Celsius Network is a decentralized lending platform that offers crypto-backed loans. The platform allows users to collateralize their digital assets and borrow against them at interest rates as low as 4.95%. Celsius Network is built on the Ethereum blockchain and utilizes smart contracts to facilitate loans.

Celsius Crypto-Backed Loans are a new kind of lending product that allows borrowers to borrow money using cryptocurrency as collateral.

This new lending product is based on the Ethereum blockchain and uses smart contracts to ensure transparency and security.

The Celsius Crypto-Backed Loans platform was created by Celsius Network, a Singapore-based company that specializes in lending products based on blockchain technology.

The Celsius Crypto-Backed Loans platform offers borrowers access to a range of loan products, including short-term loans, long-term loans, and credit products.

The Celsius Crypto-Backed Loans platform is open to both individuals and businesses and offers a variety of loan options to choose from.

The Celsius Crypto-Backed Loans platform is currently in beta mode and is available to users in Singapore.

The Celsius Crypto-Backed Loans platform has the potential to revolutionize the lending industry by offering a secure and transparent lending product that is based on the blockchain technology.

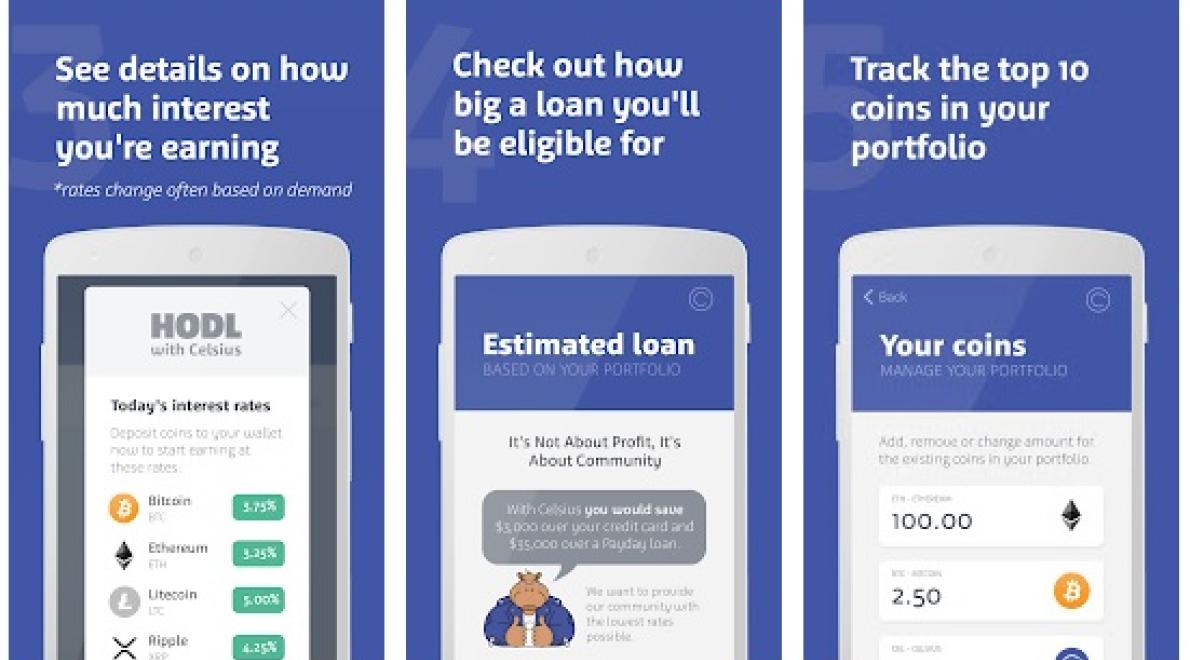

One way Celsius is making crypto-backed loans more accessible is by developing a mobile app. This will allow borrowers to get loans from anywhere in the world, without having to go through a traditional lender. This will make it much easier for people to get access to these types of loans, and will make them more affordable.

Crypto-backed loans offer a number of benefits to borrowers and lenders. For borrowers, crypto-backed loans offer security and stability not found in traditional loans. For lenders, crypto-backed loans offer the potential for high returns and reduced risk.

One downside to crypto-backed loans is that they are not as widely available as traditional loans. Additionally, crypto-backed loans may not be as accessible to borrowers who do not have access to traditional banking services.

Celsius is a new platform that is looking to revolutionize the way crypto-backed loans are made. The Celsius platform will allow borrowers and lenders to exchange payments in Celsius tokens. This will allow for fast and easy transactions, without the need for banks or other middlemen.

Celsius has already received backing from some of the world’s largest banks, and is now looking to expand its network even further. The Celsius platform is already live in Lithuania, and plans to launch in Europe and Asia later this year.

If Celsius can successfully implement its platform and bring crypto-backed loans to a wider audience, it could be the next big thing in the world of finance.

Crypto-backed loans are a new type of lending that uses blockchain technology to secure the loan. The borrower can use the loan to purchase cryptocurrencies or to trade them. The loan is repaid with the proceeds from the sale of the cryptocurrencies.

Crypto-backed loans are sometimes called crypto-loans. They are similar to traditional loans, but the collateral is the cryptocurrency rather than a physical asset.

