Cryptocurrency loans are becoming increasingly popular as a way to obtain capital without having to sell one's crypto holdings. These loans typically have low interest rates and can be used for a variety of purposes, including investing in new projects or simply obtaining cash when needed. There are a number of different platforms that offer crypto loans, and each has its own advantages and disadvantages.

If you are looking for a loan in cryptocurrency, you are in luck! There are now a number of loan companies that offer loans in cryptocurrency.

Some of the most popular loan companies that offer loans in cryptocurrency include BitLendingClub and BTCjam.

These companies take a number of different approaches to lending in cryptocurrency. BitLendingClub typically offers longer term loans, while BTCjam typically offers shorter term loans.

Both companies offer interest rates that are typically above the market rate. This means that you can expect to receive a higher rate of return on your loan if you choose to borrow in cryptocurrency through one of these companies.

If you are interested in finding a loan in cryptocurrency, be sure to check out these two companies. They are both well known and trusted lenders in the cryptocurrency community.

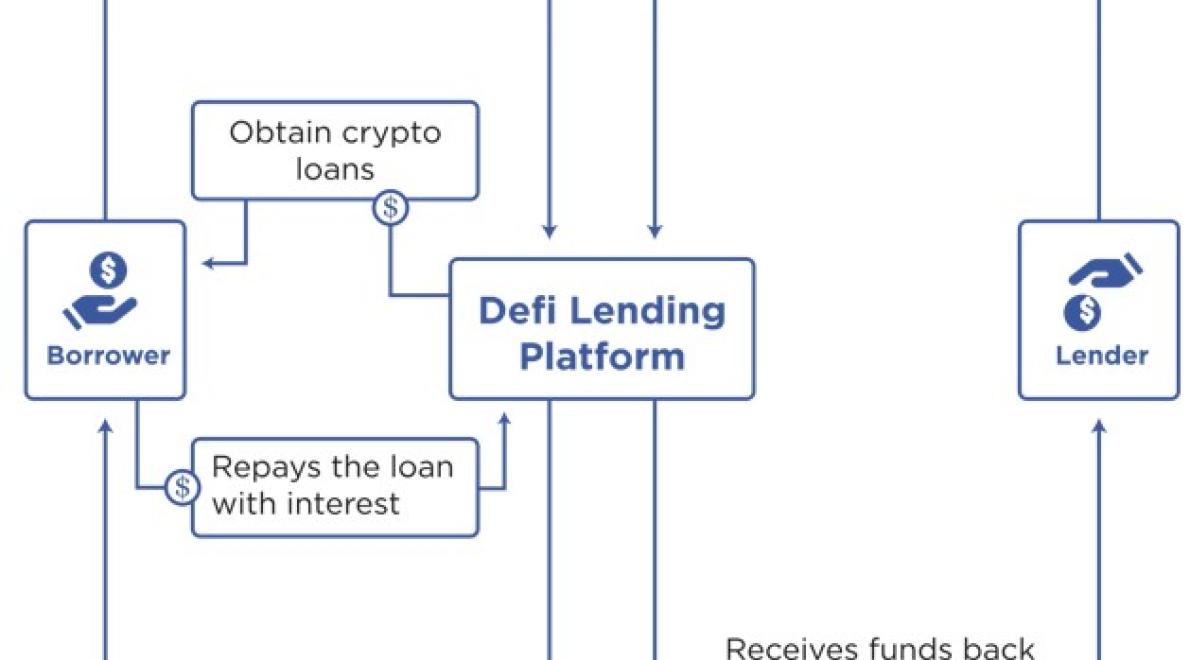

If you want to get a loan using cryptocurrency, there are a few options open to you. One option is to use a peer-to-peer lending platform like Lending Club or BitLendingClub. These platforms allow borrowers and lenders to connect directly, and borrowers can use the funds they borrow to purchase cryptocurrencies or other assets.

Another option is to use a Bitcoin or Ethereum-based lending platform like BitBond or BitLoans. These platforms allow borrowers to borrow money from lenders in exchange for Bitcoin or Ethereum, respectively. The platforms typically charge a small percentage of the loan amount as fee, and they sometimes also offer rebates to borrowers who pay their loans back on time.

Crypto Loans are a new way to borrow money that uses cryptocurrency. They are a great way to get a quick and easy loan, without having to worry about traditional lending processes.

This is a great option if you need a small amount of money quickly, or if you want to borrow money without having to worry about collateral or credit checks.

How Crypto Loans Work

Crypto Loans work by borrowing money using digital currencies like Bitcoin or Ethereum. You simply submit an application and pay the loan back using the same cryptocurrencies that were used to borrow the money in the first place.

This means that there is no need to worry about collateral or credit checks, which makes them a great option for people who want to borrow money without worrying about traditional lending processes.

