Crypto loans are a type of loan that does not require collateral. This type of loan can be beneficial for individuals or businesses that do not have the necessary collateral to secure a loan from a traditional lender. Crypto loans can also be beneficial for borrowers who want to avoid the hassle of dealing with collateral.

Crypto loans are becoming increasingly popular, but they can be difficult to get without collateral. Here are some tips on how to get a crypto loan without collateral.

1. Do Your Research

Before you even think about requesting a crypto loan, it is important that you do your research first. Make sure you understand the terms and conditions of the loan, as well as the risks involved.

2. Meet With a Crypto Loan Provider

Once you have a good understanding of crypto loans, the next step is to find a reputable provider. Look for providers who have a good reputation and have been in the crypto lending business for a long time.

3. Put in a Request

Once you have found a provider you trust, it is time to put in a request for a loan. Be sure to provide as much information as possible, including your credit score and collateral requirements.

4. Wait for a Response

Once you have submitted your request, it is important to wait for a response. It may take some time for a lender to get back to you, so be patient.

5. Follow Up If There Is No Response

If there is no response from the lender after a few weeks, it is worth following up with them. Try contacting them via email or phone to see if there has been any progress.

There are a few key benefits to consider when considering a crypto loan without collateral.

First and foremost, borrowing cryptocurrency without any collateral allows you to take advantage of lower interest rates. Rates on crypto loans can be significantly lower than traditional loans, which can provide significant savings.

Secondly, borrowing cryptocurrency without collateral also allows you to avoid the risk of losing your money if the cryptocurrency value diminishes. While there is always some risk associated with any investment, borrowing cryptocurrency without collateral minimizes this risk to a significant degree.

Finally, borrowing cryptocurrency without collateral can also provide a sense of security and stability when investing in cryptocurrencies. Unlike traditional investments, where the value of the asset can be impacted by a wide range of external factors, cryptocurrencies are largely immune to market volatility. This makes them a more stable investment option, which can be appealing to those who are wary of volatile markets.

The risks of a crypto loan without collateral are high. If a borrower doesn’t have any usable assets to pledge as collateral, they could be at risk of losing their entire investment. Additionally, if the value of the cryptocurrency falls below the loan amount, the borrower could be left with a large financial burden.

There are pros and cons to borrowing money in cryptocurrency without collateral. On the pro side, this type of loan is fast and easy to get approved. You don't need to provide any documents or proof of income. The process is also anonymous, so you can borrow money without worrying about your personal information being revealed.

However, there are also risks involved with this type of loan. If the borrower fails to pay back the loan, the lender could seize the borrower's crypto assets as collateral. This could result in a loss for the borrower, as well as the platform or lender that provided the loan.

Crypto loans without collateral can be a great option for some borrowers, but they may not be right for everyone. If you don’t have any assets that can be used as collateral, a crypto loan may not be the best option for you. Instead, consider borrowing money from a traditional lender.

When choosing a crypto loan, it is important to consider factors such as the loan’s interest rate, the amount of collateral required, and the repayment schedule.

Interest Rate

The interest rate of a crypto loan varies depending on the loan’s terms and the lender’s lending policy. Lenders may offer lower rates for short-term loans and higher rates for long-term loans.

Amount of Collateral Required

The amount of collateral required varies depending on the loan type and the borrower’s credit history. For example, a crypto loan with a high interest rate may require more collateral than a crypto loan with a low interest rate.

Repayment Schedule

The repayment schedule of a crypto loan varies depending on the terms of the loan. For example, some lenders offer a fixed repayment schedule, while others allow borrowers to repay the loan over time.

Crypto loans without collateral are becoming increasingly popular, and for good reason. They offer a low-cost, secure way to borrow money without having to put your assets at risk.

Here’s everything you need to know to get started:

What is a crypto loan?

A crypto loan is a short-term borrowing solution that uses cryptocurrency as collateral. This means that you don’t need to sell your cryptocurrencies to receive the loan, and you can always withdraw the funds if you need them.

How do I get a crypto loan?