Crypto-backed loans are often used to finance Initial Coin Offerings ( ICOs ). ICOs are a new type of fundraising that uses cryptocurrencies.

). ICOs are a new type of fundraising that uses cryptocurrencies. Crypto-backed loans are not regulated by the government.

Crypto-backed loans are not insured by the government.

Crypto-backed loans are not backed by a bank or other financial institution.

Crypto-backed loans are not guaranteed by a third party.

Crypto-backed loans are not subject to income verification or credit checks.

Crypto-backed loans are not subject to financial stability standards.

Crypto-backed loans are not subject to consumer protection regulations.

Crypto-backed loans are not subject to fiduciary responsibility or securities laws.

Crypto-backed loans provide a way for lenders to get access to stable and liquid cryptocurrencies without having to hold the underlying asset. This allows borrowers to receive financing in a variety of currencies, without having to worry about the volatility of the underlying asset.

This could revolutionize the way lending is done, as it could provide a more stable and liquid medium for financing transactions. Additionally, it could help to reduce the reliance on traditional banks, as borrowers can get financing from a wide range of sources.

Crypto-backed loans could also have a significant impact on the economy as a whole. By providing a more stable and liquid medium for financing transactions, it could help to reduce the number of times that goods and services need to be exchanged. This could have a significant impact on the economy as a whole, as it could lead to increased economic growth.

One of the most promising applications for blockchain technology is in the field of lending. Crypto-backed loans are a key part of this future, and Celsius is leading the way.

Celsius is a decentralized platform that connects borrowers and lenders in a secure and transparent way. The platform uses blockchain technology to create a tamper-proof record of all transactions.

The founders of Celsius believe that the blockchain technology will revolutionize the lending industry. They see crypto-backed loans as a key part of this future.

Celsius has already created a few successful loans. The first was a loan worth $25,000 that was successfully repaid. The second was a loan worth $150,000 that was also repaid.

Celsius is looking to expand its loan portfolio and reach a wider audience. The team is currently in the process of launching a new version of the Celsius platform that will allow for simultaneous lending and borrowing.

This will make it easier for borrowers and lenders to find each other. The team is also planning to launch a mobile app that will allow borrowers to access their loans from anywhere in the world.

Celsius is quickly becoming one of the leading players in the crypto-backed lending industry. The platform is reliable and secure, and it has already proven itself by successfully repaying loans.

The Celsius team is committed to expanding its reach and helping to revolutionize the lending industry. This is a platform that investors should keep an eye on.

Crypto-backed loans could provide a solution to the banking crisis by providing a more secure and reliable way for people to borrow money. They could also help to reduce the amount of collateral that is required for a loan, which could make them more accessible to people who would not normally be able to access traditional loans.

Crypto-backed loans are a new type of lending product that uses blockchain technology to secure the loan. The borrower pays a small fee to the lender in bitcoin or other cryptocurrencies, and the lender uses the digital asset to secure the loan.

Crypto-backed loans are a new type of lending product that uses blockchain technology to secure the loan.

The borrower pays a small fee to the lender in bitcoin or other cryptocurrencies, and the lender uses the digital asset to secure the loan. Crypto-backed loans are a new type of lending product that uses blockchain technology to secure the loan. The borrower pays a small fee to the lender in bitcoin or other cryptocurrencies, and the lender uses the digital asset to secure the loan.

Crypto-backed loans are changing the lending landscape. These loans are backed by cryptocurrency assets, which means that borrowers can trust the loan without having to worry about the security of the underlying asset.

This is a big deal because it allows borrowers to get loans without having to provide any collateral. This means that borrowers can access funding more easily and at a lower rate than traditional lenders.

Crypto-backed loans also offer a higher level of security than traditional loans. Because the loans are backed by cryptocurrency assets, borrowers are protected from default and theft.

This is a big advantage over traditional loans, which can be subject to fraud and theft.

Crypto-backed loans are also becoming more popular because they offer a low interest rate. This is because borrowers do not need to pay any interest on their loans, which reduces the cost of borrowing.

Overall, crypto-backed loans are changing the lending landscape by offering a more secure and easier way to get loans. They are also becoming more popular because they offer a low interest rate and a high level of security.

Crypto-backed loans are one of the most exciting developments in the world of banking. They offer a new way for people to borrow money that is more secure and easier to use than traditional loans.

Crypto-backed loans work by using blockchain technology to create a secure record of the loan transaction. This makes the loan more reliable and difficult to fake.

Crypto-backed loans could revolutionize the way people borrow money. They could make it easier for people to get loans, and they could also reduce the cost of borrowing money.

Cryptocurrency backed loans are quickly becoming one of the most popular ways for people to borrow money. This is because they offer a number of unique benefits that other loans don’t.

For example, cryptocurrency backed loans are very safe and secure. This is because they use blockchain technology to ensure that the loan is fully documented and that the lender can always track the progress of the loan.

Cryptocurrency backed loans also offer a high degree of flexibility. This is because you can borrow money in any amount and you can repay the loan at any time.

Overall, cryptocurrency backed loans offer a number of unique benefits that make them a popular choice for people looking to borrow money.