Benefits of Crypto Loans

There are many benefits to using Crypto Loans as a way to get a quick and easy loan. These include:

No Collateral : Unlike traditional loans, there is no need for you to provide collateral when you borrow money through Crypto Loans. This means that you can borrow money without worrying about losing any of your assets.

: Unlike traditional loans, there is no need for you to provide collateral when you borrow money through Crypto Loans. This means that you can borrow money without worrying about losing any of your assets. Quick and Easy : Crypto Loans are a quick and easy way to get a small amount of money, without having to wait on long traditional lending processes.

: Crypto Loans are a quick and easy way to get a small amount of money, without having to wait on long traditional lending processes. No Credit Check : Unlike traditional loans, there is no need to have good credit or have been approved by a credit institution before you can borrow through Crypto Loans. This means that they are perfect for people who may have trouble getting approved for traditional loans.

: Unlike traditional loans, there is no need to have good credit or have been approved by a credit institution before you can borrow through Crypto Loans. This means that they are perfect for people who may have trouble getting approved for traditional loans. Low Interest Rates: Unlike traditional loans, which usually have high interest rates, Crypto Loans usually have low interest rates. This means that you will usually be able to borrow money at a lower cost than with other types of loans.

How to Apply for a Crypto Loan

To apply for a Crypto Loan, you first need to find a lender that offers these loans. You can find lenders online or through local networks. Once you have found a lender, you will need to submit an application and pay the loan back using the same cryptocurrencies that were used to borrow the money in the first place.

Crypto loans can provide numerous benefits for borrowers and lenders. Borrowers can benefit from access to a fast and reliable funding source, while lenders can gain exposure to high-return opportunities in the crypto space.

Benefits for Borrowers

Fast and Reliable Funding: Crypto loans are typically fast and reliable, providing borrowers with quick access to funding.

High-Return Opportunities: Crypto loans offer high-return opportunities, as the interest rates on these loans are often much higher than those found in traditional borrowing markets.

Access to a New Funding Source: By taking out a crypto loan, borrowers can access a new and innovative funding source that could be of great benefit to their business.

Benefits for Lenders

High-Return Opportunities: Crypto loans offer high-return opportunities as the interest rates on these loans are often much higher than those found in traditional borrowing markets.

Exposure to a New Area: Lenders can gain exposure to a new and innovative area of investment by investing in crypto loans.

Fast and Reliable Funding: Crypto loans are typically fast and reliable, providing lenders with quick access to funding.

Access to a New Funding Source: By taking out a crypto loan, lenders can access a new and innovative funding source that could be of great benefit to their business.

Crypto loans are a new form of lending that allows you to borrow money in the form of cryptocurrency. This can be a great way to get an emergency loan when you need it, or to bridge a funding gap until you can get a traditional loan.

How They Work

Crypto loans work like traditional loans, but instead of using traditional currency, you borrow in cryptocurrency. This allows you to get a loan in a more secure and anonymous way, without having to worry about the associated risks.

The Benefits

There are a few key benefits to using crypto loans:

They are fast and easy to get – Crypto loans can be processed quickly and easily, so you can get the money you need as soon as possible.

They are secure and anonymous – Crypto loans are secure and anonymous, which means you don’t have to worry about your personal information being compromised.

They are flexible – You can use crypto loans for a variety of purposes, so they are perfect for any situation.

The Risks

Like any other loan, there are risks associated with using crypto loans. These include the following:

They are not always available – Crypto loans are not always available, so you may have to wait if you need them.

They are subject to market volatility – Cryptocurrency values can be volatile, which could impact the amount you are able to borrow.

They are not always guaranteed – The terms and conditions of crypto loans are not always guaranteed, so you may not be able to get the money you need if things don’t go as planned.

Cryptocurrency loans are a great way to get started in the crypto world, but there are some risks involved. Here are four of the biggest:

1. You may not be able to repay the loan

If you take out a cryptocurrency loan, you are essentially borrowing money from a digital currency exchange. This means that the chance of not being able to repay the loan is high. If the value of your digital currency falls below the value of the loan, you may not be able to repay the money you borrowed.

2. You may lose your investment

If you take out a cryptocurrency loan, you are essentially gambling with your money. The chances of making a profit are slim, and the chances of losing your investment are high. If the value of your digital currency falls below the value of the loan, you may have to repay the money you borrowed even if your digital currency is worth less.

3. You may have to pay high interest rates

Cryptocurrency loans usually have high interest rates. This means that you may have to pay a lot of money in interest each month. If the value of your digital currency falls below the value of the loan, you may have to pay back the money you borrowed even if your digital currency is worth less.

