number of risks and should be carefully considered before taking out a loan.

It is no secret that collateralized crypto loans are becoming more and more popular. One of the main reasons for this is that these loans offer a number of benefits that traditional loans simply cannot offer.

For starters, collateralized crypto loans provide lenders with a much higher yield than traditional loans. This is because the collateral that is used to secure the loan is typically much more valuable than traditional loans. Additionally, collateralized crypto loans are often much easier to get than traditional loans. This is because there is no need to provide proof of income or assets, which makes them a much more accessible option for those who may not have the best credit history.

Overall, collateralized crypto loans offer a number of benefits that make them a popular choice for those looking for a financial solution.

Before you make a collateralized crypto loan, you should carefully consider the risks and benefits. Here are some tips to help you make sure the loan is right for you:

1. Understand the risks.

Cryptocurrencies are volatile and can be difficult to trade, which means that there is a risk that the value of the collateral could decline while you are still owed money.

2. Consider your financial situation.

If you don't have a strong credit history, collateralized crypto loans may not be a good option for you.

3. Verify the legitimacy of the loan.

Make sure the company you are dealing with is legitimate and has been in business for a long time.

4. Compare rates.

Compare rates between different lenders to find the best one for you.

5. Be prepared to repay the loan.

Be prepared to repay the loan in full if you can't meet your obligations.

1. Understand the terms of the loan.

Understand the terms of the loan before signing up. This includes the interest rate, maturity date, and collateral requirements.

2. Review the loan agreement carefully.

Review the loan agreement carefully before signing up. This will help you understand the terms of the loan, including the interest rate and collateral requirements.

3. Verify the collateral.

Verify the collateral before signing up for the loan. This will help you ensure that the pledged assets are worth the required amount.

4. Pay attention to the repayment schedule.

Pay attention to the repayment schedule when signing up for a collateralized crypto loan. This will help you ensure that you are able to repay the loan on time.

5. Follow the loan agreement closely.

Follow the loan agreement closely to ensure that you are complying with the terms of the loan. If there are any changes to the terms of the loan, be sure to update your paperwork accordingly.

When you borrow money from a lender, you expect to pay them back with interest. However, with a collateralized crypto loan, you don’t have to worry about interest rates or paying back the money on time. Instead, the lender will take a percentage of the value of your crypto assets as collateral. If you don’t repay the loan on time, the lender can seize your crypto assets.

However, collateralized crypto loans are only available to high-net-worth individuals and startups. So, if you don’t have a lot of money saved up, you’re not likely to be able to get a collateralized crypto loan.

What are the benefits of collateralized crypto loans?

There are a few key benefits to taking out a collateralized crypto loan. First, collateralized crypto loans offer a higher degree of security than traditional loans. This is because the collateral invested in the loan is typically more valuable than the total amount of the loan itself. Additionally, collateralized crypto loans are typically less expensive than traditional loans. This is because the interest rates charged on these loans are typically lower than those charged on standard loans. Finally, collateralized crypto loans offer borrowers the potential to earn generous interest rates and bonuses. This is because many lenders are willing to offer higher interest rates to borrowers who are able to secure a high level of collateral.