If you're looking for a loan to help with your crypto trading, there are a few options available. You can take out a traditional loan from a bank or other financial institution, or you can opt for a peer-to-peer loan from a platform like Bitcoin.com. If you go the traditional route, you'll likely have to put up some collateral in the form of cryptocurrency or cash. And if you opt for a peer-to-peer loan, you'll need to find a willing lender who's willing to give you a loan in exchange for cryptocurrency. Either way, it's important to do your research and make sure you understand the terms of the loan before you sign anything.

There are a few ways to get a loan for crypto trading. One way is to find a lending platform that specializes in crypto loans. Another way is to find a traditional lender that is willing to work with crypto traders.

Cryptocurrency trading is a highly speculative industry, and there is a high risk of losing all your money. Before you start trading cryptocurrencies, make sure you have enough money to cover any losses.

Here are the best loans for cryptocurrency trading:

1. Coinbase Pro

Coinbase Pro is one of the most popular platforms for buying and selling cryptocurrencies. They offer a variety of different loans, including a personal loan that is available to US customers.

2. Bitfinex

Bitfinex is one of the largest cryptocurrency exchanges in the world. They offer a variety of loans, including a short-term margin loan that is available to US customers.

3. Kraken

Kraken is one of the most popular exchanges for trading cryptocurrencies. They offer a personal loan that is available to US customers.

Cryptocurrency trading can be a lucrative investment, but it can also be risky. That’s why it’s important to find a reliable source of financing for your crypto trading endeavors. Here are some places to find loans for cryptocurrency trading:

1. Online lending platforms

Online lending platforms are a great way to get quick and easy access to loans for cryptocurrency trading. These platforms typically offer short-term loans that you can use to finance your trades.

2. Bank loans

If you’re looking for a longer-term loan for your cryptocurrency trading ventures, you may want to consider using a bank loan. These loans typically have higher interest rates, but they can provide you with the capital you need to make big profits in the cryptocurrency market.

3. Credit unions

Credit unions are another good option for finding financing for your cryptocurrency trading ventures. These institutions typically offer low-interest loans that you can use to purchase cryptocurrencies or other investments.

There are a few different ways to apply for a loan for crypto trading. One way is to find a bank or lending institution that offers loans for crypto trading. Another way is to find a peer-to-peer lending platform that specializes in loans for crypto trading.

Cryptocurrencies are volatile and can be risky investments. Before investing in cryptocurrencies, you should carefully consider your financial situation, investment goals, and risk tolerance. It is important to speak with a qualified financial advisor to help you understand the risks associated with cryptocurrency trading.

There are a number of different types of loans for crypto trading. Some lenders may offer short-term loans that can be used to purchase cryptocurrencies. These loans can typically be repaid within a few days or weeks. Lenders may also offer longer-term loans that can be used to buy cryptocurrencies or to invest in other cryptocurrencies.

Before investing in cryptocurrency, it is important to make sure that you understand the risks involved. You should also speak with a qualified financial advisor to help you determine if cryptocurrency trading is a good investment for you.

Pros

-Fast and easy process: most loans are processed within minutes, which is great if you need a quick solution to your trading problems.

-Great for short-term solutions: many loans are available for as little as 24 hours, which is perfect for when you need to solve a specific problem quickly.

-Access to a large pool of lenders: many lenders offer loans in different currencies, so you can find the best loan option for your needs.

-Wide range of lending options: there are loans available for both day trading and long-term investing, so you can find the perfect solution for your trading needs.

-Low interest rates: most loans have low interest rates, which makes them a great option if you're looking to save money on your trading costs.

Cons

-Possible debt burden: if you don't pay back your loan on time, you could end up with a large debt burden that will affect your financial stability.

-High interest rates: most loans have high interest rates, which can make them expensive if you don't pay them back on time.

There are a few things to consider before taking out a loan for crypto trading. First, you should make sure that you have a good understanding of the risks involved. Second, you should be sure that the loan is appropriate for your needs. Finally, you should make sure that the terms of the loan are acceptable to you.

There are different types of loans available for crypto traders.