There are a few ways to get a crypto loan. You can find lenders online, through meetups, or in person. Just be sure to research the potential lenders before meeting with them, as not all of them are reputable.

How do I pay back the loan?

Once you have repaid the loan, you can either sell your cryptocurrencies back to the lender or keep them. It’s important to note that you won’t be able to use the borrowed funds to buy new cryptocurrencies, as this would be considered a violation of the loan agreement.

Is a crypto loan safe?

Yes, a crypto loan is a safe way to borrow money. lenders typically require proof of identity and a credit score, and they usually charge interest rates that are lower than traditional loans.

Overall, crypto loans are a great option for people who want to borrow money without having to sell their cryptocurrencies. Just be sure to research the lenders before meeting with them, and be prepared to repay the loan quickly.

Crypto loans are a new and growing trend in the world of cryptocurrency. They allow users to borrow cryptocurrency against future returns, without needing to provide collateral.

The concept of crypto loans is relatively new, but they have been growing in popularity due to their many benefits. Here are four key things to know about crypto loans:

1. Crypto loans are a great way to get started in the world of cryptocurrency.

Crypto loans can be a great way for new investors to get started in the world of cryptocurrency. They offer the potential for high returns, without the risks associated with investing in cryptocurrencies outright.

2. Crypto loans are a great way to get access to high-return investments.

Crypto loans offer investors the opportunity to access high-return investments without having to put up any collateral. This makes them a great option for those looking for high returns without any risk.

3. Crypto loans are a great way to diversify your portfolio.

Crypto loans can be a great way to diversify your portfolio. By investing in crypto loans, you can access a variety of different cryptocurrencies and assets. This can help you to reduce the risk of investing in one particular asset class.

4. Crypto loans are a great way to get started in the world of cryptocurrency.

Crypto loans are a great way for new investors to get started in the world of cryptocurrency. They offer the potential for high returns, without the risks associated with investing in cryptocurrencies outright.

What are Crypto Loans?

Crypto loans are a new type of loan that uses blockchain technology. They are a way to borrow money using cryptocurrency as collateral.

