If you're thinking of taking out a crypto loan, it's important to be aware of the tax implications. While crypto loans can offer some advantages, they also come with their own set of challenges - especially when it comes to taxes. Here's what you need to know about crypto loans and taxes.

There are a few ways to use crypto loans to pay your taxes. One option is to use a crypto loan to cover your regular tax bill. This will help you avoid any tax penalties. Another option is to use a crypto loan to pay your estimated taxes. This will help you avoid any penalties if you miss paying your taxes.

Crypto loans can be a great way to reduce or avoid tax obligations. For example, if you receive crypto as a gift, you may be able to exclude the value of the gift from your taxable income. Likewise, if you sell crypto for cash, you may be able to exclude the value of the sale from your taxable income.

In addition, crypto loans can provide an avenue for tax-deferred growth. If you borrow money using cryptocurrency, you can enjoy the benefits of tax-deferred growth on your investment. This can result in a larger return on your investment over time, which can reduce or avoid taxes owed on that return.

If you are investing in cryptocurrencies for the long term, you may be wondering how to get the most out of your crypto loan for taxes. Here are some tips:

1. Review your tax situation

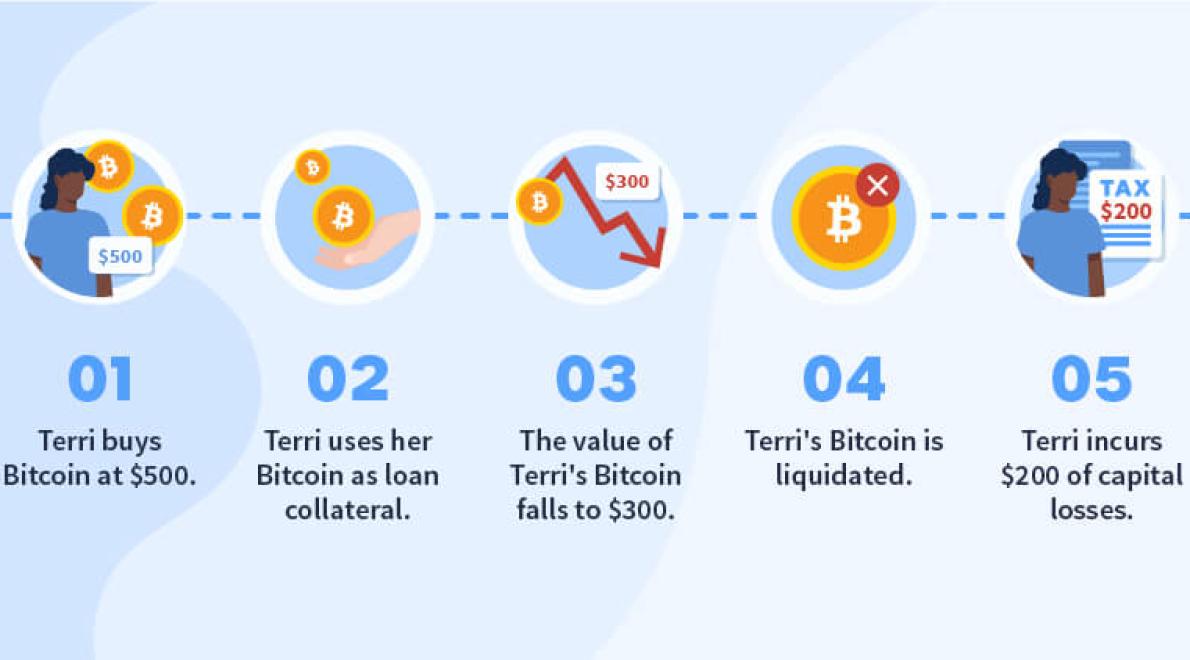

Before you take out a crypto loan, it is important to first review your tax situation. This will help you determine which transactions qualify as capital gains or losses.

2. Make sure your loans are treated as investments

If you are taking out a crypto loan to invest in cryptocurrencies, make sure your loans are treated as investments for tax purposes. This means that you will likely be taxed on the profits you make from the investments.

3. Consider using a tax preparer

If you are not familiar with tax law, it is recommended that you consult with a tax preparer to help you maximize your crypto loan for taxes.

There are a few crypto loans that can help with paying taxes. One option is to use a crypto loan to purchase cryptocurrency that can then be used to pay taxes. Another option is to use a crypto loan to purchase fiat currency that can then be used to pay taxes.

When considering a crypto loan for tax purposes, careful consideration must be given to the characteristics of the loan in order to ensure that it qualifies as a form of financial assistance. Some key factors to consider include:

The interest rate charged on the loan

The terms of the loan, including the amount of time it will take to repay the loan

The repayment schedule for the loan

The tax implications of borrowing money in cryptocurrency

Interest rates

When considering a crypto loan for tax purposes, it is important to be aware of the interest rate charged on the loan. If the interest rate on the loan is high, this could negatively impact the financial stability of the borrower. In addition, high interest rates could result in significant debt payments over time, which could lead to tax liabilities.