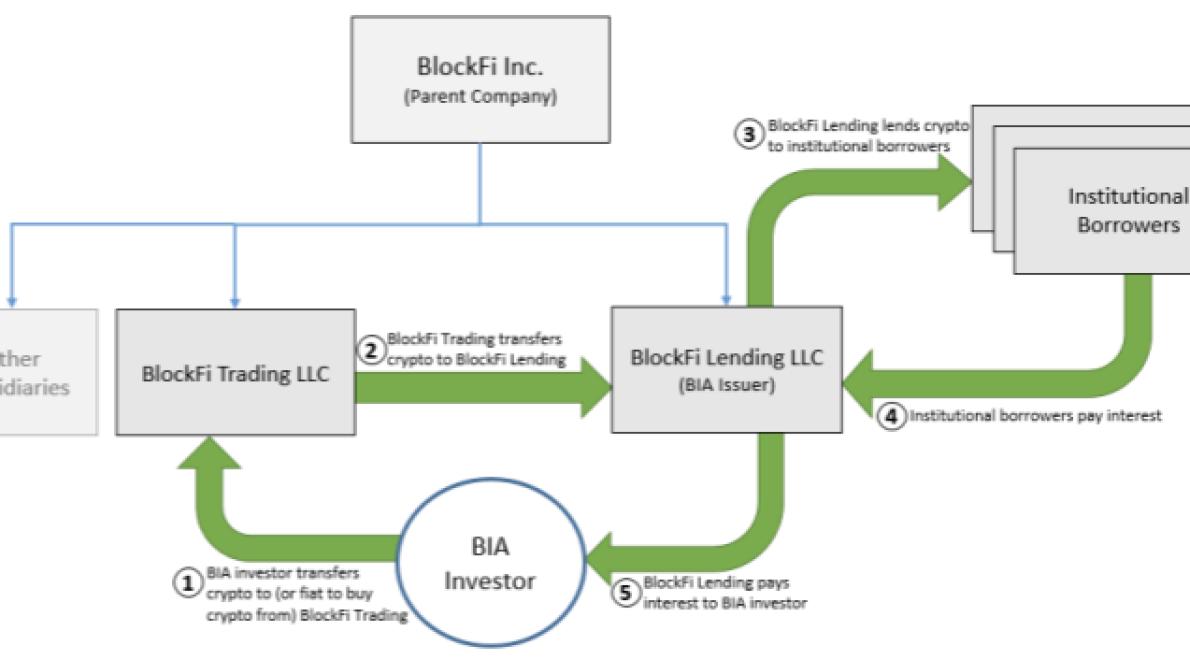

1. Crypto-to-crypto lending

This is a type of lending where borrowers use cryptocurrencies to borrow money from lenders. The interest rates on these loans are usually higher than traditional loans, but they are also more risky since the value of cryptocurrencies can be volatile.

2. Crypto-to- fiat lending

This is a type of lending where borrowers use fiat currencies to borrow money from lenders. The interest rates on these loans are usually lower than traditional loans, but they are also more stable since fiat currencies are tradable and backed by governments.

3. Crypto-to-crypto margin trading

This is a type of trading where traders borrow money from lenders to buy more cryptocurrencies than they can afford to lose. The interest rates on these loans are usually higher than traditional loans, but they are also more risky since the value of cryptocurrencies can be volatile.

There are a few risks associated with taking out a loan for crypto trading. The first is that you may not be able to repay the loan in a timely manner, which could lead to disastrous consequences. Second, if the value of the cryptocurrency you are trading falls significantly, you may not be able to repay the loan in full, which could also lead to financial ruin. Finally, crypto trading is a high-risk activity and there is a chance that you could lose all of your money if you don’t make wise investments. If you are considering taking out a loan for crypto trading, it is important to weigh the risks carefully before making any decisions.

Cryptocurrencies are not backed by anything, meaning that you cannot physically repay a loan in cryptocurrency. The best way to repay a loan for crypto trading is typically through traditional financial institutions.

There are many reasons why someone might want to take out a loan for crypto trading. For one, a loan can help you to get started in the market quickly and with a smaller investment than you might otherwise. Additionally, a loan can help you to cover any unexpected costs that may crop up while you’re trading, such as missed trades or price drops. Finally, if you plan on trading for a long period of time, a loan can help you to cover living expenses while you’re away from home.

There are a few things you should do before you begin looking for a loan for crypto trading. First, make sure you have a solid understanding of what crypto trading is and the risks involved. Second, be sure to calculate your trading goals and identify the amount of money you need to start trading. Third, consider the types of loans available to you. Finally, compare lenders to find the best option for you.

1. Understand what crypto trading is and the risks involved

Before you can decide if a loan is right for you, you first have to understand what crypto trading is and the risks involved. Crypto trading is the process of buying and selling digital assets such as Bitcoin and Ethereum. Crypto assets are often considered a high-risk investment, and there is a risk of losing all your money. Before you start trading, be sure to understand the risks and how to mitigate them.

2. Calculate your trading goals

Next, you need to calculate how much money you need to start trading. Be sure to identify your trading goals and the amount of money you want to invest. Once you have this information, you can begin to search for a loan that will help you reach your goals.

3. Consider the types of loans available to you

There are a number of different loans available to people who want to start or expand their crypto trading business. loans can come in different forms, including secured loans and unsecured loans. You'll need to decide which type of loan is right for you based on your financial situation and trading goals.

4. Compare lenders to find the best option for you

Once you have determined which loan is right for you, it's time to compare lenders to find the best option for you. Lenders offer different terms and conditions, so be sure to read each lender's terms carefully. You also want to make sure the lender has a good history of lending to crypto traders.