4. You may not be able to get your money back

If you take out a cryptocurrency loan, you are essentially lending your money to a digital currency exchange. This means that the digital currency exchange has the right to take your money if you do not repay the loan. If the digital currency exchange goes bankrupt, you may not be able to get your money back.

When looking for a crypto loan, you should keep the following in mind:

The interest rate – A high interest rate can be a sign that the loan is not worth taking out. However, some loans may have higher interest rates than others, so it is important to read the terms carefully.

– A high interest rate can be a sign that the loan is not worth taking out. However, some loans may have higher interest rates than others, so it is important to read the terms carefully. The repayment period – Repayment periods can range from a few weeks to several years. It is important to find a loan that has a repayment period that you are comfortable with.

– Repayment periods can range from a few weeks to several years. It is important to find a loan that has a repayment period that you are comfortable with. The APR – The APR ( Annual Percentage Rate ) is the interest rate that will be charged on the loan. This should be a figure that is important to you, as it will affect how much you will pay in total over the course of the loan.

– The APR ( ) is the interest rate that will be charged on the loan. This should be a figure that is important to you, as it will affect how much you will pay in total over the course of the loan. The terms – The terms of the loan should be clear and concise. You should be able to understand them easily and be able to agree to them without any difficulty.

– The terms of the loan should be clear and concise. You should be able to understand them easily and be able to agree to them without any difficulty. The credit score – A good credit score is essential for most loans, but it is especially important for crypto loans. If you do not have a good credit score, you may not be able to get approved for a loan at all. This could lead to frustration and difficulty in getting your money back if you decide to default on the loan.

– A good credit score is essential for most loans, but it is especially important for crypto loans. If you do not have a good credit score, you may not be able to get approved for a loan at all. This could lead to frustration and difficulty in getting your money back if you decide to default on the loan. The company – Make sure that the company you are working with is reputable and has a good track record. You should also be sure that the company has a solid customer service policy in place should you need it.

– Make sure that the company you are working with is reputable and has a good track record. You should also be sure that the company has a solid customer service policy in place should you need it. The payment methods – Some companies offer loans in different ways, such as through credit cards or PayPal. It is important to find a company that offers loans in a way that is convenient for you.

Cryptocurrencies have been in the news a lot lately, and one of the most talked about is Bitcoin. Bitcoin is a digital asset and a payment system invented by an unknown person or group of people under the name Satoshi Nakamoto. Bitcoin is unique in that there are no central authorities or banks in control of it: it is decentralized. However, Bitcoin is not the only cryptocurrency in the market. There are also other cryptocurrencies such as Ethereum, Litecoin, and Ripple.

Cryptocurrencies are decentralized digital assets that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are unique in that they use blockchain technology. A blockchain is a continuously growing list of records, called blocks, which are linked and secured using cryptography. Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data. Bitcoin nodes use the block chain to differentiate legitimate Bitcoin transactions from attempts to re-spend coins that have already been spent elsewhere.

Cryptocurrencies are not without their problems. For example, Bitcoin has been plagued with scalability issues, meaning that its network can’t handle an increasing number of transactions. Ethereum has had similar issues. Ripple has been touted as a potential solution to these problems, but it has also had its share of problems.

Despite these problems, cryptocurrencies continue to be popular, mainly because they offer certain advantages over traditional financial systems. Cryptocurrencies are more difficult to hack than traditional systems because they use cryptography to protect against theft. Cryptocurrencies also offer anonymity and security, which is important for people who want to protect their personal data.

There are a number of ways in which cryptocurrencies could continue to grow in popularity. For example, cryptocurrencies could be used to pay for goods and services. They could also be used as an investment vehicle. Cryptocurrencies could also be used to pay for tuition and other educational costs.

There is no doubt that cryptocurrencies are here to stay, and they will continue to grow in popularity.

Crypto loans can be a great way to boost your finances while also protecting yourself from potential risks. By using a crypto loan, you can get access to funds that you otherwise would not be able to access. Additionally, crypto loans offer some security features that other loan options do not.

Before you take out a crypto loan, it is important to understand the risks involved. First and foremost, crypto loans are not regulated by any central authority, so there is a greater chance that you will not be able to repay the loan. Additionally, crypto loans are often associated with high risk activities, such as cryptocurrency trading. If you are not experienced in this area, then you may be at a higher risk of losing your money.

When taking out a crypto loan, it is important to consider your goals. You should decide what kind of return you are looking for on your investment and what kind of risk you are willing to take. For example, if you are looking for a short-term return, then you may be willing to take on more risk. If you are looking for a long-term return, then you may be less likely to take on the same level of risk.

Finally, it is important to remember that crypto loans are not a guaranteed investment. There is always the chance that you will not be able to repay the loan, and you will lose your investment. It is important to do your research and understand the risks involved before making a decision.