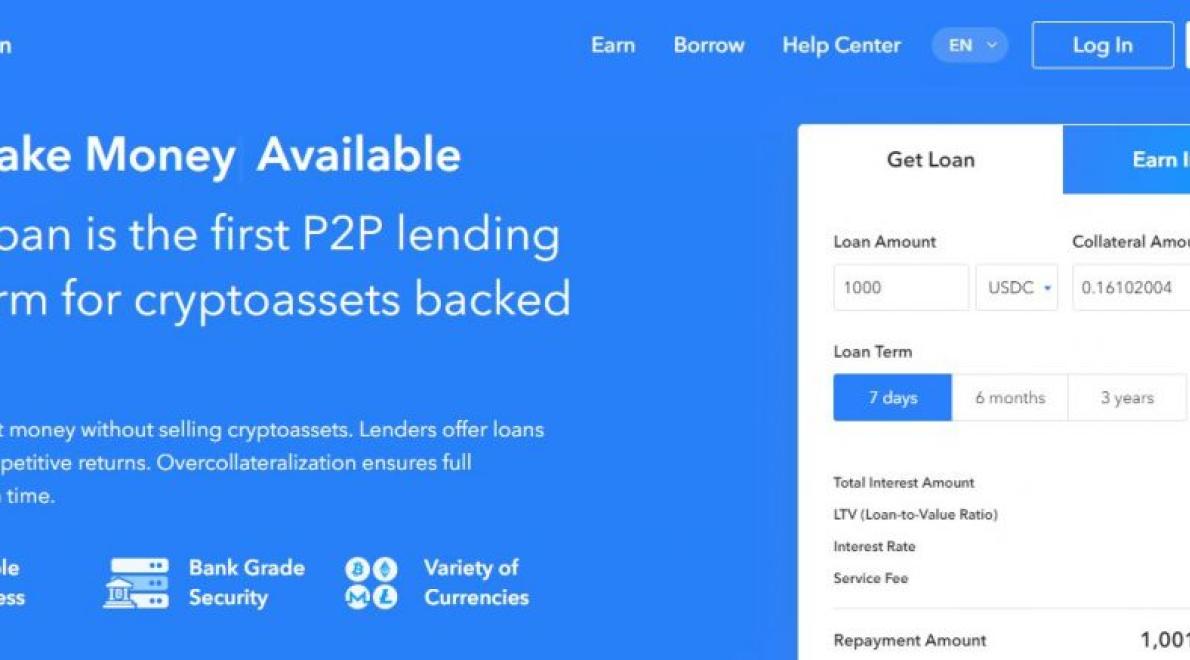

How do Crypto Loans Work?

To borrow money using a crypto loan, you first need to create a loan request on the lending platform. You will then need to provide information about your loan, including the amount you want to borrow, the interest rate you want to receive, and the collateral you will use to secure the loan.

Once you have completed your loan request, the lending platform will contact you to confirm the details of your loan. You will then need to provide the lending platform with the cryptocurrency you will use as collateral for your loan. The lending platform will then use your cryptocurrency to collateralize your loan.

What are the Benefits of Crypto Loans?

There are many benefits to using a crypto loan as a way to borrow money. First, crypto loans are a new and innovative way to borrow money. They are also a way to borrow money using cryptocurrency as collateral. This makes crypto loans a very safe and secure way to borrow money.

Another benefit of using a crypto loan as a way to borrow money is that crypto loans are a very fast way to borrow money. You can usually borrow money using a crypto loan within minutes of completing your loan request. this makes crypto loans a great option for people who need to borrow money quickly.

Finally, one of the biggest benefits of using a crypto loan as a way to borrow money is that crypto loans offer low interest rates. This means that you can usually get a very low interest rate when borrowing money using a crypto loan. this makes crypto loans a great option for people who want to borrow money at a low interest rate.

1. You want to test the crypto market before investing

2. You need a short-term loan to cover expenses

3. You don’t have enough cryptocurrency to cover a loan

4. You want to diversify your portfolio

5. You want to get a loan before the price goes up

6. You want to get a loan before the price goes down

7. You want a higher interest rate than traditional loans

8. You don’t have a credit score and traditional loans are not available to you

9. You want to get a loan before you sell your cryptocurrency

10. You want to avoid paying taxes on your cryptocurrency

There are a few things you can do to maximize the potential return on a crypto loan without collateral.

1. Evaluate the Rates and Terms of the Loan

Before signing up for a crypto loan, it is important to compare the rates and terms offered by different lenders. Compare interest rates, APR, and terms of repayment to find the best option for you.

2. Choose a Lender With a Good Reputation

It is important to choose a lender with a good reputation. Check online reviews and look for lenders with a high rating from respected organizations such as the Better Business Bureau.

3. Make Sure You Have a Good Credit Score

To be eligible for a crypto loan, you will need a good credit score. Make sure you have established credit before signing up for a loan. If you do not have good credit, consider using a credit card to borrow money instead.

4. Pay Off Your Debt as Soon as possible

One of the best ways to get the most out of a crypto loan is to pay off your debt as soon as possible. This will reduce your interest payments and make it easier to repay the loan.

5. Monitor Your Loan Progress Regularly

It is important to monitor your loan progress regularly. This will help you stay informed about your financial situation and ensure that you are making the best use of your loan.

Crypto loans are a great way to get started in the world of cryptocurrency without having to put up collateral. However, there are a few things you need to know if you want to make the most of a crypto loan.

First and foremost, make sure you fully understand the terms of the loan. There are a number of different loan terms available, so be sure to read the fine print.

Secondly, be prepared to pay back the loan as soon as possible. Most crypto loans come with a set repayment schedule, so be sure to adhere to it. If you don’t repay the loan on time, you may find yourself in trouble.

Finally, make sure you have a solid understanding of cryptocurrency. Not only will this help you understand the terms of the loan, but it will also help you understand how the loan works. This will give you a better chance of repaying the loan on time.