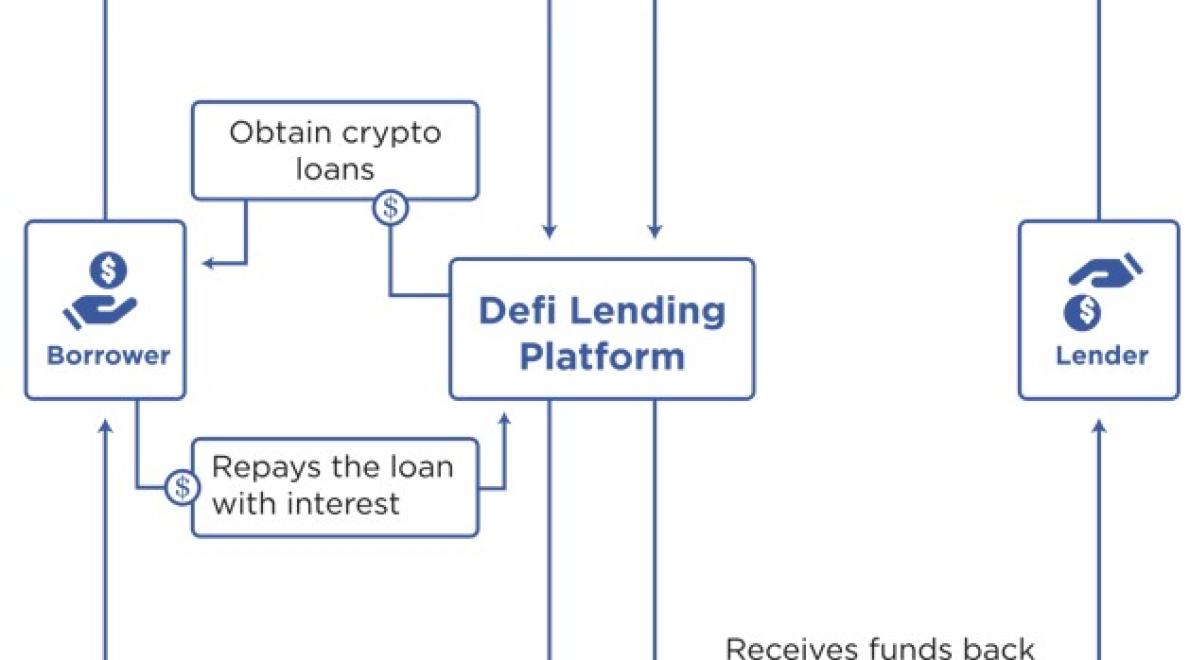

Crypto Defi Loans is a decentralized lending platform that offers loans in cryptocurrency. It is built on the Ethereum blockchain and uses smart contracts to facilitate the lending process. Crypto Defi Loans is a P2P lending platform that allows borrowers to get loans from lenders without the need for a bank or other financial institution. The platform is powered by the ERC20 token, which is used to collateralize loans and to pay interest and fees. Crypto Defi Loans is a decentralized, peer-to-peer lending platform that enables borrowers to get loans in cryptocurrency. The platform is built on the Ethereum blockchain and uses smart contracts to facilitate the lending process. Crypto Defi Loans is a P2P lending platform that allows borrowers to get loans from lenders without the need for a bank or other financial institution. The platform is powered by the ERC20 token, which is used to collateralize loans and to pay interest and fees.

Decentralized finance is a new way of providing credit and financing. It uses blockchain technology to create a peer-to-peer network that allows users to borrow and lend money without the need for a middleman. This system is similar to the traditional banking system, but it is decentralized and does not rely on a single institution.

Lending money using decentralized finance is a new and innovative way to provide financial services to people around the world. The system is based on the blockchain technology, which is an online ledger that allows users to track the transactions of digital assets. This system makes it difficult for thieves to steal funds, and it is also transparent so that everyone can see the details of the loans.