Terms of the loan

When considering a crypto loan for tax purposes, it is important to ensure that the terms of the loan are fair and reasonable. This includes ensuring that the repayment schedule is reasonable and that the loan is payable in a timely manner. It is also important to ensure that the terms of the loan do not violate any tax laws.

Repayment schedule

When considering a crypto loan for tax purposes, it is important to ensure that the repayment schedule for the loan is fair and reasonable. This includes ensuring that the loan is payable in a timely manner and that there are no unexpected costs associated with repaying the loan.

Tax implications of borrowing money in cryptocurrency

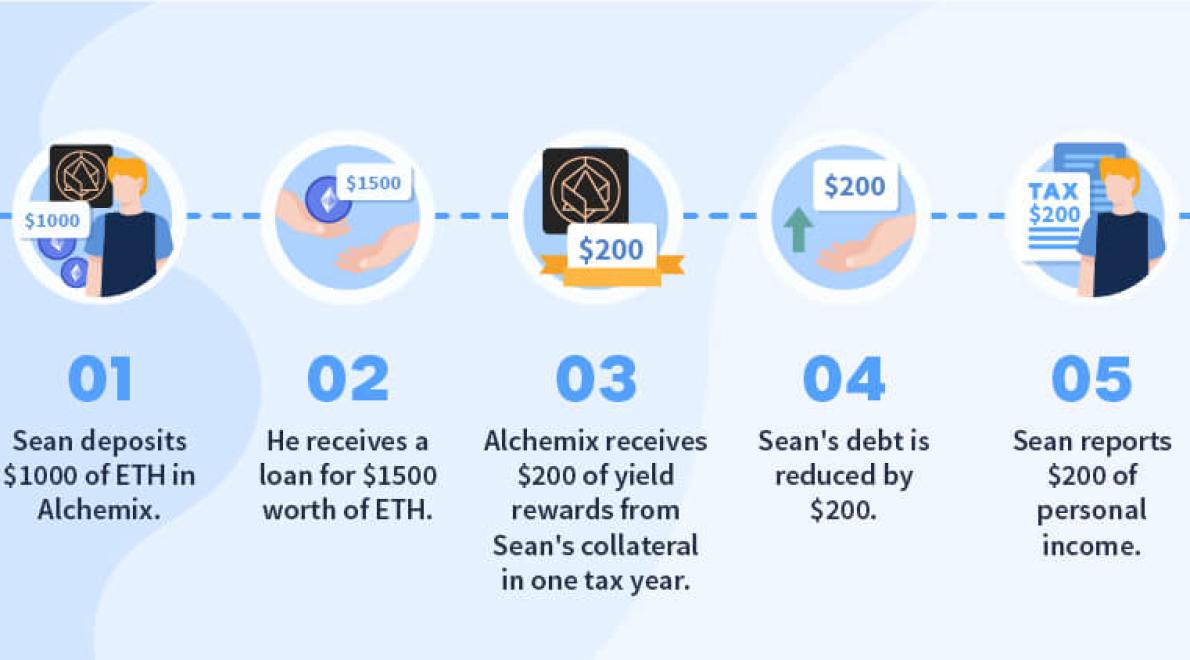

When borrowing money in cryptocurrency, it is important to be aware of the tax implications of doing so. Depending on the circumstances, borrowing money in cryptocurrency may be considered a form of capital gain or loss. In addition, depending on the tax bracket of the borrower, borrowing money in cryptocurrency may result in taxes being owed on the interest payments received on the loan.

Cryptocurrencies are not regulated by the government, so it can be difficult to know how to pay taxes on them. Here are some tips to help you avoid common mistakes when using crypto loans for taxes.

1. Make sure you keep track of your crypto loans

It's important to keep track of your crypto loans in order to pay taxes on them. This means keeping track of the amount you've borrowed, the interest rate you're paying, and any other relevant information.

2. Report your crypto loans as income

If you use a crypto loan to pay taxes on your cryptoassets, you should report the loan as income on your tax return. This means reporting the total amount you borrowed, the interest rate you're paying, and any other relevant information.

3. Use a tax advisor

If you're not sure how to report your crypto loans on your tax return, you should talk to a tax advisor. A tax advisor can help you understand all the different tax rules associated with cryptocurrencies, and they can also help you file your taxes correctly.

Pros of using crypto loans for taxes

-The use of crypto loans for taxes can help reduce tax liabilities.

-Crypto loans can be used to pay off taxes owed in a more timely manner.

-Crypto loans can also be used to pay for other tax-related expenses, such as accountant fees and filing fees.

Cons of using crypto loans for taxes

-Crypto loans may not be available in all jurisdictions.

-Crypto loans may have interest rates that are higher than traditional loans.

-Crypto loans may not be available to all taxpayers.

There is no one-size-fits-all answer to this question, as the best way to use a crypto loan for taxes depends on your individual tax situation. However, some crypto loan providers may offer tax tips and advice to help you use your crypto loan in the most tax-effective way possible.