There are several companies that are currently offering crypto loans. These companies allow people to borrow money using cryptocurrencies such as Bitcoin and Ethereum. The repayment process is usually handled through the use of tokens or coins.

Decentralized finance is a new and innovative way of providing financial services to people around the world. The system is based on the blockchain technology, which is an online ledger that allows users to track the transactions of digital assets. This system makes it difficult for thieves to steal funds, and it is also transparent so that everyone can see the details of the loans.

Crypto loan providers offer borrowers the opportunity to borrow cryptocurrency against a collateralized token. These providers will allow you to pledge your tokens as security for the loan, and then use the proceeds of the loan to purchase other cryptocurrencies or fiat currencies.

Some of the most popular crypto loan providers include BitLendingClub, BitBond, and BTCjam. Each provider has its own unique features and fees, so it is important to research each one before deciding which to use.

Crypto loans are a new and innovative way to borrow money. They are a way to get loans that is more secure and transparent than traditional loans.

Crypto loans are a new and innovative way to borrow money. They are a way to get loans that is more secure and transparent than traditional loans.

Crypto loans are a new and innovative way to borrow money. They are a way to get loans that is more secure and transparent than traditional loans.

Crypto loans are a new and innovative way to borrow money. They are a way to get loans that is more secure and transparent than traditional loans.

Crypto loans are a new and innovative way to borrow money. They are a way to get loans that is more secure and transparent than traditional loans.

Crypto loans are a new and innovative way to borrow money. They are a way to get loans that is more secure and transparent than traditional loans.

Crypto loans are a new and innovative way to borrow money. They are a way to get loans that is more secure and transparent than traditional loans.

Crypto loans are risky because they are not regulated by the banking system. This means that there is no guarantee that the borrower will be able to repay the loan, and there is a risk that the cryptocurrency could be stolen or lost.

Crypto loans are a great way to get access to cryptocurrency without having to sell your own assets. Before choosing a crypto loan, it is important to understand the different types of loans available and how they work.

There are three main types of crypto loans:

1. Short-term loans: These loans are usually between one and three months and can be used to purchase cryptocurrencies or fiat currencies.

2. Medium-term loans: These loans are usually between six and 12 months and can be used to purchase cryptocurrencies, fiat currencies, or other digital assets.

3. Long-term loans: These loans are usually between one and five years and can be used to purchase cryptocurrencies, fiat currencies, real estate, or other digital assets.

When choosing a crypto loan, it is important to consider the terms and conditions of the loan. Some lenders may require a down payment or a security deposit, while others may not have any down payments or security deposits required.

It is also important to consider the interest rates charged by the lender. Some lenders charge high interest rates, while others charge lower interest rates. It is important to carefully consider the interest rates charged by the lender before choosing a loan.

Before taking out a crypto loan, it’s important to consider a few things:

1. What is the loan amount?

2. What is the interest rate?

3. What is the repayment schedule?

4. What is the collateral requirement?

5. What are the risks associated with the loan?

6. What are the consequences of not repaying the loan?

Crypto loans can be repaid in a variety of ways, depending on the terms of the loan. For example, some loans may require a periodic repayment, while others may be repaid in full at once.

If you can't repay a crypto loan, it will default. This means that the lender may take legal action to get their money back.

There are a few alternatives to crypto loans that may be more suitable for your needs.

One option is to use a traditional lending platform such as Lending Club. Lending Club is a peer-to-peer lending platform that allows you to borrow money from other borrowers. You can then use the borrowed money to invest in different types of assets, such as stocks and bonds.

Another option is to use a cryptocurrency lending platform. These platforms allow you to borrow cryptocurrencies from other borrowers. Once you have borrowed the cryptocurrency, you can then use it to purchase assets or pay back your debt.

Finally, you can also use an online money market account to borrow money. This option is best for people who want to short-term borrow money. In short, this means that you borrow money from a lender and then sell the borrowed money to a third party.